In gold we trust

What do you do when you think the end is nigh? Buy gold, lots of it. And bring it to Singapore.

FORGET the zombie apocalypse. Some of us are locked and loaded for likelier problems. Two years after the Great Financial Crisis, Michael Tan (not his real name) took his life's savings and converted 70 per cent of it into gold and silver bullion. As the world picked through the debris of the post-Lehman era, the 38-year-old liquidated several insurance policies so that he could buy the precious metals, never mind the penalty for early withdrawals. His reason for this radical move? A deep distrust of the financial system.

"The crisis got me thinking," the private educator says. "It's not because (the banks) don't do a good job, but if everything is online there's no way it's foolproof compared to your wealth held in your own hands."

After reading alternative investment and media sites, he came to the conclusion that there was more to the world than met the eye. Certain large countries, he says, have allowed powerful industry lobby groups to shape their foreign policies, while politicians might have nefarious motives when appearing to do good through donations.

Some of these things, others might have dismissed as conspiracy theories. But "at the rate Wikileaks was revealing stuff, I wasn't that far off," Mr Tan says.

By the pricking of my thumbs

Mr Tan is not alone in fearing that something wicked this way comes. These are unsettling times. A recession looms. Extremist parties are on the ascent globally. One of the oldest banks in the world in Italy is on the brink of collapse. A sense of unease is on the rise, but with it, Singapore's safe-haven status has soared.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

As investors the world over seek refuge in precious metals, they need somewhere to put all of it, and that somewhere is Singapore. Now, commercial vaults on the island have quietly begun to bulge with gold and silver.

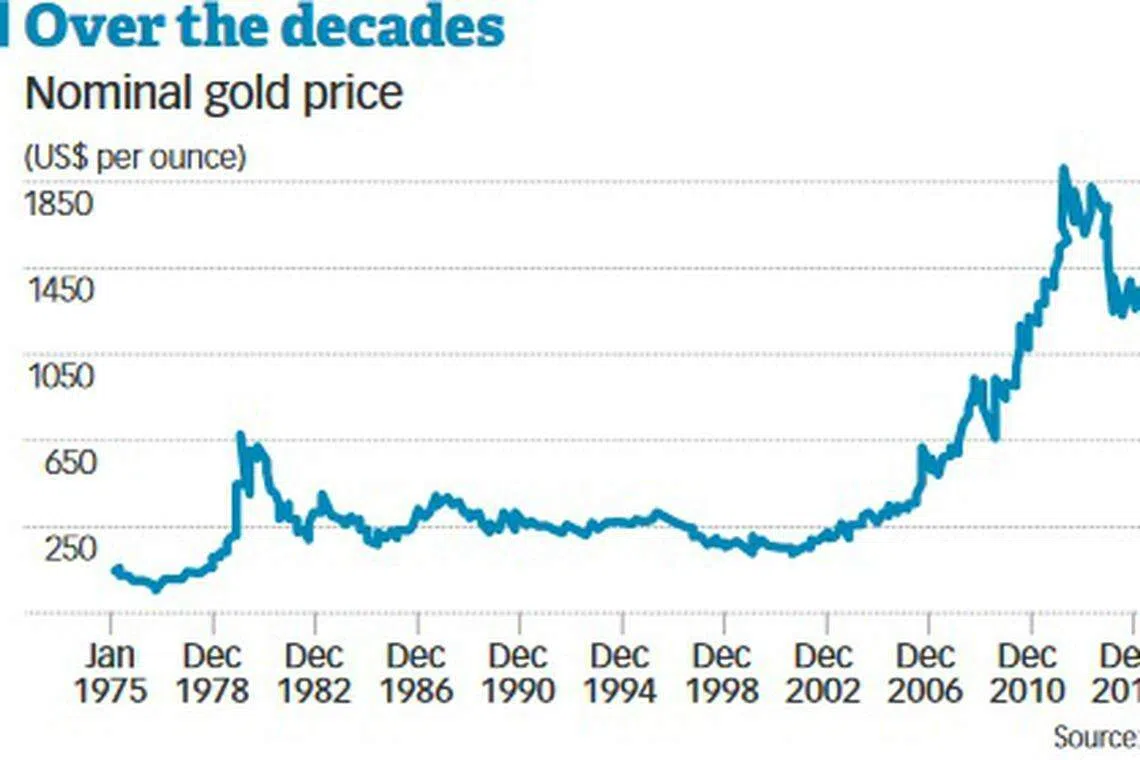

Even as the price of gold rose 11 per cent to about US$1,177 an ounce this year, the amount of gold and silver stored with Malca-Amit in the city-state has jumped some 45 per cent in tonnage in the past year.

