SIA posts 82.1% drop in net profit to S$52 million for Q2; declares special dividend package

The group attributes the decline in earnings to losses by its associate Air India, which are not included in previous year’s results

[SINGAPORE] National carrier Singapore Airlines (SIA) posted a 82.1 per cent drop in net profit to S$52 million for the second quarter of FY2026 ended September, down from S$290 million in the year-ago period.

The group attributed this largely to the share of results of associated companies and lower interest income.

Operating profit rose 22.5 per cent to S$398 million for the quarter, up from S$325 million a year ago.

Revenue for the quarter came in at S$4.9 billion, up 2.2 per cent from the corresponding period a year ago.

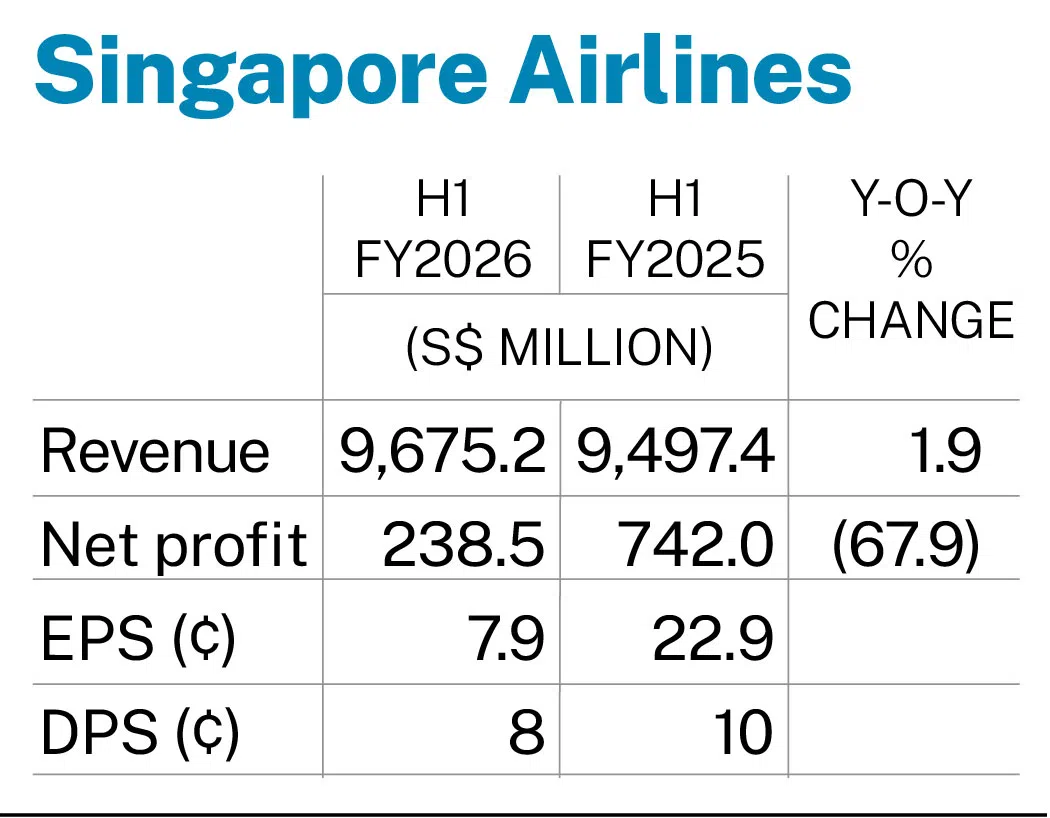

For the first half of FY2026 ended September, SIA posted a 67.9 per cent drop in net profit to S$238.5 million, down from S$742 million in the year-ago period.

The group attributed the fall in net profit to losses by its associate Air India, which were not included in its financial results for the previous year. The group began equity-accounting for Air India’s financial performance from December 2024, following the full integration of Vistara into Air India.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Lower interest income at S$163.6 million, from S$266.5 million in H1 FY2025, also contributed to the fall in net profit, added the group in its financial results published on Thursday (Nov 13). The drop in interest income was due to lower cash balances and interest rate cuts.

On the other hand, the group’s operating profit rose slightly by 0.9 per cent to S$802.9 million in H1 FY2026, compared with S$795.6 million in the previous corresponding period.

The group’s revenue rose 1.9 per cent year on year to a first-half-year record of S$9.7 billion.

Special dividend package

The group said that it plans to return capital to shareholders via a special dividend package of S$0.10 per share yearly over three financial years. This will amount to about S$900 million over the period.

As the first payment from this package, the board has declared an interim special dividend of S$0.03 per share, which will be paid on Dec 23. It will apply to shareholders as at Dec 8.

The second tranche of S$0.07 per share for FY2026 is subject to shareholders’ approval at the annual general meeting in 2026. If approved, SIA expects to pay special dividends amounting to S$0.10 per share in FY2027 and FY2028.

Separately, the board has declared an interim dividend of S$0.05 per share for the half-year ended Sep 30.

This brings the total dividend for the first half of FY2026 to S$0.08 per share.

Operating statistics

The group – which comprises national carrier SIA and budget carrier Scoot – carried 20.8 million passengers in the recent H1, up 8 per cent from H1 FY2025.

The group passenger load factor increased by 1.3 percentage points to 87.7 per cent in H1 FY2026.

The passenger load factor measures how much the airline’s passenger capacity has been utilised.

The number of passengers on SIA flights rose 6.2 per cent to 13.7 million in H1 FY2026, compared with the corresponding period a year ago. The passenger load factor for SIA increased by one percentage point to 86.7 per cent in the same period.

For Scoot, the number of passengers on its flights rose 11.8 per cent to 7.1 million in H1. The passenger load factor for the budget carrier increased by 2.9 percentage points to 91.5 per cent over the period under review.

The group’s cargo load factor, however, dipped 0.9 percentage point to 56.5 per cent for H1, compared with the year-ago period.

Outlook

SIA said that demand for air travel will be supported by the year-end peak travel period going into the third quarter of FY2026. However, it noted that the global airlines industry faces a volatile operating environment, such as geopolitical tensions and inflationary cost pressures.

“The group will remain proactive and agile, adjusting its passenger network and capacity to match evolving demand patterns and maximise revenue opportunities,” it noted.

On the cargo front, volumes are growing on the back of the group’s diversified network and verticals. However, yields remain under pressure as airlines redeploy cargo capacity from the US to other lanes, the group added.

As at Sep 30, the group’s passenger network covered 129 destinations in 37 countries and territories. SIA served 78 destinations, while Scoot served 73.

Shares of SIA fell 0.4 per cent or S$0.03 to S$6.65 before the announcement on Thursday.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.