Keppel breaches Temasek offer terms with S$697m record loss in Q2

It books S$919m impairment; excluding that, earnings were up 45%; all segments save OM improve showing

Singapore

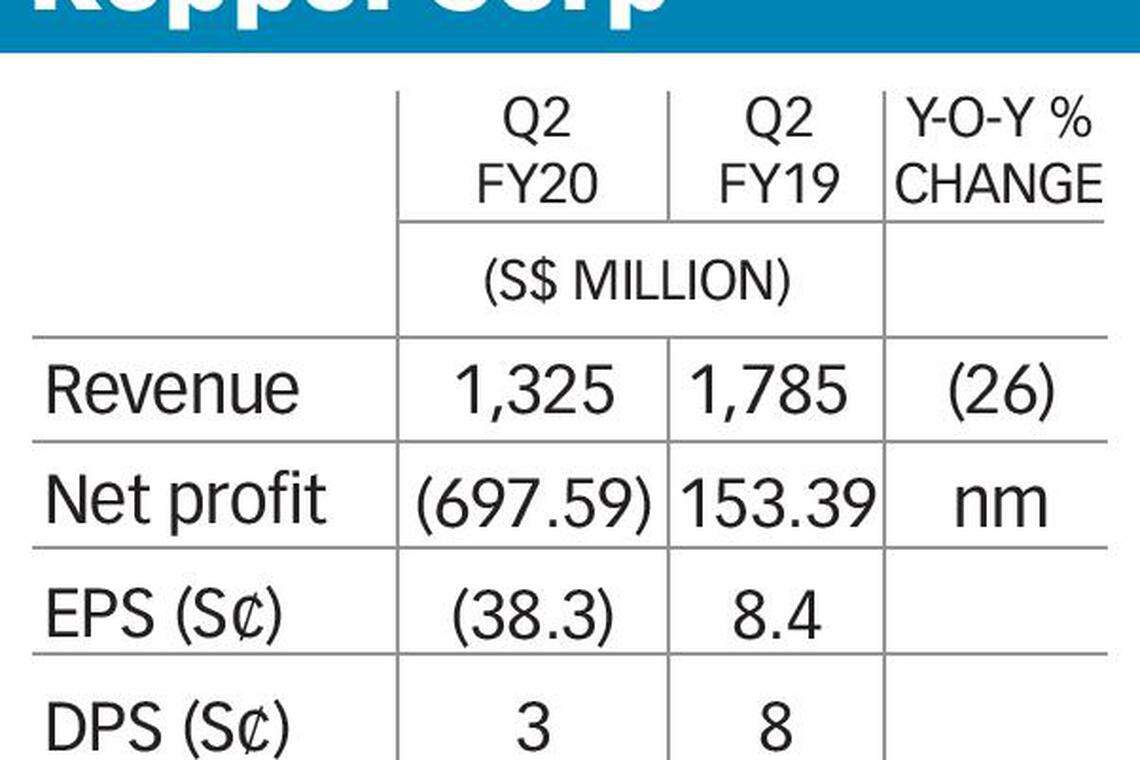

KEPPEL Corporation surpassed even the worst forecasts to post a record quarterly loss of S$697 million, breaching certain conditions for Temasek Holdings' S$4 billion pre-conditional partial offer for the conglomerate.

The loss was anchored by massive impairments of S$919 million - reflecting a gloomy outlook for offshore and marine - that took analysts by surprise. The group had chalked up a profit of S$153 million profit for the same period a year ago.

Keppel chief executive officer Loh Chin Hua pointed out that the impairments were non-cash items and would not hamper the firm's ability to secure funding in an uncertain, pandemic-hit environment. However, he said the weak showing means Keppel has failed to meet certain pre-conditions for Temasek's offer.

"We believe that the 20 per cent threshold in the MAC (Material Adverse Change) clause has been crossed in terms of the net profit after tax, which means the MAC pre-conditions in Temasek's partial offer has not been satisfied as of today," said Mr Loh at Keppel's results briefing on Thursday.