The secured logistics company's three facilities in Singapore totalling 1,240 square metres are now about three-quarters full, said the managing director of Malca Amit Singapore, Ariel Kohelet.

Similarly, at The Safe House, operated by precious metal dealer Silver Bullion, the amount of silver has soared 130 per cent, or 2.3 million tonnes, on an annualised basis from last year. The amount of gold stored there has increased by half from last year, or 20,000 troy ounces, according to Gregor Gregersen, founder of Silver Bullion.

Independent secured storage companies like these two are making hay as investors, increasingly wary of the banking system, move their precious metal out of private banks.

Joshua Rotbart, who owns an eponymous business helping customers worldwide to buy, sell, store and transport gold, silver, platinum and palladium, says that 70 per cent of his clients want private storage solutions so that they can have direct access to their precious metals. "They don't want to be subject to the bank's regulations, or the government telling them yes you can, or no you cannot," he says. "They want to be able to go to the vault and if needed, take it, or make sure it's there. It's a trust issue with the financial system."

Similarly, Silver Bullion's Mr Gregersen sees increasingly more customers transferring existing precious metals from other vaults outside the country. Some 90 per cent of these customers are from the West, with half of them from the United States, and the rest from Australia and Europe.

British customers are also increasing in number after Brexit, he says. "It's a general sense of unease with where things are going."

While Switzerland was a popular destination for precious metal storage in the past, many Swiss banks and vault operators stopped accepting individual American customers three to four years ago, due to an American law that attempts to curb tax evasion by its citizens, Mr Gregersen says. "They are being (seen) almost like people with leprosy." Singapore and American banks, on the other hand, are more likely to take on US customers, he adds.

Meanwhile, another common destination for the glittering metal, Hong Kong, has run up against its own set of challenges.

"Increasingly people are afraid that Hong Kong is ultimately under Chinese control and the one country, two systems (governance framework) is becoming weaker," Mr Gregersen explains. Throw in the political unrest currently fomenting in the city, and customers are becoming jittery enough to start transferring their precious metals from Hong Kong to Singapore.

"Every location for long-term storage is really losing its appeal for many of the customers," he says. "Singapore is standing out as a jurisdiction that has been shown to be trustworthy and stable . . . (and) slowly being recognised as the single best storage place for bullion."

Go East, young man

While wealthy families from North America and Europe make up the bulk of those buying and storing physical gold and silver for investment purposes, the trend is starting to take off in South-east Asia as well, says Mr Rotbart.

Requests for large amounts of bullion, reaching as high as US$5 million in one go, started trickling in last year, though he adds that such cases remain in the minority.

"The majority still buy and keep it in their house or office. And they buy as they go, when they have a child or anniversary," he says.

South-east Asians have a history of investing in gemstones, so they are familiar with the concept of storing wealth in tangible assets such as gold. "But their reason to do it with firms like us is to keep (their wealth) away from the banking system, and that's quite a new trend," Mr Rotbart says.

It used to be that banks were seen to be as safe as houses. But with bank runs, bank collapses and Greece's near-implosion, only houses are as safe as houses.

In Singapore too, the number of people buying gold and silver bars or coins is increasing, but most store these at home rather than in vaults.

"Singapore is very safe, (my customers) will say I'm going to put it at home," says Mr Gregersen.

Mr Tan - who put 70 per cent of his liquid assets in gold and silver - says that there are two ways to store bullion: either with Cisco's storage facility, or at home in a safe or hiding spot. "To steal bullion is not that easy because it's heavy," he says.

He stresses that if one is buying precious metals to avoid exposure to the banking sector, then he should not store them with the banks. "Because if the banks go bust and get nationalised, everything within it will be taken away - it will not be yours."

But as companies such as Silver Bullion offer innovative services such as peer-to-peer lending backed by precious metals, Singapore-based investors are starting to bring their bullion out of their homes.

"We see customers who bring the gold from home . . . especially silver which is more bulky, because they want to get a loan for 3 per cent," says Mr Gregersen, who emphasises that Silver Bullion ensures investors have legal ownership of the precious metals stored with the company.

For investors who buy gold and silver bullion, a common concern is having legal ownership of the precious metal in storage, also known as allocated metal. Under this system, investors normally have serial numbers or identification marks that tie the bars or coins to them, as opposed to unallocated gold or silver that is the property of the bank or vault.

