Asian utility companies to face climate-driven losses of US$8.4 billion by 2050: report

A report by the Asia Investor Group on Climate Change and MSCI notes that failure to adapt will increase operational costs and fixed asset losses

[SINGAPORE] Utility companies in Asia are projected to face higher levels in climate-driven losses from now until 2050.

A recent report by the Asia Investor Group on Climate Change and MSCI indicated that material costs in asset damage and lost revenue for utility companies would amount to US$6.3 billion over the next year as a result of climate hazards, and gradually rise to US$8.4 billion by 2050 – representing a 33 per cent increase – assuming these companies do not undertake any adaptation measures.

These refer to ways in which they can prepare for and adjust to the effects of climate change, such as infrastructure upgrades.

“For utilities in Asia, failure to adapt will likely increase operational costs, fixed asset losses and potential stranded asset risks which may be passed on as higher costs to consumers.

For investors, physical climate risks represent tangible risks to asset values and portfolio returns, requiring integration into investment analysis and risk management frameworks,” said the report.

The report assessed 11 utility players across seven Asian markets – China, Hong Kong, India, Indonesia, Japan, Malaysia and South Korea – and covered a total of more than 2,400 power generation assets belonging to these companies.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

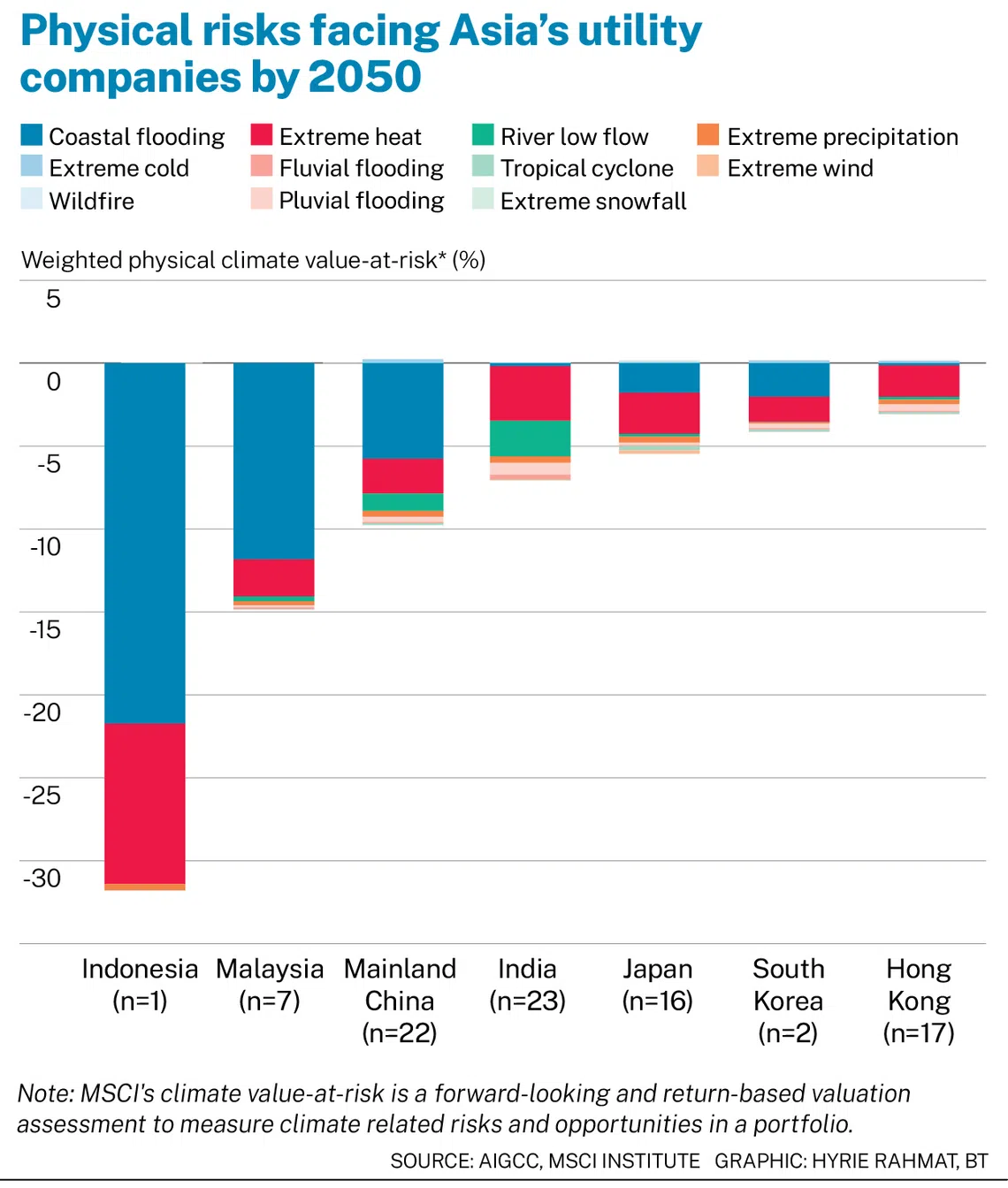

Among publicly listed utilities across these seven markets, coastal flooding and extreme heat exposure could be key drivers that impact utility companies’ valuations by 2050.

