Singapore investors lead Asean peers with 22% surge in purchase of gold bars, coins in 2024

World Gold Council reports 6.5 tonnes of purchases in the Republic – still behind Thailand’s 39.8 tonnes

SINGAPORE investors did not shy away from physical gold despite its soaring prices in 2024. They led the growth in demand in the Asean region, with 6.5 tonnes of gold bars and coins purchased.

This was up 22 per cent from 5.3 tonnes in 2023, the World Gold Council (WGC) said in its gold demand report released on Wednesday (Feb 5).

The Asean markets covered in the report registered rising investment demand for physical gold. Malaysia investors bought 6.4 tonnes of bars and coins, up 21 per cent on the year; Indonesia investors bought 19 per cent more, at 24.5 tonnes.

Their counterparts in Thailand, a leading market for physical gold investment, purchased 39.8 tonnes of gold bars and coins, up 17 per cent on the year.

WGC said: “Local currency performance was a key driver of this growth, with investors focused on gold’s role as a hedge. And currency moves across the region resulted in a local price performance that exceeded the US dollar gold price return, which made a more compelling case for investing.”

East vs West

Asean investors’ enthusiasm for gold bars and coins was, nonetheless, an Asian story. Major Asian markets such as China and India saw greater influx into physical gold, while Western investors lost some interest in gold bars and coins.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

In 2024, when gold prices surged more than 25 per cent, India investors bought 239.4 tonnes of gold bars and coins, up 29 per cent year on year. Greater China investors purchased 20 per cent more gold bars and coins, at 345.7 tonnes.

Investors in the Americas bought 87.8 tonnes or so, down 31 per cent. Those from Europe excluding the Commonwealth of Independent States saw demand drop by half, but bagged 66.6 tonnes of gold bars and coins.

Global bar and coin investment in 2024 stayed largely in line with 2023 volumes at 1,186.3 tonnes.

