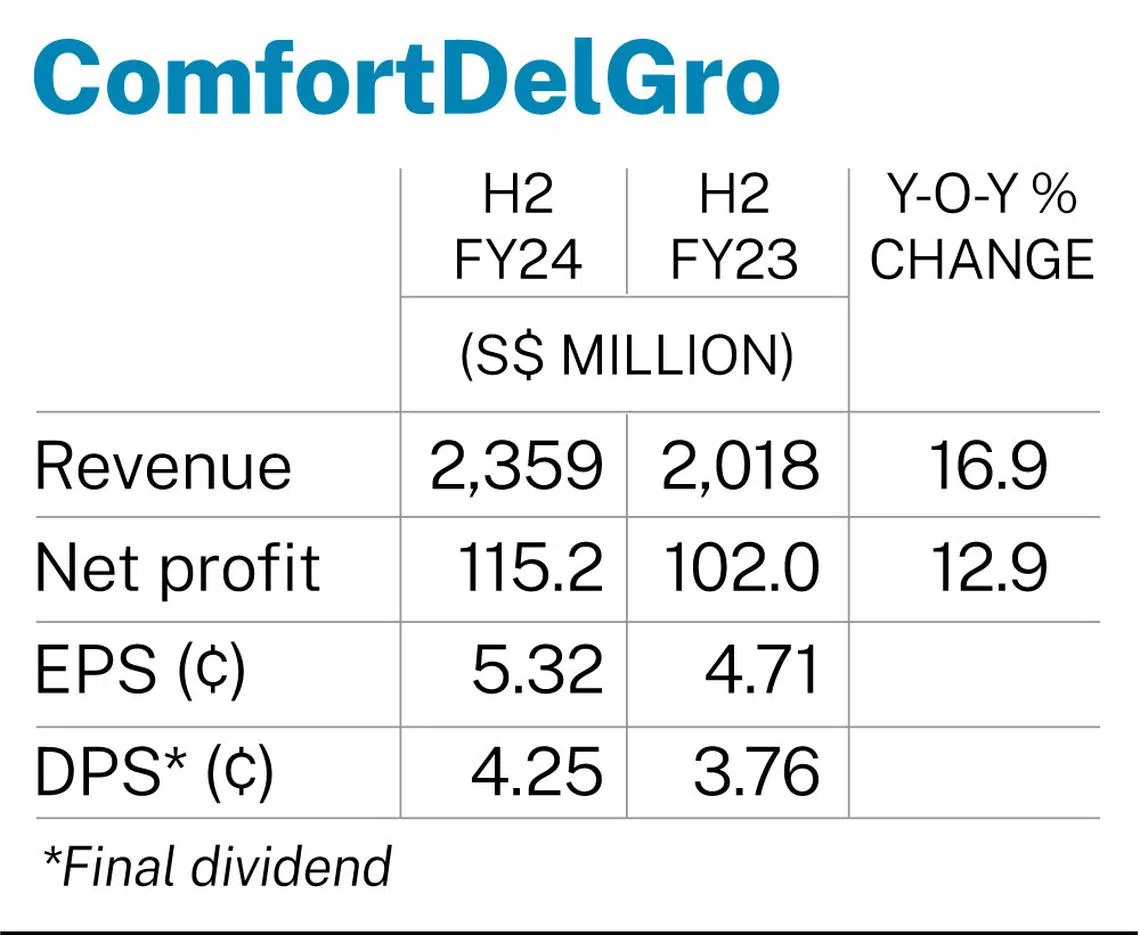

ComfortDelGro H2 earnings up 12.9% at S$115.2 million

Group chairman Mark Greaves describes 2024 as a ‘momentous’ year and the culmination of three to five years of activity

COMFORTDELGRO reported a 12.9 per cent year-on-year rise in earnings to S$115.2 million for the second half of financial year 2024 ended December.

H2 revenue was up 16.9 per cent at S$2.4 billion, from S$2 billion in the corresponding year-ago period. In particular, revenue from its public transport business was 3.1 per cent higher. This was attributed to increased contributions from UK public bus contracts, improved rail ridership and fare increase, as well as contractual indexation adjustments on public bus contracts.

Meanwhile, operating profit from the segment rose 10.3 per cent. The group said that this was due to UK public bus contracts being renewed at improved margins, which partially offset contract renewals at lower margins and driver shortages in Australia.

Its taxi and private-hire vehicle (PHV) business revenue surged 41.9 per cent, mainly due to the acquisitions of taxi services providers A2B in Australia and Addison Lee in the UK, which began contributing to revenue in April and November 2024, respectively.

The two takeovers, along with higher taxi app commissions from increased fares in Singapore, resulted in a 12.7 per cent rise in operating profit for the segment.

For the second half, revenue from its other private transport segment more than trebled to S$232.7 million, chiefly from the contributions of ground transport and accommodation provider CMAC, which was acquired in February 2024.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Operating profit for the segment came in at S$14.4 million, reversing a S$1.2 million loss in the second half of 2023.

For FY2024, the group posted a 16.6 per cent improvement in earnings to S$210.5 million, from S$180.5 million. Its top line increased 15.4 per cent to S$4.5 billion, from S$3.9 billion.

A final dividend of S$0.0425 per share has been proposed, which takes the total dividend for the year to S$0.0777 per share, inclusive of the interim dividend of S$0.0352 per share. This represents a payout ratio of 80 per cent. It will be paid on May 14, if shareholders approve.

Outlook

Group chairman Mark Greaves described 2024 as a “momentous” year and the culmination of three to five years of activity, with the international expansion and strategic acquisitions being key to its strategy of building scale and pursuing profitable growth.

ComfortDelGro’s group chief executive officer Cheng Siak Kian noted it had gained entry into many large public transport contracts, such as in Manchester, UK and Victoria, Australia.

Acquisitions such as CMAC and Addison Lee and A2B – which began revenue contributions in 2024 – widened the group’s portfolio and “position it for future growth” in the taxi/PHV and other private transport segments. Revenue from outside the home market of Singapore expanded to 49.1 per cent up, from 42.6 per cent the year before.

The group noted that Singapore rail operational revenues are expected to rise marginally with higher ridership and fare increases from December 2024. Its bus revenues in the Republic are expected to dip, after the Jurong West package expired in August 2024. However, the Seletar bus package was retained at current market margins for at least five years, starting in March 2025.

On public transport overseas, the transport giant said that its London public bus contract renewals are expected to continue at improved margins, and it will tender for bus franchises in Merseyside and West Yorkshire. ComfortDelGro has formed a consortium with RATP Dev for the Copenhagen metro tender.

Meanwhile, bus driver shortages are gradually easing in Australia, the group noted. It is partnering UGL Group and Hyundai Rotem for the Sydney Metro West tender. For taxi and private hire, competition in Singapore is expected to intensify with new entrants. In China, taxi revenues likely to be subdued due to the expected economic slowdown, it added.

Shares of ComfortDelGro closed up 1.4 per cent or S$0.02 at S$1.41 on Thursday, before the financial results were made public.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.