Three S-Reits poised to benefit from tailwinds in Europe’s logistics sector

Agnes Wee SCN &

Emelia Tan

ACCORDING to a Savills report on the European logistics sector outlook published in mid-March, the region’s logistics market is faced with a mixed economic outlook and slowdown, but tailwinds are expected to return soon.

European GDP results have outperformed previous forecasts, and despite lower retail sales volumes in recent months, consumer sentiment has held up and record low vacancy rates continue to support rental growth.

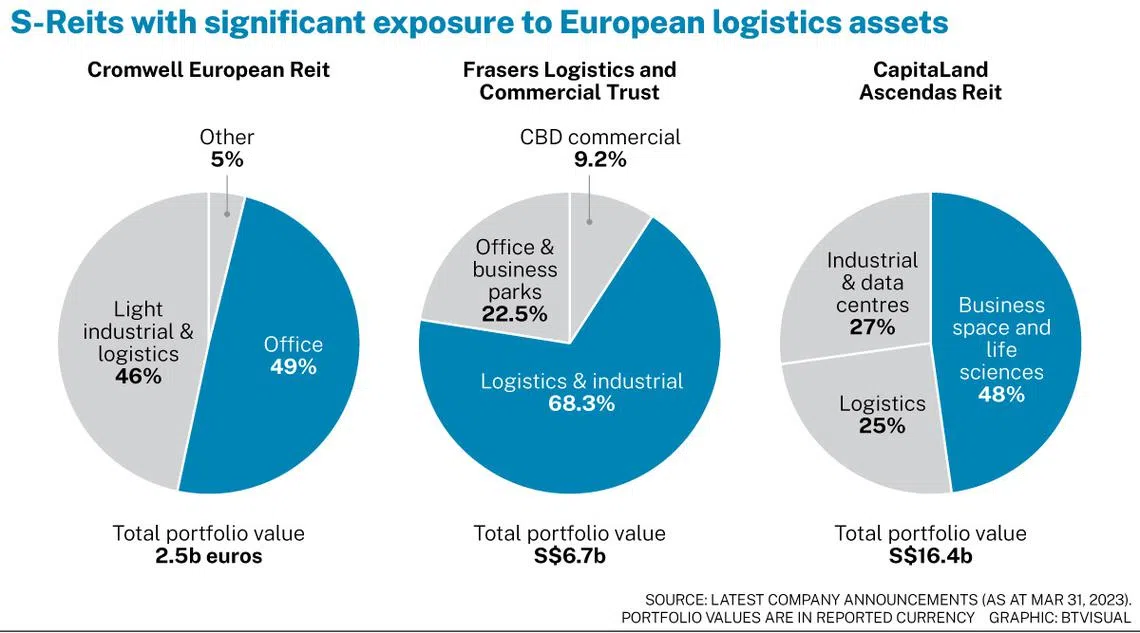

Listed in Singapore are three Reits with significant exposure to European logistics real estate properties – Cromwell European Reit , Frasers Logistics & Commercial Trust , and CapitaLand Ascendas Reit .

Cromwell European Reit (CEReit) is a pure-play Pan-European Reit with light industrial/logistics and office assets. In its latest earnings update for the year ended Dec 31, 2022 (FY22), it noted, citing CBRE’s Q1 2023 report, that occupier fundamentals remain solid in the European logistics sector as the rapid rise in e-commerce in the last six years continues into 2023.

The reshoring of supply chains has driven demand to record levels and a space shortage in warehouse and logistics space has applied upward pressure on prime rents. Average occupancy rates for logistics properties in the eight countries that CEReit has exposure to was also at an all-time low of 2.4 per cent.

CEReit announced a net property income (NPI) of 136.8 million euros (S$197.8 million) for FY22, expanding 5.1 per cent year on year (yoy). This was mainly driven by a 23.9 per cent yoy growth in the light industrial/logistics sector.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Distribution per unit (DPU) for FY22 rose 1.3 per cent yoy to 17.189 euro cents. Its portfolio occupancy in FY22 was at a record-high of 96 per cent, with strong positive 5.7 per cent rent reversion boosted by stronger leasing pace in H2 2022.

CEReit continues to execute its strategy of pivoting towards logistics assets. In 2022, it acquired five light industrial/logistics/life sciences assets for an aggregate amount of approximately 107 million euros at a blended net operating income yield of 7.4 per cent, 11 per cent below acquisition valuations.

Light industrial/logistics assets now make up 46 per cent of CEReit’s total portfolio value as at FY22 compared to 35 per cent in FY18. The Reit plans to continue developing this segment and expects it to reach 60 per cent in the future.

Frasers Logistics and Commercial Trust (FLCT) has around 31 per cent of its total portfolio value in 36 European logistics/industrial assets. Its overall logistics/industrial portfolio is fully occupied and has a long weighted average lease expiry (WALE) of 5.2 years. FLCT noted that prime rents in countries such as Germany and the Netherlands are increasing amid robust demand and limited supply.

CapitaLand Ascendas Reit (CLAR) has around 5 per cent of its total portfolio value in logistics assets in the UK. The Reit’s overall European portfolio which comprises logistics properties and data centres has a long WALE period of 5.9 years and they are expected to benefit from the strong adoption of e-commerce and digitalisation of activities. SGX RESEARCH

The writer is a research analyst at SGX. For more research and information on Singapore’s Reit sector, visit sgx.com/research-education/sectors for the monthly S-Reits & Property Trusts Chartbook.

Source: SGX Research S-Reits & Property Trusts Chartbook.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.