Asia can attract more FDI with greener treaties: ADB

Wong Pei Ting

GOVERNMENTS in Asia should adopt a more environmentally ambitious approach in negotiating new investment agreements, the Asian Development Bank (ADB) said.

The regional development bank suggested this as its analysis found that economies which included climate change and environmental elements in their bilateral investment treaties benefited from greater foreign direct investment (FDI) flows.

Releasing its findings in a report on Tuesday (Feb 7), ADB said that the effect of new environmental elements in bilateral investment treaties is “positive and significant” for total FDI and green FDI.

Naming Australia, Hong Kong, South Korea and Vietnam as economies that benefited from greater green FDI inflows, it added that these economies notably included environmental elements in specific provisions such as expropriation and performance requirements.

ADB proposed that a model agreement or “opt-in” mechanism – a multilateral agreement where economies can flexibly join to modify old agreements – including substantive standards on environmental protection and climate change should be part of the reforms to existing agreements.

Economies can also consider granting some form of regulatory immunity for partners with climate policy measures, as well as imposing a cap on compensation amounts that carbon-intensive investments can claim to discourage such investments, it said.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

ADB also noted that beyond standard trade and investment agreements, new modes of cooperation have emerged to encourage environmental protection. They cover topics such as the identification, certification and liberalisation of green products.

Citing the proposed Singapore-Australia green economy agreement as one example, it said such agreements offer the possibility of combining green industrial policy objects with the depth, commitment and legal standing of trade agreements.

While its elements are more consistent with traditional deep trade agreements, they are “substantially more ambitious than most”, ADB said.

