Starhill Global Reit H1 DPU flat at S$0.018

Revenue remains unchanged at S$96.3 million for the first-half period

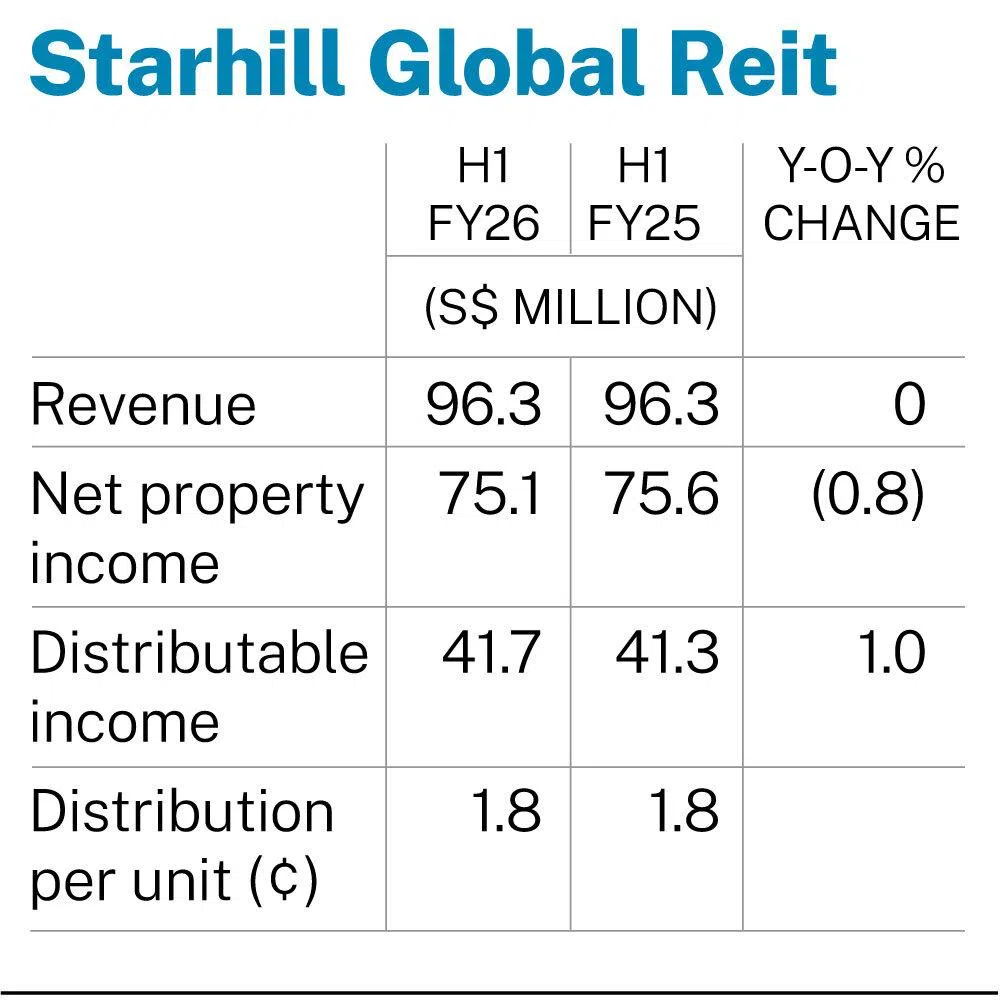

[SINGAPORE] The manager of Starhill Global Real Estate Investment Trust (Reit) on Thursday (Jan 29) posted a distribution per unit (DPU) of S$0.018 for the first half ended Dec 31, flat compared to the year-ago period.

Revenue also remained unchanged at S$96.3 million for the first-half period, compared to the corresponding period in the previous year.

Net property income (NPI) fell 0.8 per cent to S$75.1 million, from S$75.6 million a year ago.

The Reit manager attributed the fall in NPI to the loss of income from the divestment of Wisma Atria office strata units and rental arrears provisions mainly for its China properties.

It also cited lower contributions from its Australian property Myer Centre Adelaide office and depreciating Australian dollar against the Singapore dollar as additional headwinds.

“The decrease was offset by higher contributions from Ngee Ann City Property and Lot 10 Property, as well as appreciation of the Malaysian ringgit against the Singdollar,” said Starhill Global in a bourse filing.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

It noted that excluding the effects of divestment, NPI for the first-half would have increased 0.1 per cent, compared to the previous year.

Income available for distribution for the first-half period fell 0.2 per cent to S$43.2 million, from S$43.3 million the corresponding period a year ago.

The company cited higher trust expenses attributed to legal and professional fees incurred for the ongoing arbitration case in Australia, as well as higher distribution on perpetual securities and lower NPI as reasons for the dip.

The manager will retain approximately S$1.5 million of income available in the first-half for distribution for working capital requirements, it noted.

This means that income distributable to unitholders increased 1 per cent to S$41.7 million, from S$41.3 compared to the previous year.

Unitholders can expect to receive their first-half DPU on Mar 27; the record date is on Feb 6 at 5pm.

The group’s first-half occupancy declined to 91.9 per cent, down from 94.6 per cent in June following the lease termination with the sole tenant in China in December last year.

A new replacement tenant has signed a conditional lease in January this year. Following this, committed occupancy in China is expected to be reinstated to 100 per cent, with committed portfolio occupancy rising to 96.5 per cent.

The portfolio weighted average lease term expiry remains at 7.4 years by gross rental income as at Dec 31 last year, noted the company.

The group’s gearing ratio stood at 35.4 per cent, slightly lower than the 36 per cent posted in June the same year. Average debt maturity remains “healthy” at 3.8 years, it added.

Francis Yeoh, chairman of Starhill Global noted that the Reit will focus on maintaining a strong balance sheet and delivering high-quality earnings.

The company will further strengthen the balance sheet through ongoing capital recycling, said Ho Sing, chief executive officer of Starhill Global.

Units of Starhill Global rose 0.9 per cent or S$0.005 to S$0.595 on Thursday, before the results were released.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.