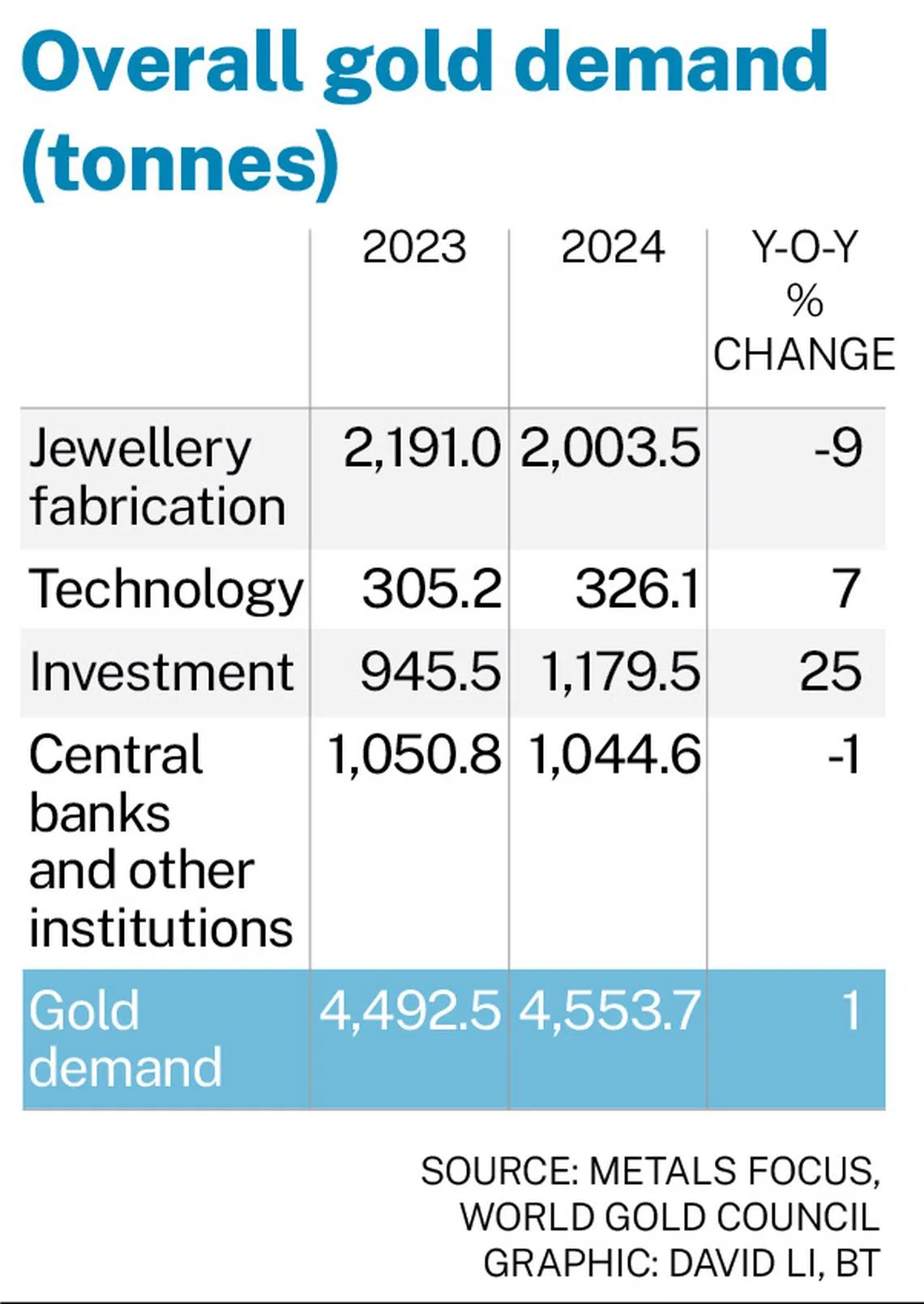

Overall investment demand for gold, comprising both gold-backed exchange-traded funds (ETFs) as well as bars and coins, hit a four-year high, increasing 25 per cent year on year to 1,179.5 tonnes. It was driven by a revival in demand for gold ETFs in the second half of 2024, which added 19 tonnes in the fourth quarter, said WGC.

Demand for gold, including investment, jewellery fabrication, central bank purchases and technology uses, stood at 4,553.7 tonnes in 2024, up 1 per cent from 2023.

Strong central bank purchases

WGC highlighted that central banks’ appetite for gold reserves stayed strong, driven by those in emerging markets such as Poland, Turkey, India and China.

In total, global central banks bought 1,044.6 tonnes of gold in 2024. It was the third year in a row that these institutions added more than 1,000 tonnes of gold reserves.

WGC noted: “Selling activity was also seen throughout the year, although in most cases, it appeared more tactical than strategic in the face of a rapidly rising gold price, as well as in more modest volumes than the purchases seen elsewhere.”

Fan Shaokai, head of Asia-Pacific (ex-China) and global head of central banks at WGC, said: “Central banks have extended their gold-buying streak to 15 consecutive years, reinforcing gold’s role as a strategic safe-haven asset class for risk management and financial stability.”

High prices stifle jewellery demand

The unrelenting strength of the price of gold dampened jewellery consumption. Global jewellery demand fell 11 per cent to 1,877.1 tonnes, driven by weakness in major gold jewellery markets China and India.

“Despite a seasonal quarterly improvement in Chinese Q4 demand for gold jewellery, the year-on-year comparison showed a sharp decline,” noted WGC.

It added that Chinese demand for gold jewellery in 2024 fell 24 per cent on the year to 479.3 tonnes, 26 per cent below the 10-year average and 10 per cent lower than in 2020, when Covid ravaged demand.

Full-year demand in India was 2 per cent lower at 563.4 tonnes, which WGC described as “resilience” amid the record-high gold prices, reflecting the country’s relatively healthy economic environment.

The organisation added that many Indian consumers front-loaded their purchases of gold jewellery in the third quarter of 2024, when the cut in duties on gold imports effectively offset much of the price increase.

Gold prices continue to notch record highs in this new year, amid tariff announcements by US President Donald Trump and China’s retaliation, fuelling safe-haven demand for the yellow metal.

As at 7 pm on Wednesday, spot gold hit a new high of US$2,867.96 an ounce.

Louise Street, senior markets analyst at WGC, expects central banks’ purchases and gold ETFs to continue driving demand for gold in 2025, especially under a lower, but volatile, interest-rate environment.

“On the other hand, jewellery weakness will likely continue, as high gold prices and soft economic growth squeeze consumer spending power.

“Geopolitical and macroeconomic uncertainty should be prevalent themes this year, supporting demand for gold as a store of wealth and a hedge against risk,” she added.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.