Singapore should exempt carbon credits from GST: KPMG

Clarity on tax treatment will remove barriers to development of carbon market, says consultancy

Wong Pei Ting

SINGAPORE should review and clarify how its goods and services tax (GST) applies to voluntary carbon credits to foster development of carbon credit markets in the nation, professional services firm KPMG said in a white paper this week.

Current exemptions for carbon credits are narrowly defined and exclude significant classes of credits, wrote the authors of the paper, tax partner Mark Addy and principal consultant of indirect tax Gan Hwee Leng. Meanwhile, crucial differences between carbon credits and currently exempted products make it problematic to simply subsume carbon credits into an existing exemption, they said.

GST exemptions or provisions already exist where carbon credits are integral to the business, such as in the event where an airline is legally required to purchase carbon credits, KPMG explained. An exemption also exists for compliance credits – regulated emission allocations – that are issued by the National Environment Agency.

But voluntary sales of carbon credits by most businesses are not covered by those exemptions, KPMG said. Carbon credits sold by businesses are classified as supply of rights to emit the amount of carbon covered by the credit, and are therefore subject to the prevailing GST of 7 per cent, which is charged to buyers in Singapore.

Moreover, none of the existing financial services currently exempted from the GST adequately cover voluntary carbon credits, KPMG said. The closest exempted category would be one used for commodity instruments, or “any unallocated commodity which does not lead to a delivery of the commodity”. But this exemption would no longer be appropriate when buyers require delivery of the credits, which might happen if buyers want to retire the credits from the market in order to offset their own emissions.

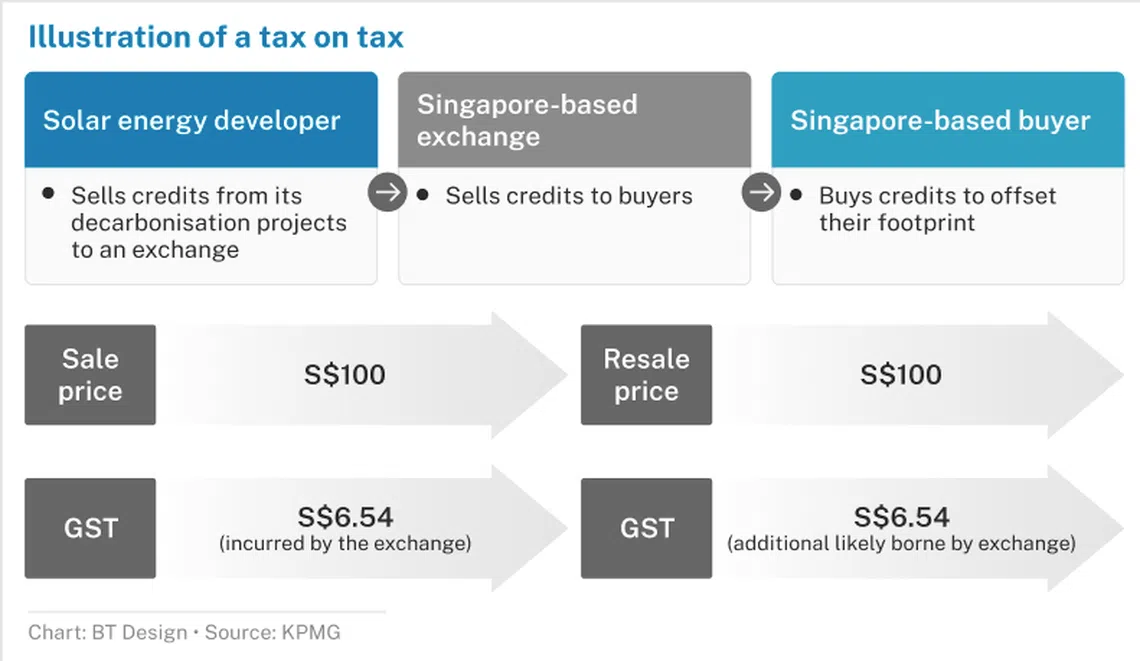

Charging GST on carbon credits can create a cascading effect where tax is charged at every step through which a carbon credit moves between seller and buyer, which could create cost barriers to the development of a carbon credit market in Singapore, the authors argued.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

For instance, a Singapore-based exchange might have to pay GST twice as a central counterparty: once to the seller of a carbon credit, and the second time to absorb the GST because it cannot pass it on to the end buyer of the same credit.

“Given that buyers are unlikely to be willing to pay the GST, the exchange would have to charge the S$100 as GST-inclusive and bear the S$6.54 as output tax, creating a loss for the exchange,” the paper stated.

Singapore’s tax authority should review its GST legislation and take a page from other jurisdictions such as the United Kingdom and New Zealand, which have either exempted or zero-rated carbon credits in their respective GST regimes, KPMG said.

“This would reduce cost barriers for traders, further boost local market activity and help the country to become a carbon service and trading hub for the Asia-Pacific,” the authors said.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.