Wildfire risks threaten permanence of forest-based carbon offsets: MSCI

A significant number of projects are located in areas at medium to high risk of fires, study finds

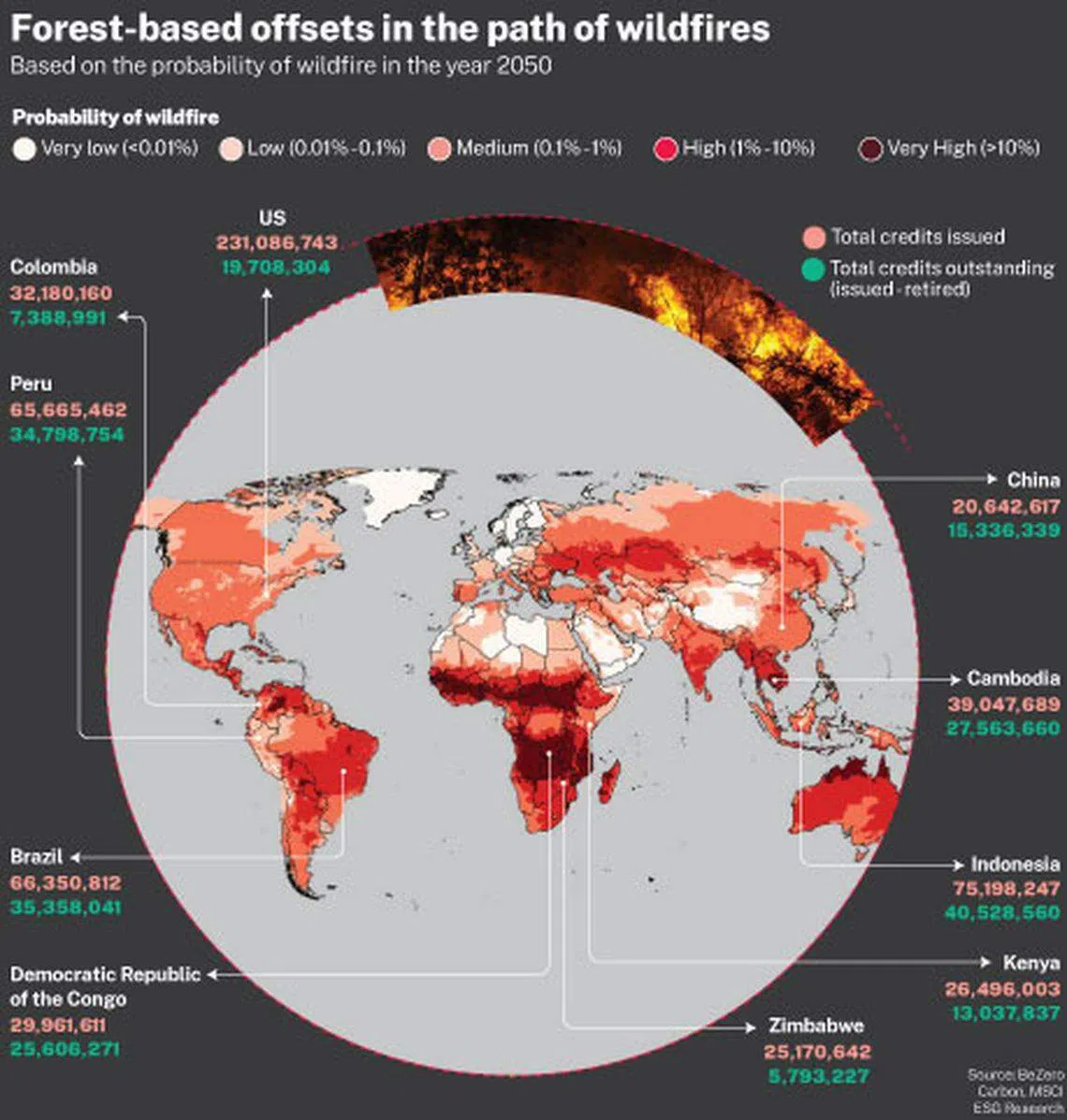

MAJOR emitters are relying on forest-based carbon credits to offset their emissions, but a significant number of these offsets are located in areas with medium to high risk of wildfires, MSCI has highlighted in its latest global stocktake of listed companies’ climate progress.

In South-east Asia, the source country of credits in greatest jeopardy is Cambodia, where much of its forests face a “very high” risk of wildfire, its map showed. It defines “very high” as a wildfire probability of more than 10 per cent by 2050.

Citing data from BeZero Carbon, the investment services company said more than 39 million credits were issued in the country, but only almost 30 per cent of these were claimed towards offsetting emissions. The rest are outstanding, meaning they are yet to be retired.

Meanwhile, some parts of Indonesia face a “high” risk of wildfire, or a 1 to 10 per cent probability by 2050, it noted. The country, with 75.2 million issued credits, hosts 40.5 million outstanding credits. These issuances in the region are large compared to China, where only 20.6 million credits were issued.

