Agricultural dependence and rapid urbanisation: Why South-east Asia cannot delay climate action

DBS Group Research’s Vishal Kapoor and Suvro Sarkar share how balance between environmental efforts and economic progress can be key to a sustainable future in the region

WALK down any unsheltered space along Singapore on a hot afternoon and you will feel it – the searing heat that once felt seasonal now stretches across months.

In recent years, the country has clocked its highest temperatures in decades, while flash floods have swamped major intersections with little warning1. These are not isolated incidents. Across South-east Asia, climate change is not a distant threat but a lived reality. Beyond Singapore, it is found in dwindling harvests in Vietnam2 and saltwater intrusion creeping into rice fields in Thailand3.

What makes the region especially vulnerable is a combination of geography and growth. Dense populations along coastlines, reliance on climate-sensitive sectors like agriculture and fisheries, and rapid urbanisation mean the impacts of climate change hit harder – and faster. Climate action, therefore, cannot be divorced from socio-economic progress.

Yet despite mounting evidence that suggests we are unlikely to keep global warming below 1.5 deg C on our current trajectory, the pace and scale of climate investment remain staggeringly insufficient.

Fossil fuel infrastructure continues to expand while global emissions remain on the rise. Asia’s carbon intensity is 41 per cent higher than the global average4 – a reflection not only of the region’s energy mix, but also of the fact that Asia is still in a critical phase of industrialisation and urbanisation. Balancing the need for growth with the need for decarbonisation will be one of the defining challenges of our time.

Although global efforts have largely focused on emissions reduction, or climate mitigation, this work is not enough. Mitigation alone overlooks the lived realities of South-east Asia and will not protect the region from the already unfolding effects of climate change. Beyond mitigation, the region urgently needs investment in climate adaptation and resilience – adjusting to current and future climate impacts, as well as building the capacity to cope with and recover from those impacts.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

It is time to redefine climate finance not as a burden, but as South-east Asia’s most pressing economic opportunity. If we fail to act now, the costs – in human, ecological and financial terms – will be exponential. But if we invest smartly and swiftly in climate mitigation, adaptation and resilience, we can lay the foundation for a more secure and sustainable future.

Adaptation and resilience – the new frontiers of climate investment

Climate adaptation and resilience are crucial but remain the most underfunded components of climate action. This must change. The next wave of climate investment must prioritise these areas, focusing on climate-resilient infrastructure like roads, ports and coastal defences; urban planning designed to withstand future heatwaves; and agricultural technology, particularly for rice and livestock, that can thrive amid erratic weather patterns to safeguard regional food security.

Nature-based solutions like mangrove restoration, reforestation and sustainable land use also present high-impact, low-cost opportunities to protect biodiversity, absorb carbon and shield communities from extreme weather events.

