Suntec Reit posts 3.4% rise in Q1 DPU to S$0.01563

Revenue is up 3.4% at S$113.5 million for the period

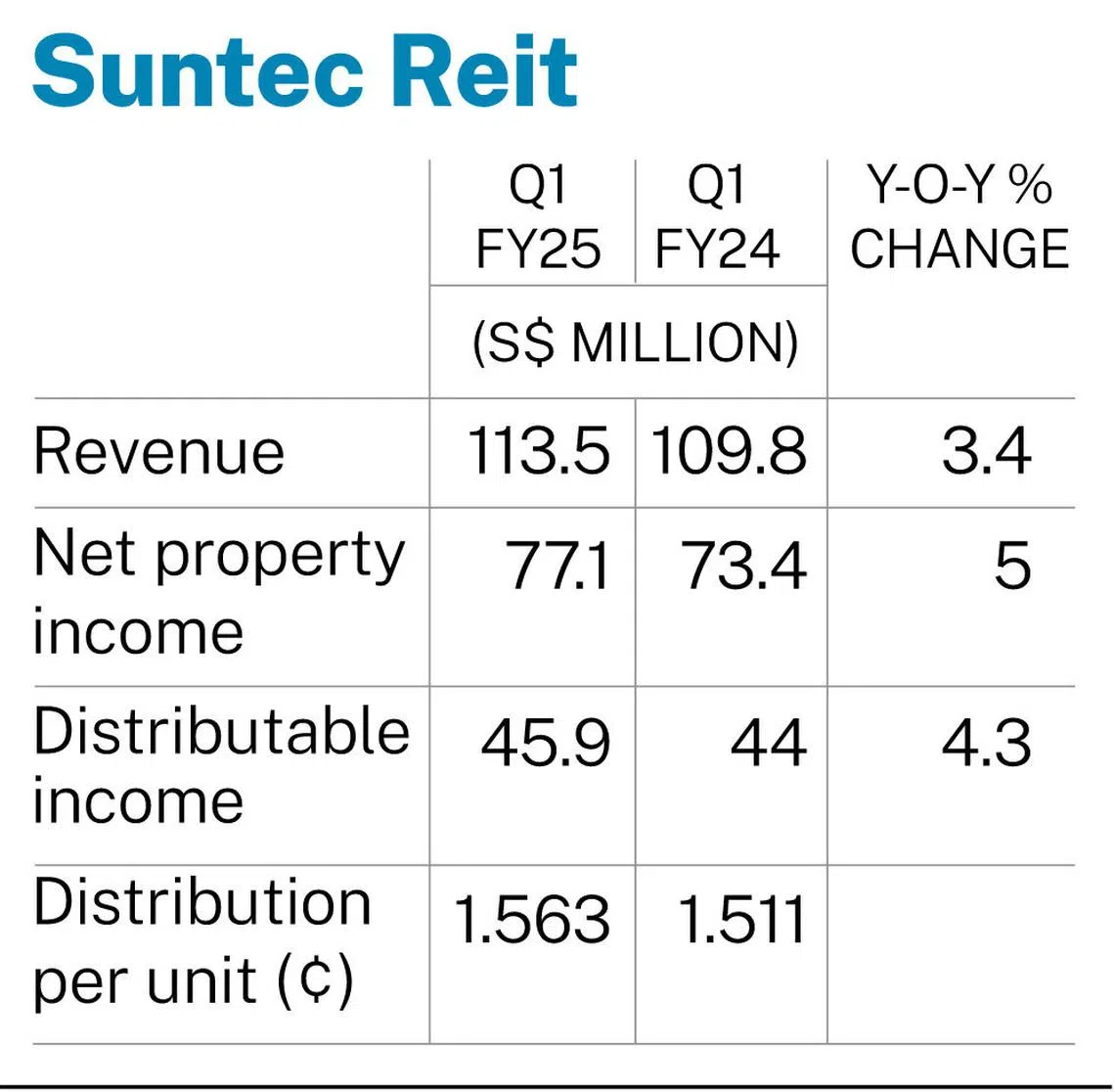

[SINGAPORE] Suntec Real Estate Investment Trust’s (Reit) distribution per unit (DPU) rose by 3.4 per cent to S$0.01563 for its first quarter ended Mar 31, 2025, from S$0.01511 in the same period a year earlier.

Revenue was up 3.4 per cent at S$113.5 million for the quarter, from S$109.8 million in the corresponding period in the previous year.

All properties – except for 55 Currie Street, Adelaide – registered stronger operating performance, said the manager in a business update on Thursday (Apr 24). Distributable income improved due to the better performance and lower financing costs, it added.

Net property income rose 5 per cent on the year to S$77.1 million for the quarter, from S$73.4 million.

Distributable income rose 4.3 per cent year on year to S$45.9 million, from S$44 million.

The distribution will be paid out on May 30, after the record date on May 5.

SEE ALSO

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Chong Kee Hiong, chief executive of the manager, noted that its Singapore office, retail, and convention portfolios as well as the UK portfolios continued to deliver strong operating performances.

“Suntec Reit’s continual improvement in operating performance highlights the strong fundamentals of the properties,” he said. “In light of the global macroeconomic uncertainties, we remain focused on strengthening the operating performance of our properties.”

Units of Suntec Reit closed S$0.01 or 0.9 per cent lower at S$1.16, before the results were released.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.