The latest development could cast a cloud over the group's share price. Up till last week when Keppel issued a profit warning, the market had not paid much attention to the issue of potentially higher impairments in the deteriorating offshore segment.

A NEWSLETTER FOR YOU

SGSME

Get updates on Singapore's SME community, along with profiles, news and tips.

The MAC pre-condition for Temasek's bid for control over Keppel includes thresholds for net profit after tax and net asset value, among others.

"We are unable to comment on the action that Temasek could take resulting from the non-fulfilment of this pre-condition. I won't speculate...," Mr Loh said, adding that the group's underlying business, apart from Keppel Offshore & Marine, remains strong.

"(We) will do our utmost to realise full potential of Keppel regardless... for all stakeholders," he remarked.

Excluding the impairments, Keppel posted a net profit of S$222 million for the quarter - up 45 per cent from a year ago.

The impairments mainly related to Keppel Offshore & Marine's contract assets, doubtful debts and stocks plus a S$227 million share of associate company Floatel International's impairment of vessels and a S$10 million fair value loss on the investment in Floatel.

One analyst said the poor showing follows the steep losses recently reported by peer Sembcorp Marine and Floatel's announcement on Thursday that it was set to book higher impairment charges of nearly US$400 million on its vessels following an independent review. (see amendment note)

Floatel's review was in fact prompted by Keppel after Oslo-listed Prosafe - Floatel's key rival in the offshore accommodation space - made an impairment of US$810.5 million to the book value of its vessels which had dwarfed Floatel's US$30 million impairment recognised in Q4 FY2019.

"We are satisfied that the impairment provision today is adequate," said Mr Loh.

Revenue came in 26 per cent lower at S$1.33 billion due to lower contributions across its divisions as a result of "significantly lower level of activities" due to Covid-19 and the measures to combat the outbreak.

Except for the O&M division that was hit by a net loss of S$962 million in the quarter, the other segments had better report cards.

Net profit from property was up 25 per cent at S$162 million while the infrastructure segment posted an 81 per cent jump to S$78 million. The investments division earned S$25 million from a loss of S$24 million a year ago.

It posted a loss per share of 38.3 Singapore cents for the period under review from an earnings per share of 8.4 cents. Keppel declared an interim dividend of 3.0 cents per share, down from 8.0 cents a year ago. The interim dividend will be paid on Aug 20.

For the half-year period, Keppel reported a net loss of S$537 million versus a profit of S$356 million a year ago on the back of a 4 per cent fall in revenue to S$3.18 billion. Excluding the S$930 million impairments, it would have registered a net profit of S$393 million, up 5 per cent.

Net gearing stood at 1.0x at end-June 2020 compared to 0.88x as at end-March owing to investments, higher working capital requirements, impairments to asset carrying values, and final dividend payout for FY 2019. According to Mr Loh, the firm has a few levers it could pull to bring gearing below 1.0x such as being more disciplined with capital while it was also looking closely at "activating landbanks and potential assets that are ready for monetisation".

"We have sufficient credit facilities to see us through different scenarios," chief financial officer Chan Hon Chew reassured.

Keppel shares fell 20 Singapore cents or 3.6 per cent to finish at S$5.40 on Thursday. The counter has shed 55 Singapore cents or 9.2 per cent since it issued a profit guidance on July 24.

Amendment note: An earlier version of this article stated that Floatel announced a month ago that it was set to book higher impairment charges on its vessels. It in fact announced this on July 30.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

Lululemon to shutter Washington distribution center, lay off 128 employees

Wall Street bonus rules return to regulatory agenda in third try

Honda to invest US$808 million in Brazil by 2030

US: Nasdaq, S&P tumble as Netflix, chip stocks drag

Europe: L’Oreal gains cap third week of declines

Telegram messaging service to allow Tether stablecoin payments