"It becomes a big issue for the customer when you realise that a crisis is coming and these providers are running out of inventory, and what the customer might end up having is an IOU of a company that cannot fulfil its liabilities and might declare bankruptcy," Mr Gregersen says.

"Here he is, putting a big chunk of his life savings into what he saw was going to be a safe storage, only to find out that when things get tough, it all evaporates. That's where the details become so important."

Winter is coming?

The people who buy precious metal, after all, are preparing for when the fit hits the shan.

Like many others, So Kai Tong, a 53-year-old private investor, buys gold and silver as a form of insurance. "You hope that you don't need to use it," he says. "If (the gold price) reaches US$10,000 an ounce, you know the rest of the world sucks already."

Mr Rotbart adopts the same philosophy for his own portfolio. "I personally think it's really irresponsible not to allocate some portion of wealth in tangible assets, mostly precious metals, and keeping it outside of your portfolio," he says, though he adds that one shouldn't put all their fortunes in gold too, because "that would also not make too much sense".

Besides this, his customers buy gold and silver partly because they are concerned about the state of the global economy. "They don't look at it as a commodity or an investment; for them it's a currency."

"If you look historically, the purchasing power of gold remains very stable, much better than any currency," he says.

Even though the US has stopped quantitative easing (QE), which can devalue its currency, the practice is still the main tool in every central bank's toolbox, he notes. "Plus, the amount of liquidity you have in the market is so large from the previous QEs, it's already out there and you can't take it back . . . We live in a bubble because there's so much liquidity but there's nowhere to spend it."

And don't forget the geopolitical tension too, he adds. "Earlier this year you had ISIS, and then Brexit and now the elections in the US. You also have disputes in the South China Sea. It's not a steady world. It's not an era of peace and prosperity. There are signs that we're heading (in) the other direction."

For some, the motivation to buy gold and silver could even be something more visceral. Gold, after all, has been part of human culture for 3,000 years. "The Oscars, the Olympics, James Bond movies - gold has always been associated with wealth and prosperity," Mr Rotbart notes.

He always encourages his clients to see the actual bullion when making purchases, instead of simply concluding the transaction online. "We can talk about it theoretically, but when they see the bar of gold, their eyes light up. And (this happens) everywhere, no matter where you come from, no matter how old you are."

Who's crazy now?

In spite of all this, gold bugs remain in the minority. "You try to tell people you love to preserve their wealth but not everyone is comfortable with this kind of change," says Mr Tan.

Six years on, his assets in gold and silver might have fallen about 38 per cent in dollar terms from their peak in June 2011, but he is unfazed. By his estimates, the amount of other commodities such as rice or sugar that he can exchange his precious metals for remains the same. "I never reference my wealth to the dollar; it's about how much you can get out of your wealth . . . I don't trust the dollar, so why would I reference it?"

"It's a whole mental shift," he says.

And indeed, mindsets are changing within the financial sector, Mr Gregersen of Silver Bullion observes.

In 2007, those in the financial industry would have laughed at someone for buying physical gold or silver, he says. "After 2008 happened, they stopped laughing but they didn't really believe in it."

Now, gold and silver buyers are no longer seen as weirdos who believe in conspiracy theories of all kinds. "They're being accepted as sane people after all," he quips.

"I think that within three to four years, if we keep on going this way, these people will start realising that it might make more and more sense to go into gold (as a store of wealth outside the banking system)."

Investors, too, ultimately have a herd mentality. Offering an analogy, Mr Gregersen says that if a person runs out an exit of a cinema halfway through a movie, nobody would follow. But if three to four people do, others start to take notice.

"If nine people start running out, there's a high chance that the 10th person, he doesn't know why, but he's unnerved by nine people running and he's going to run out too . . . and suddenly you have everybody rushing to the exit door, though they don't know why."

For now, the idea of investing in precious metals is still not a mainstream one, Mr Gregersen concedes, comparing the current situation to having the fifth person run out of the cinema.

"The time to buy physical metal is before the ninth person runs out of the door, he says. "When we get to that point suddenly things will happen very quickly."

Still, Mr So - the 53-year-old private investor - wryly notes that during a real crisis, having even gold will not be helpful. The issue then would not be a scarcity of gold, but of food.

He adds, with a laugh: "By that time, you think people want to give you food for gold?"

Copyright SPH Media. All rights reserved.