UOB beats expectations with Q4 profit up 8.6% to S$1.52 billion; announces S$3 billion capital distribution package

The lender proposes a final dividend of S$0.92 per share and a special dividend of S$0.50 per share over two tranches in 2025

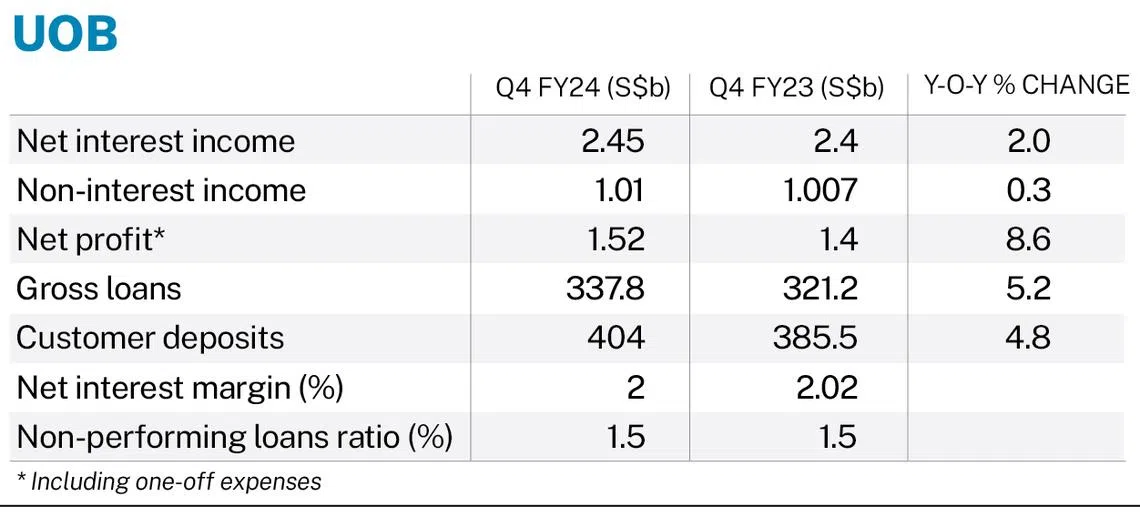

UOB on Wednesday (Feb 19) posted a net profit of S$1.52 billion for the fourth quarter ended December, up 8.6 per cent from S$1.4 billion in the previous corresponding period.

This included S$17 million in one-off expenses from the lender’s Citigroup integration costs after taxes, which was 81.9 per cent lower than the S$94 million recorded in the same period the previous year.

The earnings beat the S$1.48 billion consensus forecast in a Bloomberg survey of six analysts.

The lender has proposed a higher final dividend of S$0.92 per share for the half-year period, from S$0.85 the year before.

This brings the full-year dividend to S$1.80 per share, representing a payout ratio of about 50 per cent. The lender is also proposing a special dividend of S$0.50 per share, paying out S$800 million of UOB’s surplus capital, over two tranches in 2025.

The final dividend and first tranche of special dividend of S$0.25 will be paid out on May 13. The remaining special dividend will be issued on Aug 28.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Net interest income for the quarter was up 2 per cent on the year at S$2.45 billion, driven by loan growth of 5 per cent. Net fee income was stable at S$567 million. Other non-interest income was up 1.1 per cent on the year at S$443 million.

Net interest margin for Q4 stood at 2 per cent, down from 2.02 per cent in the same period a year earlier. This was mainly due to lower benchmark rates.

Core operating expenses increased from investment in franchise growth, with core cost-to-income ratio at 45 per cent. Total allowances rose to S$337 million on higher specific allowance.

UOB’s non-performing loan ratio remained at 1.5 per cent as at Dec 31, 2024.

For the full year, net profit was up 5.8 per cent at a record S$6.05 billion. Excluding the one-off Citigroup integration costs, core net profit would be S$6.23 billion, up 2.9 per cent on the year.

UOB deputy chairman and chief executive Wee Ee Cheong said the group’s record net profit was driven by strong fee income, as well as “robust trading and investment income”. He also expects “continued revenue growth this year”.

He is also confident that the Asean region will “remain resilient”, supported by higher domestic retail spending and stronger influx of foreign direct investment.

“Our strengthened market position in our key Asean markets, enlarged customer base and enhanced platforms will position us well to seize regional opportunities amid a reconfiguration of global trade and supply chains,” he added.

Annualised earnings per share stood at S$3.56 for FY2024, up from S$3.34 the year before.

Net interest income for the full year was stable at S$9.67 billion, driven by healthy loan growth.

Loan growth offset the effect of lower net interest margin, which fell to 2.03 per cent in FY2024, from 2.09 per cent previously. The contraction in net interest margin came from interest rate movements, said UOB.

Net fee income was up 7 per cent on the year at S$2.4 billion. This was driven by double-digit growth in wealth management fees from improved investor sentiments, stronger card fees on an enlarged regional franchise, as well as higher loan fees as lending and capital market activities picked up.

Other non-interest income jumped 10 per cent on the year to S$2.23 billion. This came amid higher customer-related treasury income from increased retail bond sales, strong hedging demands, as well as good performance from trading and liquidity management activities.

Total allowances were stable at S$926 million, with total credit costs on loans at 27 basis points.

Returning surplus capital

As part of the bank’s capital distribution strategy, the board has announced a S$3 billion package to distribute surplus capital over the next three years. The package comprises special dividends and share buybacks.

This includes the introduction of a S$2 billion share buyback programme, where shares will be acquired from the open market and cancelled.

The lender noted that its capital position “will remain strong”, following the capital distribution.

The package is estimated to optimise UOB group’s Common Equity Tier 1 capital adequacy ratio by one percentage point, based on its capital position as at Dec 31, 2024.

UOB’s Common Equity Tier 1 capital adequacy ratio stood at 15.5 per cent in Q4. Its liquidity coverage ratio stood at 143 per cent, while its net stable funding ratio was 116 per cent. Loan-to-deposit ratio was 82.7 per cent.

Wee is positive in sustaining the lender’s growth momentum. “Guided by our disciplined approach to balancing long-term growth with stability, we are poised to further enhance shareholder value in the years to come,” he added.

Shares of UOB ended Tuesday 0.1 per cent or S$0.04 higher at S$38.65.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.