Stirred, but not shaken as Singapore banks beat Q3 estimates

Cocktail of sentiment lift, strong fees and healthy provisions takes edge off margin collapse in uncertain 2021

Singapore

SINGAPORE banks sense a slight lift in business sentiment, which has eased some of their worst fears.

But caution still reigns, as they battle the effects of a global health crisis that has roiled economies for much of the year.

Some of that sentiment uplift can be found in the Q3 results that beat estimates. With DBS and OCBC closing off the results season on Thursday, shares of the three banks gained strongly, amid a buoyant market reacting too, to their expectations of the US election results.

In a report, Krishna Guha, equity analyst at Jefferies, said: "DBS seems to have better visibility on 2021 growth; OCBC is focused on driving long-term sustainable value, while UOB is more sanguine on asset quality."

In Q3, fee-related income hit record levels for DBS and OCBC.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

At OCBC, wealth income of S$938 million in the quarter was its highest since 2018. Its wealth management and brokerage fees were above 2019 levels. Customer inflows that made up treasury income also hit a new high in Q3. As for DBS, net fee income of S$913 million rebounded 17 per cent over the quarter to pre-Covid levels, reaching its third-highest level on record. This was led by wealth management and card fees.

Fee income at UOB rose 15 per cent quarter on quarter, as wealth management and credit card fees rebounded. This also helped to offset some of the decline in trading income.

All three lenders continued to plump provisions to cushion against bad loans for the uneven economic recovery next year; they kept or slightly lowered the cumulative credit cost guidance till 2021.

