Singapore, Asean telcos stand to make billions from 5G: Report

Singapore

TELECOM operators in the region could rake in billions of dollars more from 5G technology, led by demand from enterprise users, a consulting firm said in a report on Tuesday.

Across Asean, 5G could bring in U$4.3 billion to US$5.8 billion more a year in operator revenues by 2025, or 12 per cent more than what telcos make now, according to AT Kearney.

Enterprise turnover could grow by between 18 per cent and 22 per cent, while consumer revenues are pegged to rise by 6 per cent to 9 per cent.

The analysts added: "Given the otherwise widely stagnating revenues of telecom operators both in the region and around the world, this is an astonishing opportunity that operators must make all efforts to capture."

But, even though the biggest shares of 5G-added revenues will likely go to bigger countries such as Indonesia, the AT Kearney analysts still expect Singapore to lead its peers in 5G adoption in South-east Asia.

Among Asean markets, Singapore is expected to capture the largest share of potential value from 5G.

By 2025, the Republic is projected to achieve Asean's most positive "win-win" scenario, where enterprise businesses are transformed with 5G-enabled technologies and consumers fork out for faster mobile services.

In Malaysia and Indonesia, only leading telcos will succeed in snagging enterprise and consumer value, amid fierce price competition, the report's authors have suggested.

The other Asean economies are not expected to progress beyond business as usual if they adopt a selective network rollout, with users put off by the expected 5G price premium.

"You cannot expect that enterprise will just pay for enhanced quality," said report lead author Nikolai Dobberstein, who heads AT Kearney's Asia-Pacific communications, media and technology practice. "You have to combine it with solutioning around the use cases... so you monetise the benefits - not the connectivity."

Besides telecom operators, Asean businesses in other sectors, such as manufacturing, services and agriculture could grow revenues by US$147 billion by 2025 as 5G is used to support Industry 4.0 and digitalisation efforts, the report's authors estimated.

Naveen Menon, regional president for Nasdaq-listed technology provider Cisco, which commissioned the report, added that, in the enterprise space, "the overall package price will look very different to, say, a pure consumer offer" as operators bundle solutions with industry services like maintenance, and software subscriptions.

"These are avenues that operators don't typically have right now on the enterprise side," he told reporters.

All in all, Singapore telecom operators could pick up as much as 40 per cent of the enterprise revenue up for grabs, against 30 per cent in Indonesia or 25 per cent in the Philippines.

Singapore is also pegged to reach 5G penetration of 56.9 per cent by 2025, beating out Malaysia's 39.8 per cent, and Thailand's 33 per cent.

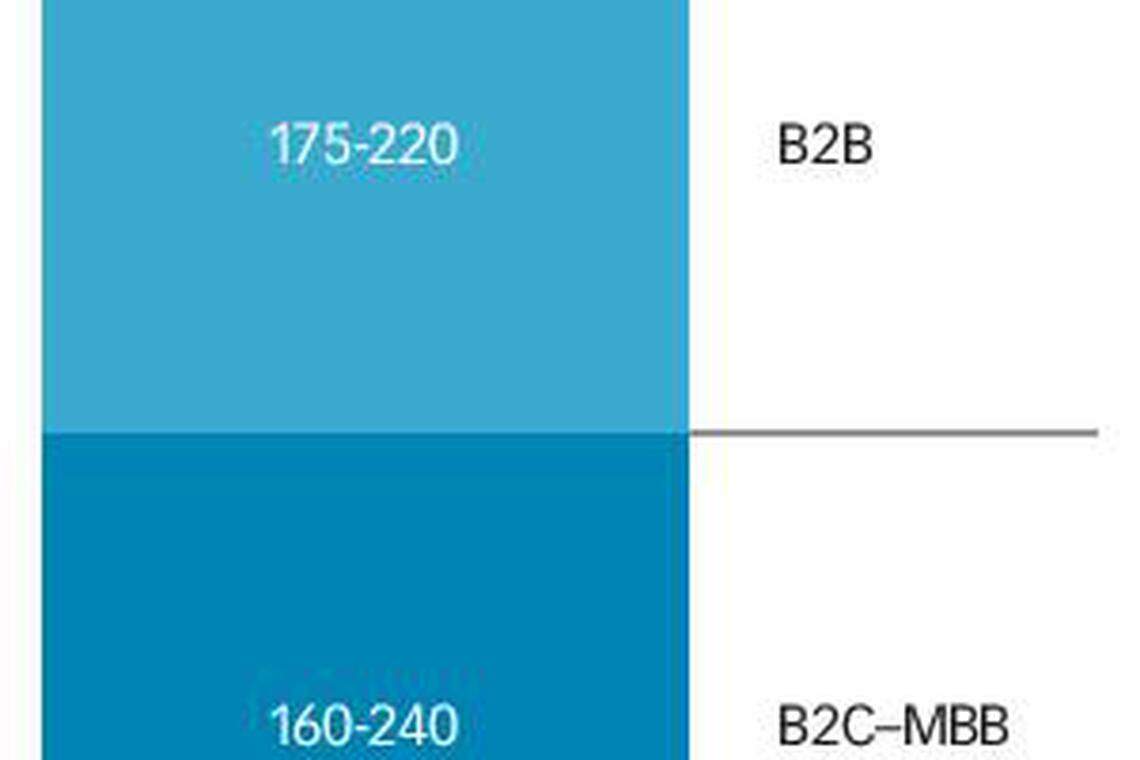

The Republic could see telco revenues up by between US$370 million and US$510 million a year by then, on the back of enterprise business.

Of that, as much as US$220 million may be from enterprise users, with another US$50 million from over-the-top firms that use the connectivity as a platform for other consumer or enterprise services. Consumer mobile will make up the rest of the projected turnover in Singapore.

Singapore regulators have already identified six strategic clusters for 5G development: maritime operations, urban mobility, smart estates, Industry 4.0, and consumer and government applications. They plan to start rolling out the 5G network next year, with fuller coverage from 2023 onwards.

Industry 5G projects now under way include Singtel's advanced manufacturing tie-up with the Agency for Science, Technology and Research; M1's robotics research with the Singapore University of Technology and Design; and both operators' smart port trials with state-owned PSA.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

Meta profits soar but costs of AI cause worry

IBM falls on weak consulting sales, overshadowing HashiCorp deal

Oil settles lower as US business activity cools, concerns over Middle East ease

Europe: Stoxx 600 falls on banks drag; tech contains losses on ASMI boost

US: Stocks end flat ahead of key inflation data

TikTok suspends new app’s reward programme amid EU concerns