Lights out for five Singapore power retailers amid fierce competition

They used to supply power to big businesses. Market observers expect a consolidation

Singapore

FIVE players have called it a day in Singapore's retail electricity market for big businesses amid fierce competition triggered by a phased liberalisation of the sector - a process completed only this month, with all residential households in the fold as well.

Energy Market Company (EMC) chief executive Toh Seong Wah told The Business Times that since last year, EMC has noted the exit of five licensed retailers from the electricity retail market.

BT understands that the dropouts are Red Dot Power, Energy Supply Solutions, SmartCity Energy, Charis Electric and Sun City.

Mr Toh said: "The number of electricity retailers has climbed sharply in the last few years, ahead of the full opening of the retail electricity market. We believe market consolidation is a real possibility. As it is, we have already witnessed a few exits."

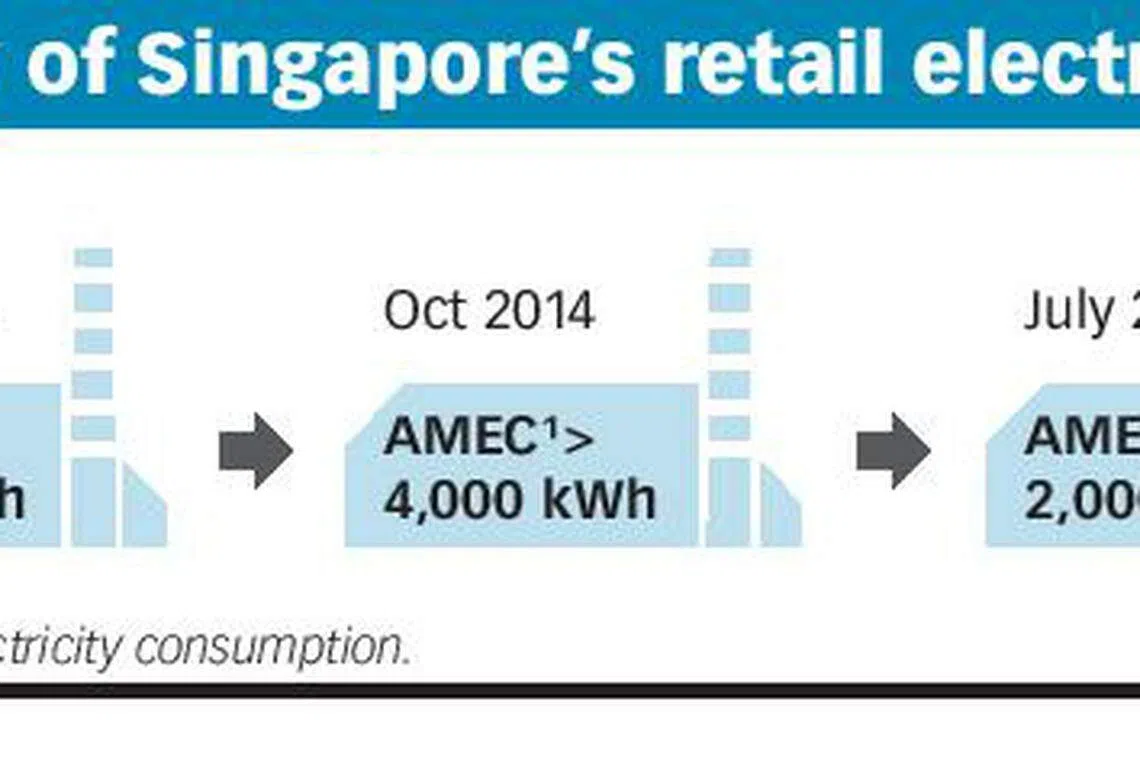

Under Singapore's liberalised energy market, larger businesses that consume 2,000 kilowatt hour (kWh) a month and more can buy power from any one of 22 retailers - or stay with the incumbent and former monopoly SP Services, the market share of which has fallen steadily in the increasingly crowded field of rivals.

Two years ago, SP's share fell below 30 per cent for the first time; last year, it stood at 26 per cent as big players like Keppel Electric and Sembcorp Power, and even smaller ones, grew their share of the pie.

Big-business consumers account for some 90,000 business accounts, or 80 per cent of Singapore's total electricity demand.

Consumers are spoilt for choice on retailers, which offer an array of price plans, but some retailers are finding it hard to keep up with their rivals.

This could partly explain why six of the 28 firms, which received the nod of the Energy Market Authority (EMA), the industry's regulator, to sell electricity to big-business consumers, are not actively retailing or selling packages to consumers, going by data on EMA's website.

Martin Lim, co-founder and chief executive of Singapore-based energy start-up Electrify, said: "There are far too many players chasing a small market. It is not a sustainable model. There were casualties earlier this year, with retailers leaving the market. Over the next year or two, we will see further consolidation - perhaps the bigger guys taking over the smaller ones as well."

The risks of exits from the sector can be unnerving for consumers.

A senior executive of a Singapore-listed company said he is now less enamored by independent retailers' low pricing. Two years ago, the company had to switch back to SP when its retailer of choice exited the market after supplying the company for all of four months. (The switch was smooth and didn't entail a disruption to power supply.)

He said that as a result of that experience, the company now only goes with gentailers, that is, retailers which generate their own power, such as Keppel and Sembcorp. "We are very clear in what we want - the tangible savings - so it is not complicated," said the senior executive.

For property investment and development group 8M Real Estate, the risk that a power retailer might exit is, understandably, a real concern. The company had switched a majority of its portfolio from SP Services to Red Dot Power, but had to contend with the retailer exiting the market, citing "financial challenges".

Janelle Wong, asset manager at 8M Real Estate, said: "The opening up of the electricity market brought an influx of retailers, some of whom were not running fully sustainable businesses, and barriers to entry are low. This would be our primary concern in terms of qualifiers for new retailers entering the market."

Singapore's opening up of the energy sector began in 2001, with the biggest energy-guzzlers among businesses first becoming eligible to opt to buy power from licensed retailers. The energy consumption threshold among businesses included under the net was gradually lowered over the years until 2015, when it settled at businesses consuming 2,000 kWh a month and up.

This phase was then followed by the final piece of the plan - the Open Electricity Market (OEM), which covered all households and smaller businesses that on average use under 2,000 kWh a month.

Under the OEM soft-launched in April 2018 on a staggered basis, homes across the island gradually joined the OEM; this month, homes in the fourth and final geographical zone got to pick from among 13 electricity retailers and enjoy significant savings in their power bills. They could also opt to stay with SP and its regulated rates.

EMA said that based on a survey, one in two consumers has been open to switching away from SP, the traditional electricity provider which remains the operator of the national power grid; it will continue to provide market-support services such as billing and meter reading.

Singapore's switch rate as at end-January 2019 ranged between 18 and 40 per cent - higher than in other countries such as Australia and Japan.

READ MORE: Singapore's liberalisation of electricity market bittersweet for businesses

Copyright SPH Media. All rights reserved.