UOB posts 5.5% rise in Q2 earnings

More loans sold at higher margins give net interest income a boost

Singapore

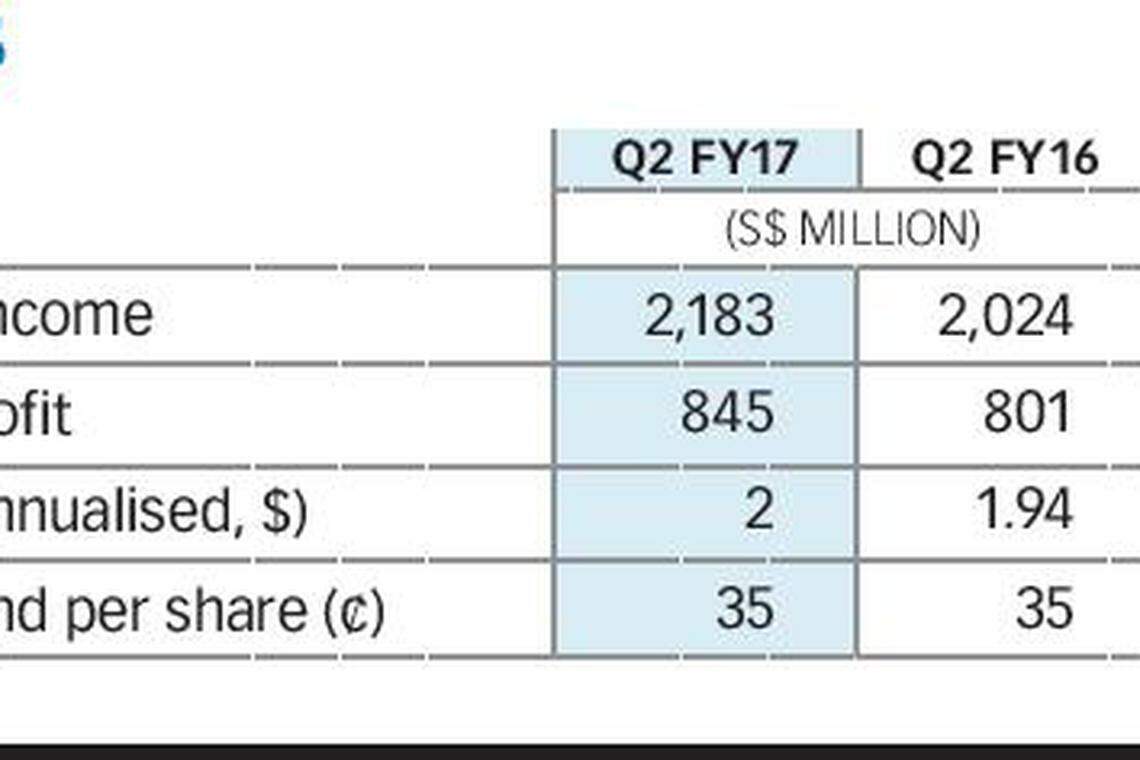

UNITED Overseas Bank said on Friday that net earnings for the second quarter rose 5.5 per cent to S$845 million from selling more loans at higher margins.

The second Singapore bank to report results, UOB's slower profit gain, after OCBC's 22 per cent jump, was a dose of cold water following an impressive run-up this year of the three bank stocks. DBS reports Q2 results on Aug 4. DBS and UOB fell 2.6 and 2.2 per cent respectively while OCBC was down 0.9 per cent. Year to date, the three are up as much as 28 per cent.

UOB said that net interest income in Q2 rose 12 per cent to S$1.36 billion, driven by gross loan growth of 7.3 per cent and an improvement in net interest margin (NIM) of seven basis points to 1.75 per cent.

Against the previous quarter loans fell marginally, down 0.6 per cent on a few large corporate repayments and disciplined pricing to protect its NIM. Net interest income rose 4 per cent to S$1.36 billion from Q1 on higher NIM, up two basis to 1.75 per cent from 1.73 per cent.

Chief executive Wee Ee Cheong said that while loans grew in the first half and margins rose slightly, due to more efficient deployment of liquid assets on the interbank market, competition is keen.

"We expect mid-single digit loan growth for the full year," he said at the bank's results briefing.

"Loan pricing remains competitive. We expect margins to be flat, or see a slight increase for the rest of the year depending on interest rate outlook."

Non-interest income rose slightly at 1.8 per cent to S$828 million. Fee and commission income grew 9 per cent to S$517 million on higher credit card, fund and wealth management fees. Other non-interest income fell 8.3 per cent due mainly to lower net trading income.

Fee income from fund and wealth management was strong, up 33 per cent and 24 per cent respectively.

Wealth management business saw steady growth, with first half income and profit up 20 per cent and 27 per cent respectively from last year, said Mr Wee.

UOB's assets under management (AUM), up 12 per cent year on year, is close to the S$100 billion milestone, he said. The mass affluent, one of its key segments, continued to do well, with income up 13 per cent, he said.

Housing loans in Singapore and in the region fared well, he said. Housing loans rose 6 per cent or S$3.6 billion to S$62.9 billion from a year ago.

On Singapore's residential market, Mr Wee said that there are signs that the "Singapore market is bottoming out". But while sentiment has improved and sales has picked up, it was too early to say if the recovery was sustainable as that would depend on the fundamentals of the economy, he said.

Mr Wee said that its wholesale banking franchise continues to gain more customers, though its bottom line was affected by higher allowances, largely from the oil and gas sector. Group wholesale banking profit before tax fell 17 per cent in first half 2017 to S$980 million.

"Overall transaction banking income grew 9 per cent in the first half of this year. Despite a competitive market and margin compression, we achieved growth in trade revenue," he said.

The bank continues to attract cash management mandates from multinationals and regional corporates, he said.

UOB's total expenses rose 7.3 per cent from a year ago to S$995 million due to higher staff and IT-related expenses.

Group non-performing loans (NPL) rose 13 per cent to S$3.5 billion from a year ago due to new NPLs from the oil and gas and shipping sectors. Against the previous quarter, NPL was up by 2 per cent due to new NPLs in Malaysia and other countries. The NPL ratio rose to 1.5 per cent from 1.4 per cent a year ago; it was unchanged from the last quarter.

UOB proposed an interim dividend of 35 Singapore cents, unchanged from a year ago.

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

Hong Kong regulator to probe PwC auditing role over Evergrande

US: S&P, Dow open flat as Middle East jitters ease, Netflix weighs on Nasdaq

DBS puts 46 HDB shops, private strata retail units on market for S$210 million

China to facilitate Hong Kong IPOs and expand Stock Connect

Global equity funds see surge in outflows as rate cut hopes fade

Gazelle Ventures makes cash offer for No Signboard shares at S$0.0021 apiece