Driving revenue with improved financial visibility: How cloud accounting primes SMEs for growth

Business consulting firm Bob & Co guides companies to uncover hidden business potential in local and global markets by digitalising their accounts on Xero

WHEN a home-grown catering company engaged a business consultant five years ago, neither expected their relationship to evolve into a joint venture. The two parties are now business partners making a foray into the Cambodian market together.

This partnership would not have been possible had Foodtalks not switched to cloud-based bookkeeping and accounting, as recommended by its business consultant Bob & Co.

While not directly involved in operations, Bob & Co has played a crucial advisory role, which included providing guidance on available grants for overseas expansion and insights into potential pitfalls and risks associated with their new joint venture.

This is the second overseas venture for 20-year-old caterer Foodtalks, following its first international endeavour into Malaysia earlier this year.

Bob & Co’s managing director Bob Ng explains that the move online allowed the once tech-shy company to automate its financial tasks.

Using cloud-based accounting, Foodtalks’ accountants can now process invoices and payments to multiple suppliers in just four days, down from 10 days previously. This improvement comes from using optical character recognition (OCR) technology to quickly digitise invoices and process all payments online.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The caterer also reduced time spent on balancing its books from over one month to just 10 days, freeing staff to focus on business growth and expansion strategies.

More importantly, the company’s figures are now centralised and updated on the go, which was key to enabling Foodtalks’ venture into new markets overseas.

Foodtalks’ regional expansion is part of a large 66 per cent increase in Singapore firms venturing into new markets for the first time in 2023, according to Enterprise Singapore.

Given the limited size of the domestic market, Enterprise Singapore stresses the need for local companies to expand overseas to drive growth.

