SIA clocks record loss of S$4.3b for 'toughest year in its history'

Singapore

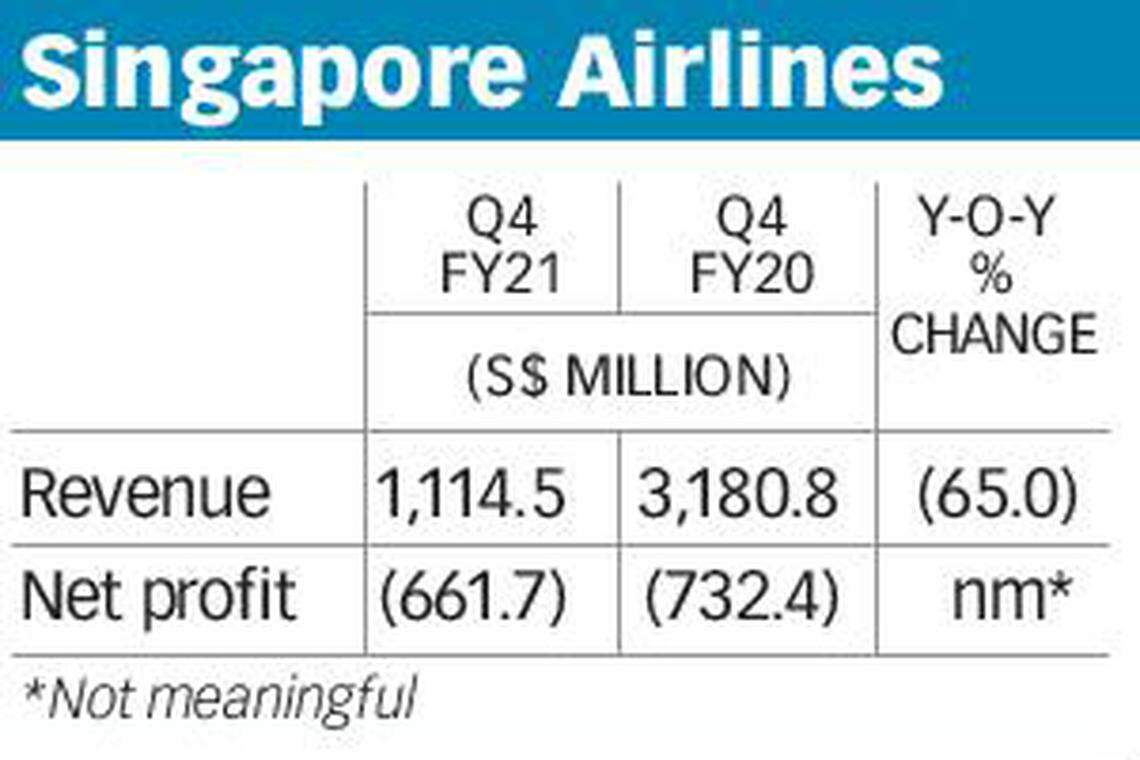

DESPITE clocking a smaller year-on-year quarterly loss of S$661.7 million for the three months to March, mainboard-listed Singapore Airlines (SIA) is proceeding with the issuance of additional mandatory convertible bonds to raise a further S$6.2 billion.

Temasek, SIA's largest shareholder with a stake of about 55 per cent, has provided an undertaking to subscribe to its pro-rata entitlement and any remaining balance of this issuance.

The carrier was awash in red ink for FY2021 ended March 31, chalking up a record net loss of S$4.27 billion in the "toughest year in its history", said SIA in a financial results filing on Wednesday.

The losses mark a full year of the impact from the coronavirus pandemic that hit international travel in early 2020. SIA burned through cash to the tune of hundreds of millions of dollars a month as passenger traffic plunged 97.9 per cent in FY2021 from the year before.

Substantial non-cash impairments were made to its fleet as well.

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

In comparison, net loss for FY2020 was S$212 million - its first annual red ink, as the flag carrier had been profitable for the first three quarters of that year before the novel coronavirus started to wreak havoc.

Net loss for Q4 FY2020 stood at S$732.4 million, when it was also hit by S$710 million in ineffective fuel hedges.

But SIA recorded S$110 million in net gain for Q4 FY2021 in relation to fuel hedging and fuel derivatives, comprising fuel hedging losses of S$89 million and fair value gains of S$198 million on fuel derivatives that had earlier been deemed to be ineffective hedges.

SIA has hedged more than half of its anticipated fuel needs at average prices of US$74 per barrel for jet fuel, or US$58 per barrel in Brent crude oil hedges for FY2021. Brent crude prices rebounded from the trough of under US$20 a barrel in April 2020 and spiked to about US$70 in March, helping SIA to book fair value gains as a result.

Fourth-quarter revenue was 65 per cent lower year on year at S$1.1 billion, as passenger traffic continued to be curtailed by international border closures to stem the virus spread. Operating loss at S$318.6 million for the quarter was an improvement from that of S$802.5 million incurred in the corresponding period a year ago.

Full-year revenue came in at S$3.82 billion, 76.1 per cent lower than S$15.98 billion previously. The hit to passenger business was partially offset by S$758 million or 38.8 per cent year-on-year increase in freight revenue to S$2.71 billion.

Mark-to-market losses of S$497 million were recognised in FY2021 on ineffective fuel hedges, following downward adjustments to the expected rate of capacity recovery and the corresponding fuel consumption. This was mitigated by a S$283 million fair value gain on fuel hedges.

SIA's net asset value stood at S$5.36 per share as at March 31, versus S$7.86 a year earlier.

No final dividend was declared - the same as FY2020 - as SIA wants to conserve cash to meet near-term cash needs of the business in view of the significant impact from the pandemic.

Going by its current published schedules, the airline group expects the passenger capacity to be around 28 per cent of pre-Covid levels by June 2021 and 32 per cent a month later.

As it noted, international air travel remains severely constrained and since the recovery trajectory is still unclear, SIA said it is "crucial for the group to have sufficient liquidity to weather the current challenges". Thus, it has decided to issue an additional S$6.2 billion worth of mandatory convertible bonds.

SIA chairman Peter Seah said in a separate announcement that the growing pace of vaccinations has given it hope, but new waves of infections around the world mean that restrictions on international travel largely remain in place.

Mr Seah also noted the forecast by industry bodies that air traffic is not expected to recover to the pre-pandemic levels until 2024.

Entitled shareholders will be offered on a pro-rata basis the rights to subscribe to 209 mandatory convertible bonds for every 100 existing shares that they hold at the record date.

The carrier had raised a total of S$14.6 billion in FY2021 from various means including bond issuances, aircraft sale-and-leaseback transactions as well as an S$8.8 billion rights issue - S$5.3 billion equity and S$3.5 billion mandatory convertible bonds.

The counter closed 3.29 per cent lower at S$4.70, leading the decline on the Straits Times Index on Wednesday, before the announcement of the financial results and the issuance of additional mandatory convertible bonds.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

iFast Q1 net profit surges on ePension unit performance

Suntec Reit Q1 DPU down 13% to S$0.01511 in absence of capital distribution

US: Wall St opens lower as Meta Platforms, economic data weigh

Sheng Siong Q1 net profit up 9.3% on higher revenue

Great Eastern chairman appeals for patience as shareholders fume over share price ‘disaster’

Changi Airport’s Q1 passenger movements surpass pre-pandemic levels