Utility companies in Indonesia were projected to have the highest valuation declines of around 30 per cent by 2050 due to their exposure to physical climate hazards. Malaysia came in second with expected valuation declines of around 15 per cent.

These utility companies collectively account for more than 550,000 megawatts in installed capacity, taking up around 15 per cent of total installed capacity across the seven markets.

The projected increase in annual losses for utility companies is based on a scenario where there is continued high levels of greenhouse gas emissions without significant global policy interventions.

Under this scenario, global average temperatures are projected to rise 2.1 deg C above pre-industrial levels by 2050 and around 3.6 deg C by 2100.

Physical risk exposure

The report quantifies the financial impact of climate hazards through two main factors – asset damage and business interruption.

It found that the utility companies are forecast to experience average annual losses between 9 and 31 per cent through business interruptions.

Asset damage projections show wide variability in financial impact across the 11 utilities, with average annual losses ranging between 10 and 91 per cent, which reflect the highly location-specific nature of climate risks.

Extreme heat would likely cause the most business interruption, accounting for 50 per cent of average annual losses by 2050. Extreme precipitation were the second-highest driver of losses at 21 per cent.

Close to 70 per cent of the assets being analysed are exposed to extreme heat and precipitation risks currently, and by 2050.

Utility companies in India, Indonesia and Malaysia show particularly high exposures to these two climate hazards.

Other climate hazards such as low flow of water in rivers as well as coastal flooding are also likely to see marked intensification, and are of increasing concern.

Malaysia’s Tenaga Nasional is forecast to have the highest average annual loss as a result of coastal flooding.

Exposure to coastal flooding can contribute not only to elevated asset damage risks but also to a rise in business interruption losses, as flood-prone infrastructure experience higher outage frequency and longer recovery times.

When analysing loss contributions by asset type, the report found that coal-fired power plants account for the largest share of both current and projected losses. This is followed by gas plants, reflecting their prevalence and sensitivity to extreme heat and water scarcity.

Tenaga is expected to experience relatively higher asset damage exposure due to its extensive asset base of coal-fired power plants along Malaysia’s coastlines, where storm-related flooding is expected to intensify.

Readiness of utility companies

The report found that there are maturity gaps in resilience preparedness across utilities.

It stated that the 11 utility companies are still in early stages of adaptation planning, with significant variations in the quality of disclosures across companies.

While most utilities recognise physical climate risks and have established fundamental governance structures, few have demonstrated comprehensive adaptation implementation and disclosed dedicated capital allocation.

For example, while 10 companies had described the financial impacts of physical risks on their business, only five had quantified financial impacts through increased dollar costs or reduced earnings.

Among eight companies that have disclosed forward-looking adaptation plans, none have stated the operational or capital expenditures relating to adaptation measures.

Only seven out of 11 utilities have addressed extreme heat or high-temperature risk.

As for floods, nine companies have assessed flood hazards or sea level rise. However, only a few have explicitly assessed risks at the asset-level and specified flood types.

Given the highly localised nature of and the multiple causes of flood hazards, this represents a major data gap, noted the report.

The report recommends that utility companies undertake quantitative and forward-looking asset-level physical risk assessments across their power generation and grid network assets to identify exposure and vulnerabilities.

Those in Malaysia and Indonesia should address coastal flood vulnerability, and develop systemic responses for coastal protection of critical infrastructure.

Expansion of renewable energy systems may be needed to reduce exposure of coastal thermal assets.

There should also be regular engagements between utility companies and governments so that there is coherence between corporate resilience measures and public adaptation planning.

Utilities’ transition plans should also incorporate adaptation actions aligned with broader resilience objectives.

Their risk analysis should inform capital allocation plans and strategies with clear implementation timelines, said the report.

“Cost-benefit analyses of resilience investments or upgrades that avoid disruptions, improve reliability and/or reduce carbon intensity should be undertaken to inform implementation priorities,” it added.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.