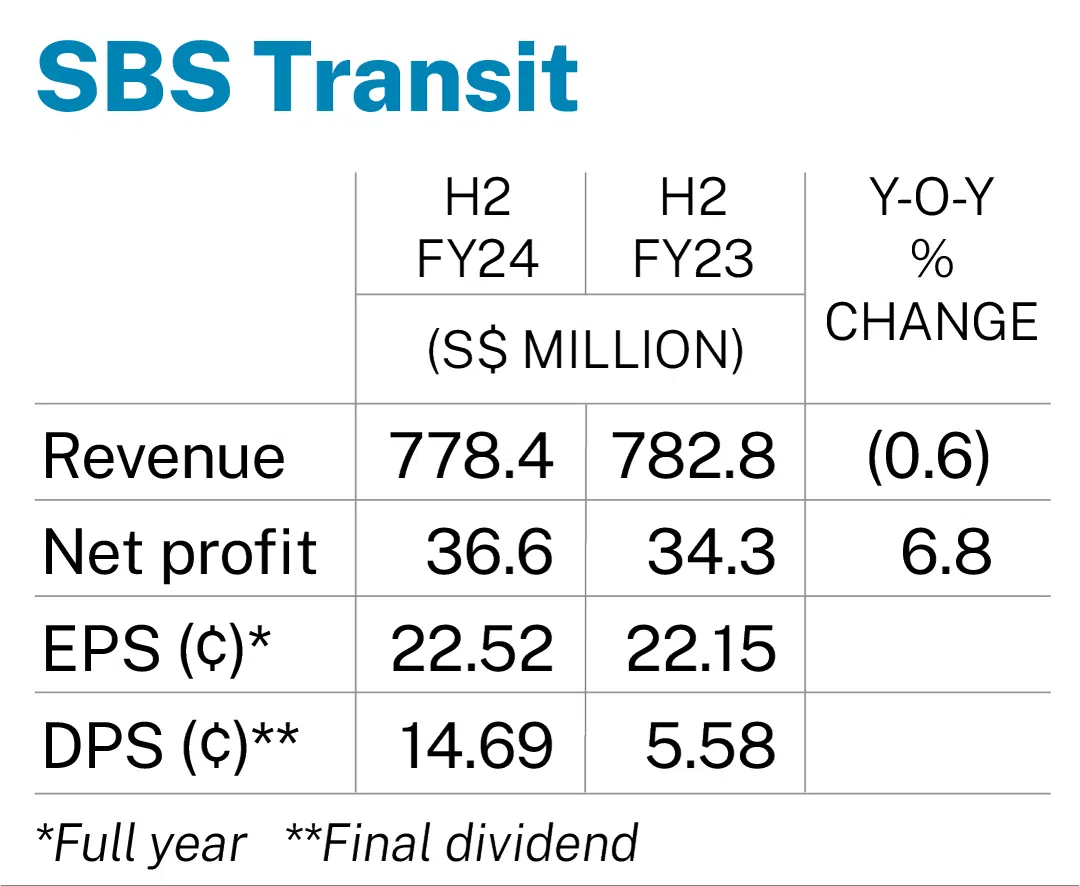

SBS Transit H2 net profit up 6.8%, pays 2.6 times higher final dividend

The transport behemoth’s revenue stands at S$778.4 million, a decline of 0.6%

KEY POINTS

H2 FY2024

- Revenue: S$778.4 million (-0.6%)

- Net profit: S$36.6 million (+6.8%)

- Final dividend: S$0.1469

SBS Transit’s net profit for the second half-year ended Dec 31, 2024, rose 6.8 per cent to S$36.6 million, despite lower revenue and operating profit. Still, it is rewarding shareholders with a final dividend of S$0.1469 – 2.6 times that of FY2023’s.

Its H2 FY2024 bottom line was bolstered by a tax expense that nearly halved due to the write-back of overprovision of earlier tax and lower profits, SBS Transit’s financial results published on Tuesday (Feb 25) showed.

The transport behemoth’s revenue stood at S$778.4 million, a decline of 0.6 per cent.

Revenue from public transport services of S$745.7 million was 1 per cent lower due mainly to lower bus revenue mileage. This was, however, mitigated by higher rail revenue as rail average fare and ridership increased.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Operating profit for this segment was up 22.4 per cent to S$26.8 million, mainly due to productivity savings, lower fuel and electricity costs, and lower repair and maintenance costs.

Average daily ridership for the North East Line was up 1.3 per cent at 590,000 passenger trips, while that for the Punggol LRT line dropped by 2.8 per cent to 157,000 passenger trips. Average daily ridership for the Downtown Line was 3.4 per cent higher at 468,000 passenger trips.

The drop in group revenue outstripped the slide of 0.3 per cent in operating cost, resulting in a 5.2 per cent lower operating profit.

The group has proposed a final dividend of S$0.1469 and a special dividend of S$0.0841 per share, making it S$0.2868 in total, including the interim dividend of S$0.0558. SBS Transit said this was in line with its policy of paying at least half of its profits as dividend.

Earnings per share for FY2024 was S$0.2252, slightly higher than FY2023’s S$0.2215.

The proposed special dividend will be paid out from the entire proceeds of the sale of Soon Lee Bus Depot in 2024. This and the final dividend are payable on May 13, if approved by shareholders at the annual general meeting on Apr 24.

For FY2023, shareholders got S$0.0558 both for interim and final dividend, or S$0.1116 in total.

For FY2024, group revenue increased by 2.1 per cent to S$1.6 billion while profit rose 1.8 per cent to S$70.3 million.

Rail operations revenue is expected to improve marginally with higher ridership and the fare adjustments that came into effect on Dec 28, 2024.

Bus operations revenue, conversely, will decrease, as the Jurong West bus package expired in August 2024.

Operating costs continue to remain a challenge, even though cost increases are expected to moderate with the easing of inflationary pressures. The tight labour market remains a concern, SBS Transit said.

The counter closed unchanged at S$2.41 on Tuesday, before the financial results were published.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.