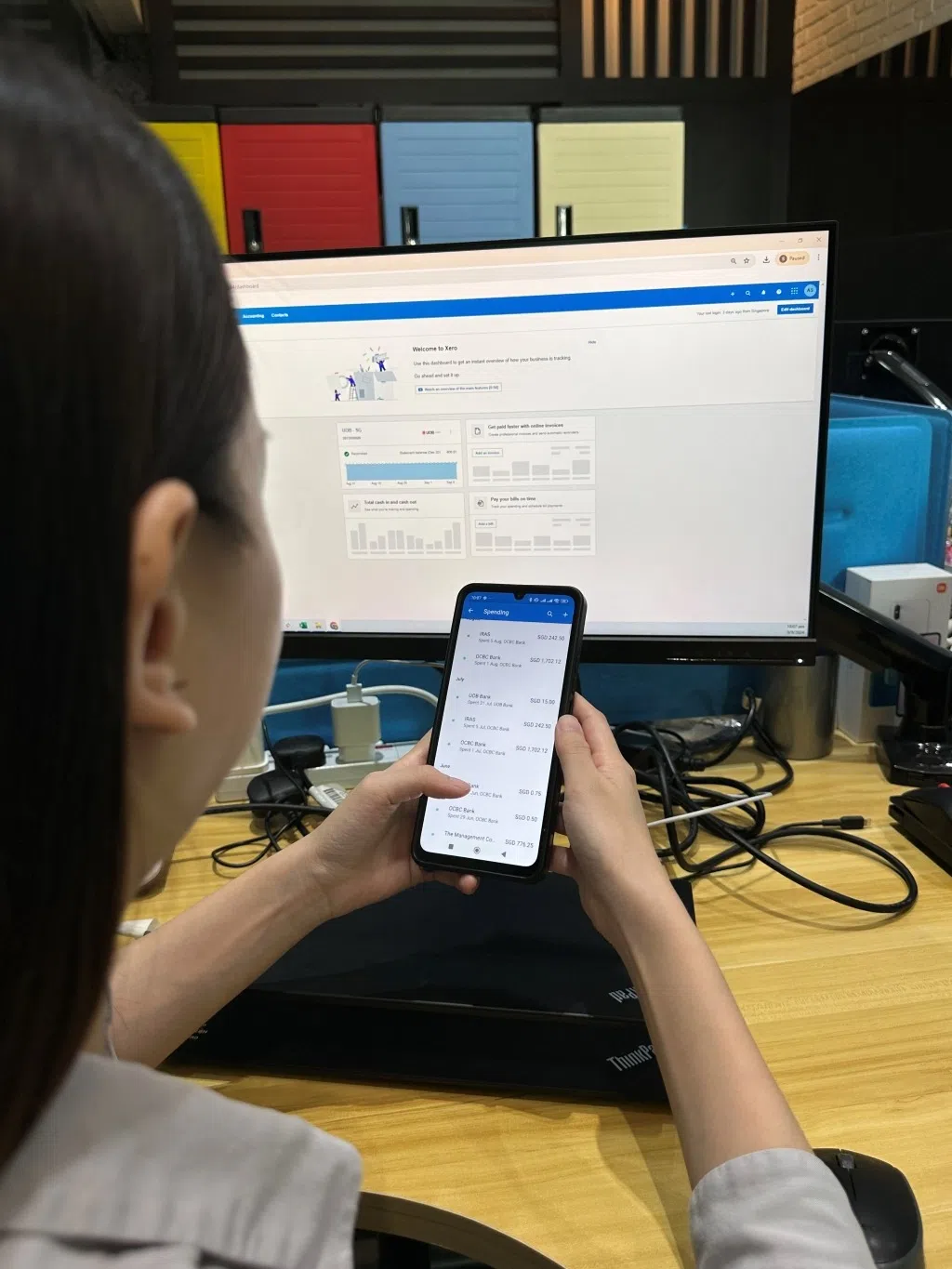

Foodtalks’ move to Xero, the cloud accounting software recommended by Bob & Co, shows that a digital foundation is key in enabling businesses to take the leap internationally.

“We’ve seen many clients work for years before coming to us not knowing what’s going on in their business, outside of seeing the sales and the money in the bank. If their business in the local market is not taken care of, they will not look elsewhere for more opportunities,” Ng says.

“But once they gain visibility of their finances, they start to learn where to cut or renegotiate expenses, take better care of their business at home, and have the confidence to venture outside of Singapore.”

Guiding SMEs towards growth

Foodtalks is one of the over 1,000 SMEs that Bob & Co has served, with 85 per cent based in Singapore. Bob & Co provides professional services in accounting, auditing, taxation and business advisory.

After a decade of working closely with local companies, Bob & Co learnt that it takes time for SMEs to go digital, and many just need a guiding hand through the process. This was the case for a construction company with $5 million in annual revenue.

Before reaching out to Bob & Co, the construction company had been using traditional spreadsheets for its accounting, invoicing, expenses and claims for 20 years.

The company passed them to a corporate services provider to wrap up its quarterly accounts and goods and services tax, a process that was inefficient and prone to errors.

“I gave them a demonstration to show how they can have one piece of software do everything,” Ng recalls. “They don’t need to extract documents and pass them to us because, as their service provider, we can log on to their Xero account directly and retrieve the information.”

Bob & Co onboarded the construction client to Xero in just two weeks, setting up accounts, importing legacy data and customising invoice templates.

“The client was definitely impressed as the perception initially was that the conversion would be a painful process and would take a long time to complete,” says Ng.

The client’s administration team realised that removing manual processing improved the accuracy of all claims. And with time freed up, the company could focus on project tendering to bring in more sales.

As it always does, Bob & Co followed up by training the client’s administration team to use Xero.

Ng adds: “We train our clients to perform basic processes, such as invoicing, on their own, but we also help them in more specialised tasks, which include reviewing and interpreting their financial and tax statements.”

Bob & Co also supports clients in navigating complex accounting scenarios.

For example, clients may receive new types of invoices with formats not yet compatible with Bluesheets, an app within Xero that automates manual data entry of documents. Bob & Co helps review the invoice coding and other necessary adjustments for processing, which clients may not have the expertise to handle effectively.

“We always work hand-in-hand with our clients and we maintain that synergy between us,” Ng says.

Bringing value to both clients and employees

With success stories like these, Ng has come to appreciate the transformative power of cloud-based accounting for SMEs, which can improve outcomes for both his clients and staff.

To speed up clients’ accounting processes, Bob & Co has established standard operating procedures that leverage the templates available on Xero. With these, accountants can prepare financial statements for clients in eight hours compared to the three to four working days it takes other companies.

These internal efficiencies improve Bob & Co’s productivity and bottom line.

“At the end of the day, my team can actually take on a lot more work compared to other accounting firms out there,” says Ng.

The efficiency gains also translate into better work-life balance for Bob & Co’s employees, who complete their work without the need for overtime.

For Ng, the many hours saved using Xero means he can dedicate more time to the value-added work of building client relationships.

For example, he is more than happy to run through a client’s financials to give them better clarity on their direction moving forward, and he does so at no extra charge.

It is this value-added work that has enabled Bob & Co to explore regional opportunities with Foodtalks.

Reflecting on his engagement with the catering company before they went international, Ng says: “That’s the biggest joy for me, when I speak to the client, give them pointers, and they take on and implement what I suggest.

“I think that that’s the time I truly feel that I’m making a difference for SMEs.”

Learn how Xero can help your business.

Share with us your feedback on BT's products and services