Either a race to the bottom, or the top

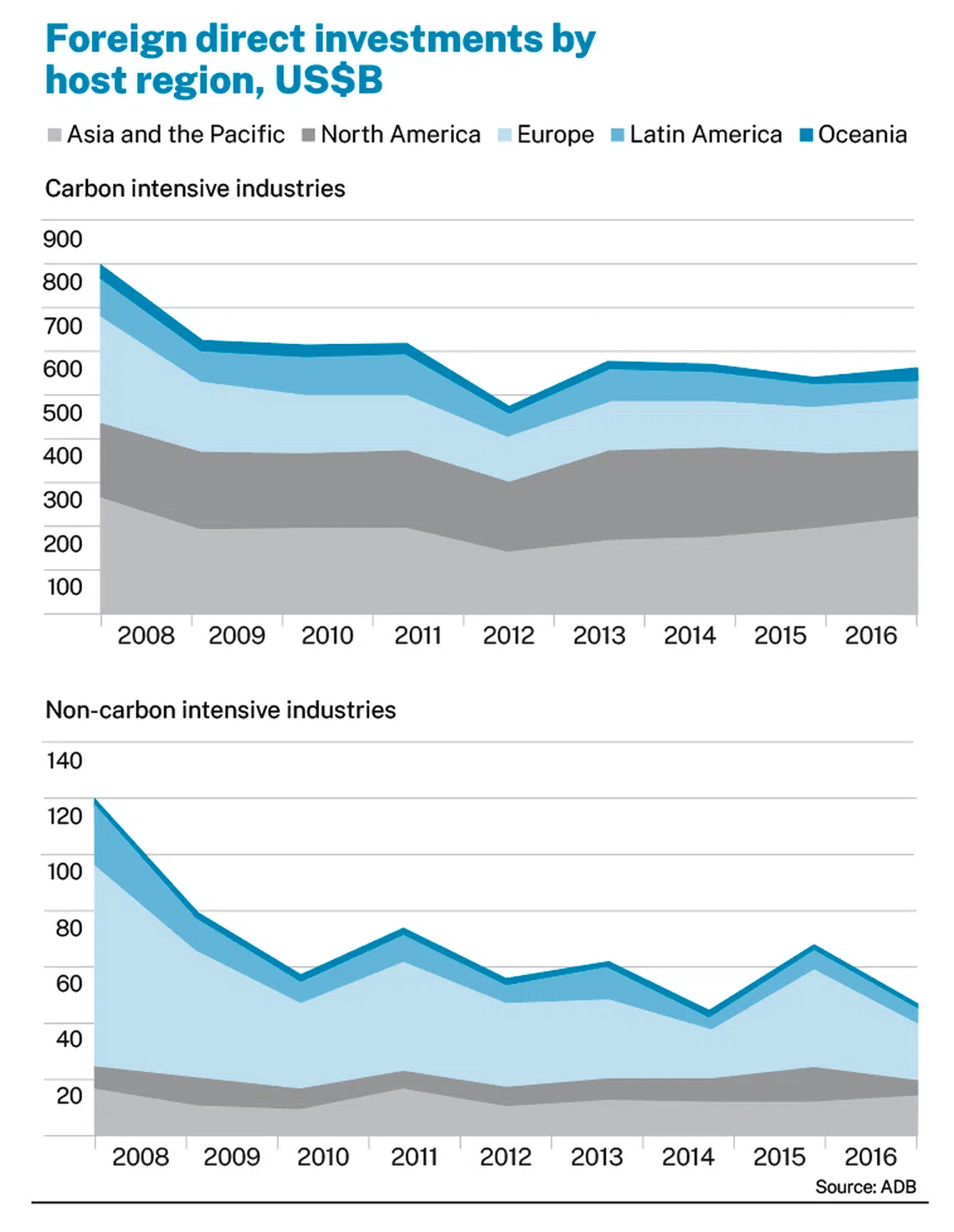

ADB made the recommendation as its computation showed that while Asia’s share in global non-carbon intensive FDI is increasing, the region hosts a greater share of FDI from carbon intensive industries than any other region.

Asia, on average, accounts for close to a third of the world’s inward carbon intensive FDI flows between 2008 and 2016, with East Asia receiving the lion’s share (42.8 per cent), followed by South-east Asia (33.5 per cent).

Intraregional FDI flows – investments from other Asian peers – are propping up the numbers. Such flows made up about 45 per cent of Asia’s carbon intensive investments, while Europe’s share fell from 25.8 per cent in 2008 to 15.9 per cent in 2016, ADB noted..

With non-carbon intensive industries, European economies however account for a substantial majority of FDI flows into Asia, while Asian investors account for just 11.7 per cent on average, although an upward trend is apparent in recent years.

Pointing out that most studies currently support the presence of a pollution haven effect in Asia, ADB warned that FDI “can facilitate both a ‘race to the bottom’ and a ‘race to the top’.”

Indeed, FDI into Asia has led to greater environmental degradation and carbon emissions, it said, citing a study which found that a 1 per cent increase in inward FDI in India may have increased carbon dioxide emissions by 0.86 per cent from 1980 to 2003.

Green FDI, on the other hand, can be a vehicle for more efficient energy consumption, energy intensity and transfer of energy-saving technologies, it said, citing recent evidence from China and Bangladesh of FDI boosting renewable power generation.

Looming threat

Meanwhile, ADB said, Asian economies should still pay attention to the European Union’s (EU) upcoming carbon border adjustment mechanism (CBAM), even though the mechanism will not affect Asia as much, given its relatively small share of trade with the region.

This is because the bank assesses a “looming possibility” that some regions and advanced economies are likely to implement a similar mechanism, which could threaten to reduce exports and hurt domestic economies.

CBAM – slated to be effective from Oct 1 with a transition period – will impose a carbon price on imports of emissions-intensive and trade-exposed goods to ensure that they have a similar carbon price to EU-made products.

ADB said that countries contemplating implementing or exploring a border carbon adjustment as an environmental trade policy include Canada, the United States and the United Kingdom.

As it stands, Asia has the highest average carbon emission intensity of exports globally. In 2019, the region emitted 635 tonnes of carbon dioxide per US$1 million of gross exports, compared with 391 tonnes per million in the North America and 387 tonnes per million in Europe.

In the long term, ADB said, the region “needs to explore ways to transform the challenges of the changing trade environment into opportunities” by increasing green investments and embracing cleaner production technologies.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.