The topic was on the agenda at the COP27 climate change summit, which convened on Sunday (Nov 6), in a push by delegates to speed action to protect forests between now and 2030.

2050, the year the findings are based on, is significant as it is when companies would have to use offsets to reach net zero emissions if they had committed to aligning themselves with a 1.5 degree Celsius decarbonisation pathway, a target set under the 2015 Paris Agreement.

A NEWSLETTER FOR YOU

ESG Insights

An exclusive weekly report on the latest environmental, social and governance issues.

For some perspective, MSCI’s report, published last week, noted that nearly one-third of the carbon offsets issued to date are tied to planting or preserving forests.

It also stated that among the 10 listed companies with the largest carbon footprints in the world, at least two – Saudi Aramco and Shell – have made forest-based offsets part of their net-zero strategies. Meanwhile, fellow oil and gas major BP is investing in forest-based offsets that it can use or sell to customers, it said.

However, as burnt forests can no longer absorb carbon dioxide emissions, the risks raise the question whether companies that purchase offsets will be able to use them in their carbon accounting, MSCI said. This is because the credits’ integrity is currently premised on their permanence, or their ability to provide lasting benefits to the environment.

While sponsors of forest-based offsets typically set aside some of them to guard against fire damage, evidence suggests that these reserves may be heavily encumbered, it added. For example, wildfires have depleted 95 per cent of the forest offsets set aside for such a purpose in California’s cap-and-trade programme, MSCI pointed out.

Wildfires, itself a consequence of climate change-induced heat and drought, are still not the main contributors to the loss of tropical primary forests, however. The bulk is destroyed by deforestation, including clearing for agriculture and logging, MSCI said.

Its research found that nearly 30 listed companies in the materials, energy, utilities and consumer staples sectors are responsible for as many as 7,000 assets in areas that are being deforested.

Latest stocktake

Every quarter, MSCI publishes its gauge of the climate change progress of the 9,300 public companies under its All Country World Investable Market Index (ACWI IMI) under its Net-Zero Tracker initiative.

On its latest count, it found that the time listed companies have to address global warming is slipping away faster than anticipated, as they continue to bust their emissions budgets.

To limit temperature rise below 1.5 deg C compared to pre-industrial levels, it had ascertained that listed entities will have to collectively cap its future direct emissions at 48 billion tonnes of carbon dioxide equivalent by 2050.

But based on Aug 31 levels, the companies are burning through this share of the budget by nearly 11 billion tonnes a year. This is 1 per cent faster compared to last year and means that companies will now have two months less to arrest the situation, MSCI said, pointing out they will use up their share of the global carbon budget by Dec 31, 2026, instead of February 2027 previously.

MSCI also took a census of a list of the top 10 emitters that had not reported any of their emissions as of Aug 31. Seven are Chinese corporations, and they include China Aviation Oil (Singapore) Corporation, Shaanxi Coal Industry Company and China State Construction Engineering Corporation. The rest are US companies – Berkshire Hathaway, PBF Energy, and MasTec.

It, nevertheless, noted some noteworthy efforts: Listed companies with the most thorough emissions reductions targets include Apple, Hong Kong’s CLP Holdings, Japan’s Toyota Tsusho Corporation, and Norwegian petroleum refining company Equinor Asa, it said.

These companies aim to achieve net-zero emissions across their entire carbon footprint, instead of forming targets that address only a fraction of it, it added.

It also named companies that have made the most improvements in their disclosures. Indian cement and concrete manufacturer ACC, Thailand’s Central Pattana Public Company, which develops retail property, and Japan’s Nissin Foods and Mitsubishi Materials Corporation are on the list.

Overall, listed companies are on track to leave the planet 2.9 deg C warmer by 2100, significantly missing the Paris Agreement targets, it said.

Almost one fifth of companies are still “strongly misaligned”, with their actions on track to make the world more than 3.2 deg C hotter, while close to a third are misaligned, on track to leave the world between 2 and 3.2 deg C hotter. A third are aligned to a 2 deg C trajectory, while 16 per cent are aligned to 1.5 deg C.

This is despite the fact that 36 per cent have set decarbonisation targets, while 46 per cent have declared net zero targets, MSCI said.

Net-zero targets vary broadly at the moment, MSCI added. Some aim to balance carbon emissions with carbon removal, while others plan to reduce direct emissions but not from the company’s suppliers or customers, or intend to simply boost the company’s use of energy from renewable sources.

Only 41 of the 9,300 listed companies tracked under its initiative have set a net-zero target approved by the Science Based Targets initiative (SBTi), while 577 companies have committed to set one in the future, it stated. The SBTi is focused on getting companies to make rapid, deep cuts to value-chain emissions, seeing it as the most effective and scientifically-sound way to limit global temperature rise to 1.5 deg C.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

Brokerage Haitong removes long-term Hong Kong unit chief Lin, appoints new head

London stocks hit new record at open

Heineken sells more beer in Q1, sticks to outlook

US seeks 36 months’ jail for Binance founder Zhao

China’s Huawei launches new software brand for intelligent driving

Capital A chief Fernandes defers retirement, renews contract for five years