Singapore-listed companies with China exposure feel the heat

Travel-leisure plays among the stocks most badly hit; hospitality sector's outlook dims

Claudia Tan HS

Singapore

THE shares of Singapore-listed companies with exposure to China were hit on Tuesday, as the Wuhan virus outbreak continued to escalate.

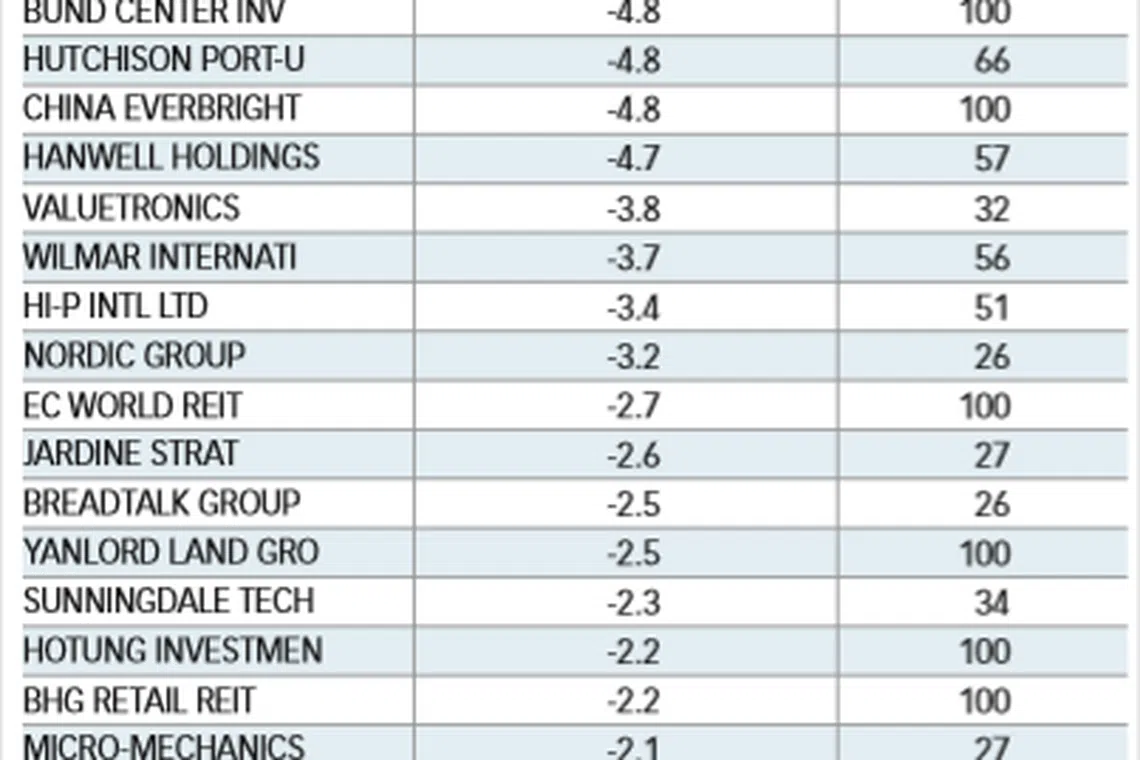

Of all Singapore companies with a market capitalisation of S$100 million and above, 44 have at least 20 per cent of annual revenues coming from China, going by data obtained from the Singapore Exchange's (SGX) research team. Of these, 35 stocks registered declines amid the general market fall on Tuesday.(See amendment note)

As the number of infections from the Wuhan virus continues to climb in China and elsewhere, SGX-listed companies driven by Chinese tourism or which have operations in China are particularly vulnerable, with business and consumer sentiment undermined by fears of contagion.

These travel and leisure plays were among stocks that fell the most on Tuesday, with Sasseur Reit (real estate investment trust) and Straco Corporation tumbling by more than 10 per cent.

Sasseur Reit, which has its whole portfolio in China, announced on Tuesday that it has temporarily closed four outlet malls owned by the trust to contain the spread of the virus.

Straco Corporation, which secures around 73 per cent of annual revenue from China, faces a downturn in its business; the tourist attractions it runs, such as the Shanghai Ocean Aquarium, Lintong Lixing Cable Car and Underwater World Xiamen, were shut last Saturday in a bid to contain the spread of the bug. It has also stepped up on the disinfection of facilities and begun screening employees.

With the Singapore economy highly reliant on the inflow of Chinese visitors, analysts say that further escalation of the current situation will send tourist numbers plunging to impact the hospitality, tourism and airline sectors in Singapore.

Chua Boon Siang, equities specialist at Phillip Securities told The Business Times (BT): "Should the severity of the Wuhan coronavirus be comparable to the 2003 Sars outbreak, we can expect to see a dip in the demand for travelling and tourism - at least until the outbreak is contained."

While the prospects for Singapore's hospitality space looked promising heading into 2020, the outbreak of the Wuhan virus has posed a downside risk to the sector.

"In the short term, the fear of contracting the virus and travel restrictions will put some downward pressure on the travel-related sectors as travellers may see the need to deter or delay travel plans," said Mr Chua.

For instance, Frasers Hospitality has started to see some cancellations for its hotel businesses, said its vice-president of global branding and communications Jastina Balen.

But this is mitigated by the fact that the trust serves largely the business and the corporate sectors.

"Most of our guests are staying (for) a longer period of time and the impact will not be as great as in hotels with leisure guests," she said.

However, with the changing situation and more companies imposing travel restrictions on staff, room occupancy is expected to be affected, she added.

Other hospitality names that may be hurt include Far East Hospitality Trust and CDL Hospitality Trusts, which have 41 per cent and 32 per cent of variable income exposure to the Singapore hospitality market, said CGS-CIMB's Ms Lim.

The Sars-like virus will also inevitably affect passenger traffic and financial performance of the aviation sector.

A DBS report noted that at the height of Sars, Singapore Airlines' passenger load factors fell below 50 per cent for a couple of months and the company reported an operating loss for the most affected quarter.

Retail malls are not spared either, especially those in popular tourist shopping belts such as Orchard Road, noted the report.

While suburban malls are generally less vulnerable as people cut back on travelling, closure of certain food and beverage (F&B) tenants pose a risk as they make up a large percentage of mall contribution by gross rental income.

During the Sars outbreak, the food and beverage index fell by close to 40 per cent on a year-on-year basis, noted the DBS report. It cited BreakTalk, Jumbo and Koufu as F&B players that could be hit if an epidemic happens.

With the slew of negative news and mounting fears surrounding the coronavirus, analysts said investors will continue to rein in risk appetites.

Phillips Securities' Mr Chua said: "In this case, the duration and degree of impact of the coronavirus is still ambiguous. Investors will take into account the uncertainty in the current market environment."

Amendment note: An earlier version of this story incorrectly stated that 45 companies have more than 20 per cent of annual revenues coming from China and 36 registered declines on Tuesday based on data provided to BT. The data has since been updated and the article above has been revised to reflect this.

READ MORE:

Copyright SPH Media. All rights reserved.