ST Engineering H1 profit grows 15% on partial recovery of business segments

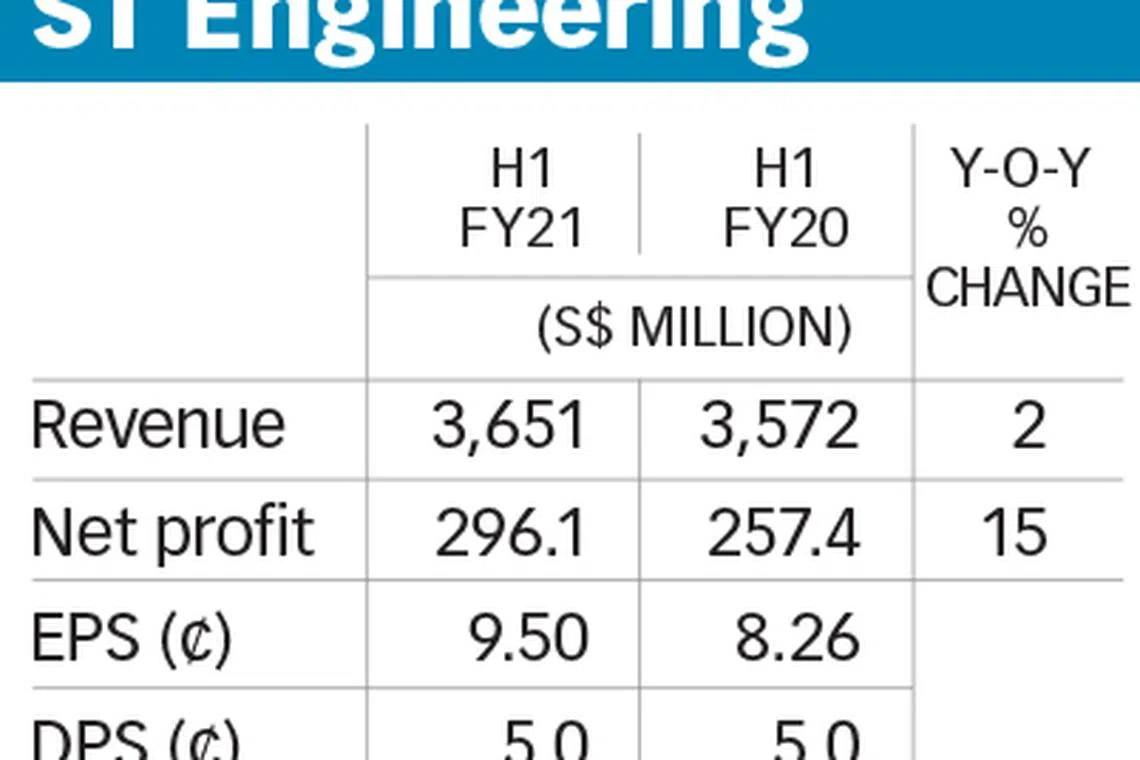

SINGAPORE Technologies Engineering S63 (ST Engineering) saw its net profit for the first half of FY2021 rise 15 per cent to S$296.1 million from S$257.4 million the previous year.

In a bourse filing on Thursday morning, the group said its bottom line improvement largely came from better operating performance of its urban solutions and satellite communications as well as defence and public security segments.

Earnings per share for the six months ended June 30, 2021 grew 15 per cent to 9.5 Singapore cents, from 8.26 cents for the corresponding period last year.

Group revenue for the half year was up 2 per cent to S$3.65 billion compared to S$3.57 billion a year ago for the same period, due to the partial recovery of the group's urban solutions and satellite communications segment along with its defence and public security segment.

These both reported revenue growth that more than offset the weaker operating performance of the commercial aerospace segment, as well as lower government support received and higher tax expense.

Weaker revenue contributions from commercial aerospace reflected the continued impact of the subdued aviation sector amid Covid-19, said the group. The segment nonetheless posted higher earnings before interest and tax compared to the previous year, due to increased government support received during the period under review.

The board of directors has approved an interim dividend of S$0.05 per share, unchanged from the previous year. It will be paid on Aug 31, 2021.

As at end-June 2021 the group's estimated order book value stands at S$16.8 billion, of which it expects to deliver some S$3.6 billion in the remaining months of 2021.

"We remain steadfast in the pursuit of our strategy to emerge stronger as the business environment improves. The diversity of our business portfolio, and our focus on seizing growth opportunities, coupled with productivity and cost management measures will continue to position us well into the future," said Vincent Chong, group president and chief executive of ST Engineering.

Shares of ST Engineering closed S$0.05 or 1.2 per cent lower at S$4.03 on Wednesday.

Read more:

- ST Engineering gets S$100m foreign state aid to invest to keep jobs

- Brokers' take: UOBKH positive on aviation sector on better-than-expected SIA Engineering results

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.