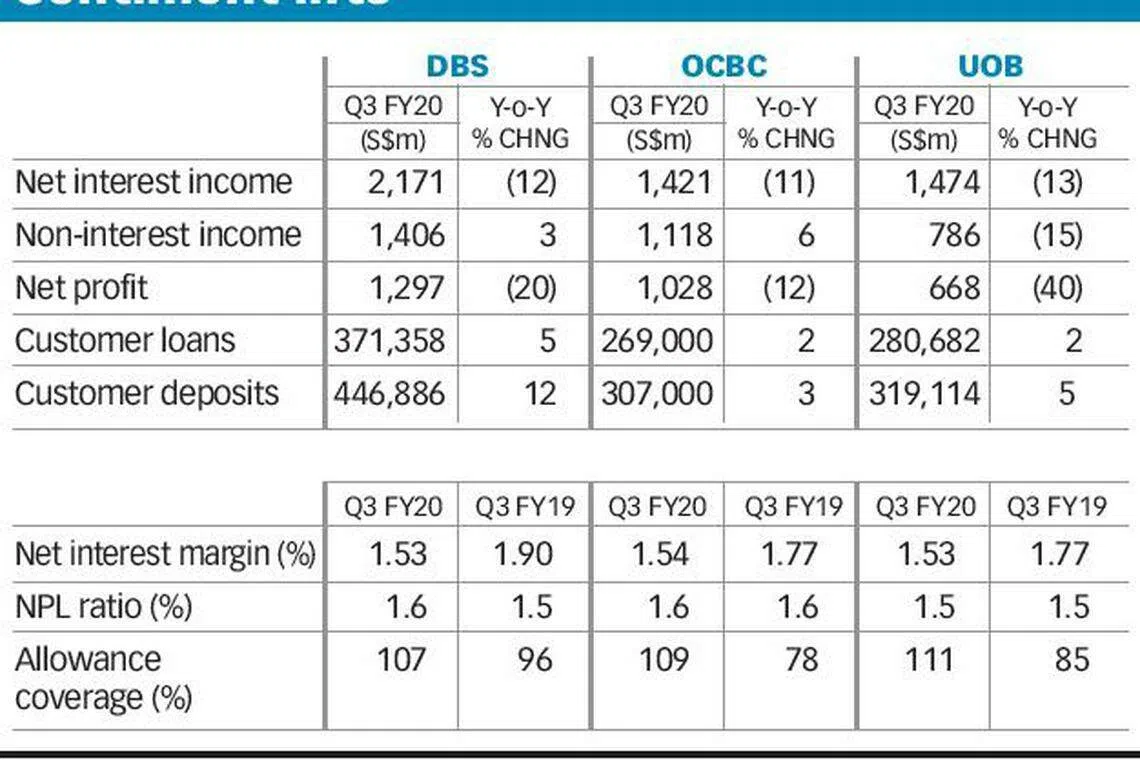

DBS' net profit for its third quarter fell 20 per cent to S$1.30 billion as the bank continued to bulk up allowances from the year-ago period. Total allowances more than doubled from a year ago to S$554 million for the quarter. Its results outshone an average estimate of S$1.17 billion from four analysts, Refinitiv data showed.

OCBC posted a 12 per cent fall in net profit for the third quarter to S$1.03 billion, with total allowances up by 8 per cent to S$350 million. This was stronger than an average profit estimate of S$865 million cited by four analysts polled by Refinitiv.

UOB's net profit fell 40 per cent to S$668 million. Allowances more than tripled to S$477 million, up from S$145 million a year ago. But this still beat an average estimate of S$570 million from three analysts, according to Refinitiv data.

The way the bulk of debt moratoriums in Singapore is being unwound will continue to be watched closely.

DBS chief Piyush Gupta cautioned that it remains tough to tell the extent of defaults, as moratoriums are still masking the true damage. Singapore's largest bank will keep its guidance for total allowances to between S$3 billion and S$5 billion.

Still, some of the worst fears of bad loans out of those under debt-holiday schemes have been dialled down a touch.

Notably, OCBC does not expect a fresh wave of loan moratorium requests amid the extension of targeted debt holidays in Singapore. As at end-October, OCBC's moratorium relief across the group fell to about S$13.6 billion - or 5 per cent of the total loan book compared with 10 per cent in Q2 - following the exit of the debt-relief programme in Malaysia.

Roughly nine in 10 of those under the moratorium programme have returned to their original repayment schedules, which is better than expected, said the bank's group chief executive officer Samuel Tsien.

At UOB, the proportion of the bank's loan book under moratorium has come down to 10 per cent, from 16 per cent in July, largely because of the expiration of blanket loan moratoriums in Malaysia.

UOB's chief financial officer Lee Wai Fai noted that some customers who had sought debt relief still have the ability to pay, but might be taking advantage of the relief to channel funds towards other uses.

While the Q3 results may not demonstrate the true measure of distress, the overall impact "may not be as bad as feared", Mr Lee said.

To be sure, margins hurt amid the collapse in rates. And it comes alongside tepid loan growth, and the unabated hot rush of customer deposits. Consequently, total income was still down for the trio, despite the stronger fee numbers.

OCBC's CASA (current account savings accounts) deposits rose to a record S$182 billion, with CASA ratio at a new high of 59.2 per cent.

DBS' deposits as at the third-quarter were up 12 per cent compared with a year ago, reflecting S$70 billion of CASA inflows.

Net interest margin (NIM) for the three banks are at 1.53-1.54 per cent, a far cry from the 1.77-1.9 per cent NIMs seen a year ago.

Jefferies' Mr Guha added what would add even more comfort is an all-cash dividend reinstatement. DBS, which has a quarterly dividend payout policy, will pay a dividend per share of 18 Singapore cents, unchanged from a quarter ago. It will apply its scrip dividend scheme.

OCBC and UOB pay their dividends twice a year. In Q2, all three offered scrip options.

On Thursday, shares of DBS closed up 88 cents or 4.08 per cent to S$22.43; those of OCBC gained 30 cents or 3.48 per cent to S$8.93. Shares of UOB rose 64 cents or 3.23 per cent, to end at S$20.44.

READ MORE:

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.