Asia’s electricity prices to be increasingly impacted by renewables: BMI

While such power sources are key to a smooth transition, their associated expenses ‘will significantly impact the overall cost’, adds its report

[SINGAPORE] Electricity prices in Asia will be influenced more and more by the costs of integrating renewable energy, as well as battery storage solutions, into the power grid, indicated a recent report by BMI, the country risk and analysis research arm of Fitch Solutions.

The firm also expects electricity prices in the region to rise modestly over 2025 for various reasons, including the transition from coal to natural gas; regulators moving towards a more liberal electricity market; and utility companies recouping losses incurred during the global energy crisis of 2021 to 2023.

Renewable energy integration

The costs of thermal coal will have a diminishing influence on electricity prices in Asia, as the share of power generation by renewable energy sources is expected to go up over the next decade, said BMI.

Instead, electricity prices will increasingly reflect renewables integration, battery energy storage systems, and grid infrastructure costs.

“Renewables integration into the grid and battery energy storage systems development will be key to a smooth transition, and their associated costs will significantly impact the overall cost of the energy transition,” said the report.

While Asia’s electricity markets remain largely governed, BMI said that several regulators are moving forward with reforms to adopt electricity pricing that is reflective of costs and market forces.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

This is one of the key trends that will put upward pressure on the region’s electricity prices this year.

For example, Vietnam’s new electricity law – which came into effect in February – aims to reform retail electricity pricing by eliminating cross-subsidies, and by creating a multi-component pricing system. Periodic reviews of electricity prices will also be conducted every three to six months.

The country has been using cross-subsidies to lower the costs of industrial electricity tariffs through higher residential duties, reflecting the economic priority of attracting investments and creating a pro-business environment.

Another example is China, which will be phasing out its feed-in tariff system from June this year, requiring all electricity from renewable energy projects to be sold through market transactions. This could lead to more dynamic pricing structures and reflect real-time market conditions.

Feed-in tariffs aim to encourage more investment in renewable energy by providing a guaranteed, long-term price for renewable energy that is at, or above, current market rates. The approach can reduce the risk and uncertainty of new renewable energy installations.

Recouping losses, rising LNG imports

Another factor pushing electricity prices up are the attempts of state-owned power generation and utility companies to recoup the losses they incurred from 2021 to 2023, during the global energy crisis. Oil and gas prices soared over this period as a result of Russia’s invasion of Ukraine, amid the slow recovery of supply disruptions that occurred during the Covid-19 pandemic.

Although these attempts have led to record profits for fossil fuel companies and higher electricity prices in liberalised markets, costs remained lower and stable in regulated markets such as China and Indonesia. This is because their governments absorbed the rising costs of energy imports through price caps and subsidies.

BMI’s report cited Malaysia’s plans to increase industrial tariffs between 2025 and 2027 as the country reduces its fuel subsidies. Meanwhile, South Korea last October raised industrial tariffs by 9.7 per cent to address financial challenges facing its largest utility company, Korea Electric Power Corporation, which is majority state-owned.

Rising imports of liquefied natural gas (LNG) are also expected to drive modest price increases in Asia, the report showed.

BMI forecasts LNG import demand to grow from 573.3 billion cubic metres (cu m) in 2025 to 803.4 billion cu m by 2034, with Asia’s share increasing from 66.8 per cent to 78 per cent. LNG prices are also expected to increase over the long term.

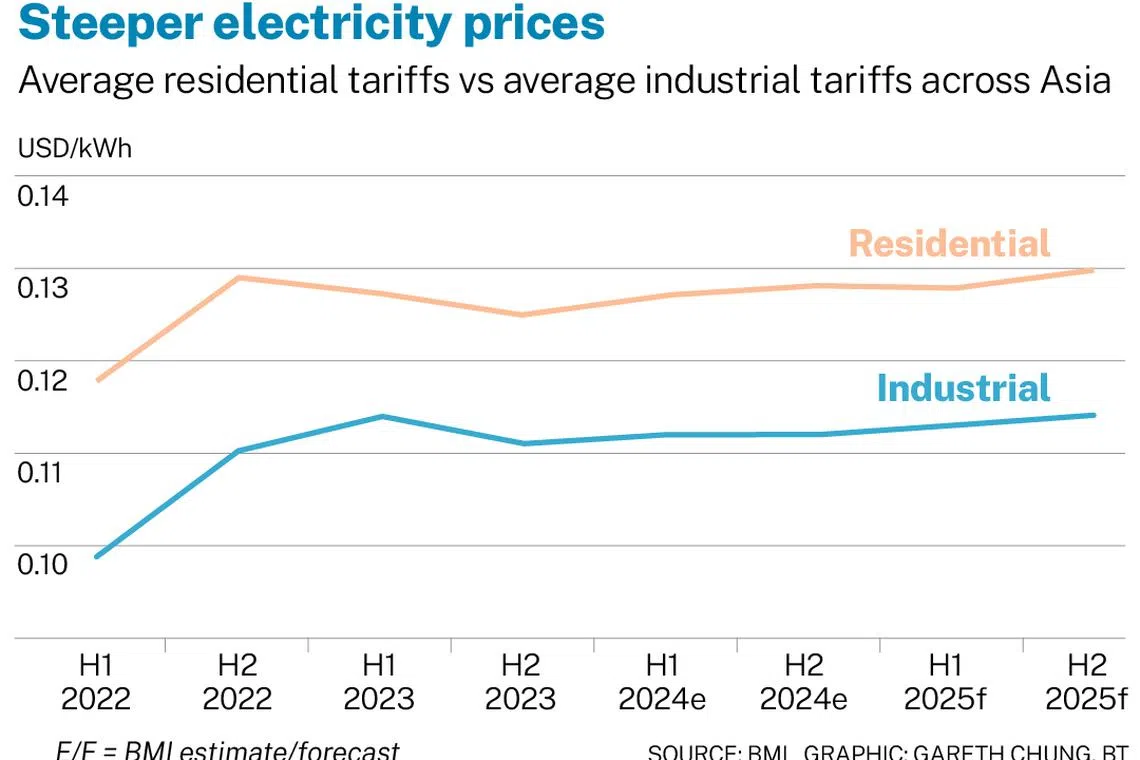

Imports of such gas have already contributed to rising electricity prices in 2024 across the region, with average household electricity prices increasing by 2.3 per cent, and industrial electricity costs going up by 1.3 per cent.

“Rising gas prices are elevating electricity costs across Asia as emerging markets increasingly transition from coal to natural gas for baseload power generation,” the report noted.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.