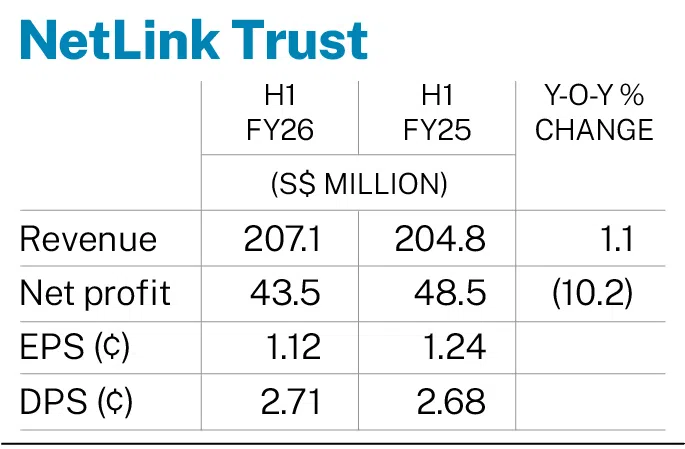

NetLink Trust posts 10.2% drop in H1 profit to S$43.5 million on higher depreciation

Revenue is up 1.1% year on year at S$207.1 million

[SINGAPORE] Fibre network provider NetLink NBN Trust on Monday (Nov 3) posted a 10.2 per cent drop in net profit to S$43.5 million for the half year ended Sep 30, from S$48.5 million in the previous corresponding period.

Its trustee-manager said that this was mainly due to higher depreciation and amortisation, primarily from its Seletar Central Office, which opened in October this year.

However, the manager added in a bourse filing that this was partially offset by a higher income tax credit.

Earnings per share stood at S$0.0112 for the first half of FY2026, down from S$0.0124 the previous year.

Revenue rose 1.1 per cent to S$207.1 million, from S$204.8 million a year earlier.

The manager said that the increase was mainly driven by higher ancillary project revenue from the completion of more government projects during the period.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Stronger co-location revenue supported by higher rack space take-up and a one-off cost recovery related to the upgrade of the Nationwide Broadband Network, which now supports speeds of up to 10 Gbps, also boosted income.

The manager also announced a distribution per unit of S$0.0271 for the half-year, 1.1 per cent higher than the previous corresponding period’s S$0.0268.

The manager said that despite a volatile global environment marked by geopolitical tensions and economic uncertainty, the group’s resilient business model – supported by regulated price certainty under the revised Interconnection Offer framework – continues to deliver stable revenue and operating cash flow.

It noted that the fibre network provider has taken proactive steps to strengthen its balance sheet. These include establishing a new three-year S$120 million sustainability-linked revolving credit facility (SLRCF) in July 2025, and refinancing its existing SLRCFs through the issuance of S$300 million in 10-year fixed-rate notes at 2.65 per cent in September 2025.

Also, NetLink Trust issued S$300 million of Qualifying Project Debt Securities to NetLink NBN Trust, a move expected to enhance the group’s tax efficiency over time.

While the group continues to improve efficiency and manage costs, operating pressures and higher depreciation from ongoing fibre network investments have affected profit margins. However, the statement said that these investments are part of its regulated asset base and qualify for recovery.

Nevertheless, the group remains focused on expanding its network to meet rising demand across residential, commercial, and other segments, while exploring new opportunities in telecoms and infrastructure-related businesses, it added.

The counter rose 0.5 per cent or S$0.005 to S$0.985 on Monday, before the news.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.