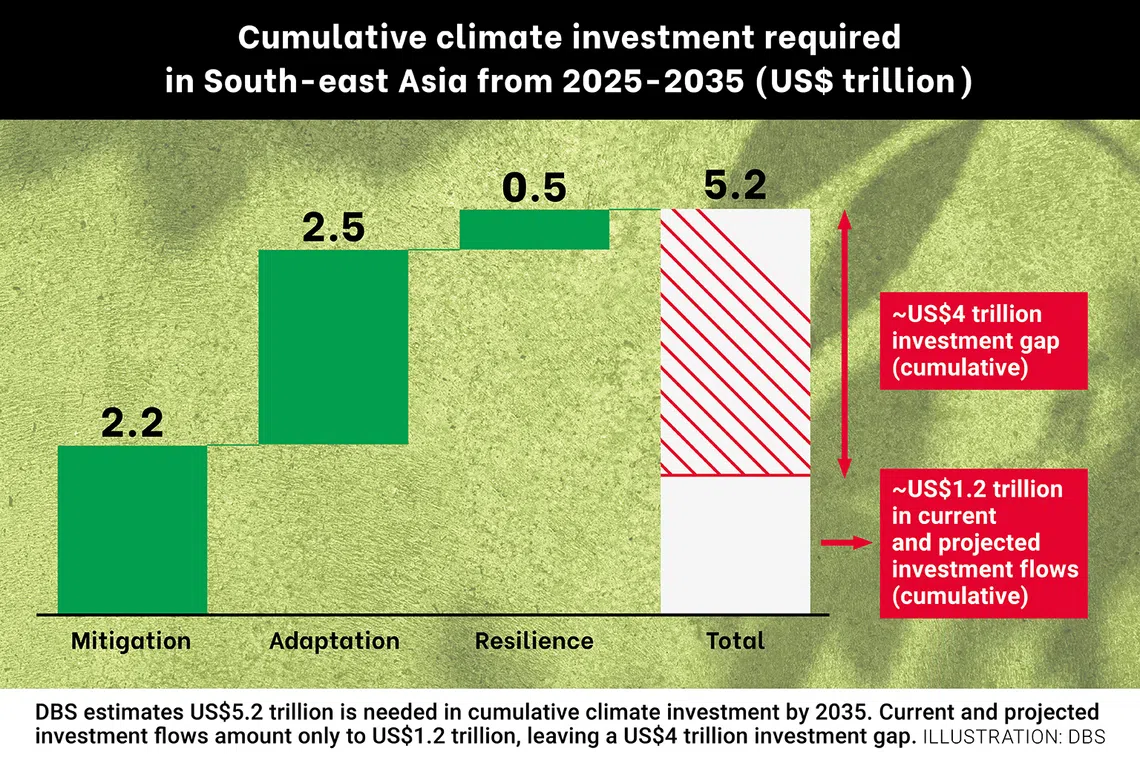

The urgency to invest in these areas cannot be overstated. According to fresh DBS estimates, South-east Asia will require at least US$5.2 trillion (S$6.7 trillion) in cumulative climate investments by 2035 to align with the Paris Agreement: US$2.2 trillion for mitigation, US$2.5 trillion for adaptation and US$0.5 trillion for resilience. However, current and projected investment flows only cover about US$1.2 trillion, leaving a staggering US$4 trillion gap.

This is not just a climate issue – it is a development and competitiveness challenge. If unaddressed, climate impacts could erase up to 4 per cent5 of South-east Asia’s gross domestic product (GDP) annually. In contrast, proactive adaptation investments, which cost just 1 per cent of GDP, could significantly reduce these losses. This makes resilience investments a clear, strategic priority – both for long-term sustainability and economic stability.

From a business perspective, investing in climate adaptation and resilience not only secures long-term prosperity but also reduces the enormous financial risks posed by climate impacts. Financial institutions like DBS play a critical role in facilitating these investments. Beyond merely financing solutions, banks also serve as strategic partners, offering the expertise and capital that businesses need to build climate-resilient infrastructure and systems.

Governments must integrate adaptation into national planning and create regulatory environments that incentivise blended finance – a combination of public and private sector investments. Multilateral institutions also have a role to play by de-risking early investments and supporting capacity building at the local level.

The choice is clear – the cost of inaction will lead to exponentially higher costs in the future.

Collective action for lasting impact

No one can solve the climate crisis alone.

Governments, banks and multilateral institutions must collaborate to drive systemic change. Governments must create the right policies and integrate climate resilience into urban planning, banks like DBS must mobilise capital and provide strategic advice – and multilateral institutions must step in with critical early-stage capital and de-risking measures.

Measurement frameworks must also evolve. Emissions reduction is a clear metric, but we also need robust frameworks to measure resilience, biodiversity outcomes and social safety nets that protect vulnerable populations.

At DBS, we are committed to playing a leading role – not only in financing solutions, but in helping define what a credible transition looks like for this region.

South-east Asia’s exposure to climate risk is not a vulnerability but a catalyst for leadership. If we redefine climate finance to embrace mitigation, adaptation and resilience as interdependent, we can not only safeguard our region but position it as a model for sustainable growth in a volatile world.

The question is no longer whether we can afford to invest in climate solutions – but whether we can afford not to.

This article was written by Vishal Kapoor, head of Financial Institutions Group Research and ESG Research, DBS Group Research, and Suvro Sarkar, head of Energy, Renewables and Infrastructure Research, DBS Group Research.

1 https://www.channelnewsasia.com/singapore/pub-flash-flood-apr-13-yishun-punggol-5062926 2 https://www.undp.org/vietnam/stories/transforming-viet-nams-agriculture-climate-resilience 3 https://www.globalwaterforum.org/2025/07/10/the-costs-of-nature-based-solutions-for-controlling-saltwater-intrusion/ 4 See page 15: https://www.adb.org/sites/default/files/publication/876891/ado-2023-thematic-report.pdf 5 World Economic Forum, Climate Adaptation: Unlocking Value Chains with the Power of Technology white paper, January 2025

Share with us your feedback on BT's products and services