Global climate fund allocations to Asia-Pacific up by 6 percentage points in H1 2025: report

South-east Asia is rapidly emerging as a strategic growth market for climate finance and clean technology, it adds

[SINGAPORE] Over the first half of 2025, around six percentage points of global climate fund allocations have shifted to Asia-Pacific, indicated a recent report by index provider MSCI, Bank of China’s Hong Kong Financial Research Institute, as well as the Jockey Club Enterprise Sustainability Global Research Institute at Hong Kong University.

This marked the first notable re-allocation of climate-themed capital towards Asia in more than seven years, reflecting growing investor recognition of the region’s potential, it added.

“Fund managers are increasingly drawn to the region by its growing pipeline of clean-energy and infrastructure projects, favourable demographics and strengthening policy support for green development,” said the report.

“Within this broader trend, South-east Asia stands out as a high-growth sub-region with opportunities in energy, mobility, water and urban resilience.”

A convergence of structural drivers is helping South-east Asia rapidly emerge as a strategic growth market for climate finance and clean technology. Growing urban populations, infrastructure demand and rising consumption all create fertile ground for scale. At the same time, policy reforms and regional cooperation are making it easier for international capital to enter the region, particularly in clean-tech sectors.

The report noted that Asian companies outpaced their global peers in the clean energy sector.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

While revenue among energy storage providers rose 39 per cent in Europe, the Middle East and Africa (EMEA), and 22 per cent in the United States, it went up 66 per cent among Asia-Pacific companies. Similarly, green mobility firms went up 14 per cent in EMEA, and 42 per cent in the US, compared to 74 per cent in Asia-Pacific.

South-east Asia is also home to a growing cluster of firms developing next-generation building materials and cooling systems, which will be increasingly important as cities globally face rising temperatures, prolonged heat stress and escalating demand for energy-efficient infrastructure.

“While challenges such as pipeline visibility and policy coordination remain, the case for scaling green investment in South-east Asia is becoming increasingly clear. For investors seeking long-term growth and exposure to real-economy transition drivers, the region’s innovation and infrastructure needs could present a compelling opportunity,” said the report.

SEE ALSO

Sustainable finance in Asia-Pacific

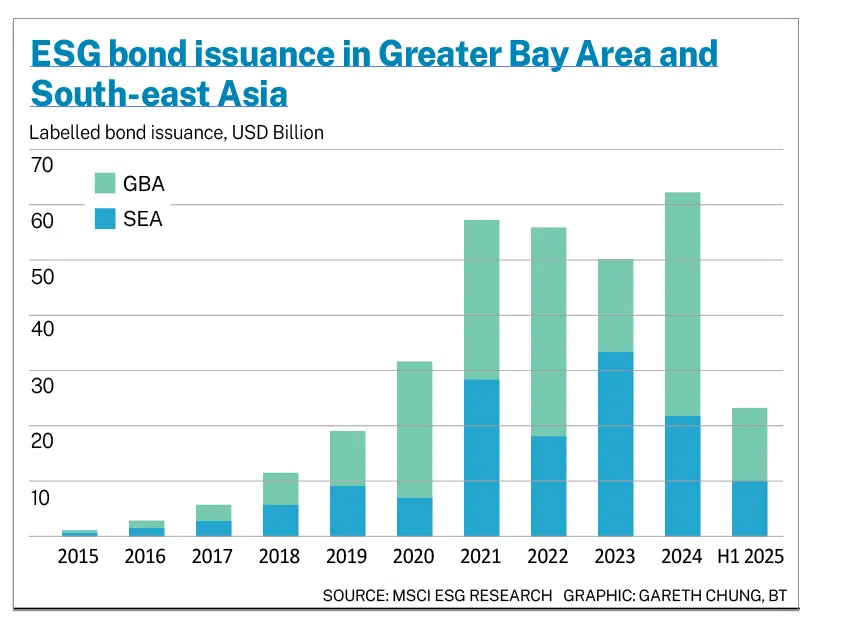

South-east Asia has also emerged as a hub for more targeted sustainable finance. The cumulative total sustainable bonds issued in the region over the past five years has crossed US$100 billion.

When including labelled bonds from the Greater Bay Area – which refers to the region in Southern China encompassing Hong Kong, Macau and nine mainland cities in Guangdong province – total issuance proceeds surpassed US$300 billion between 2015 and June 2025.

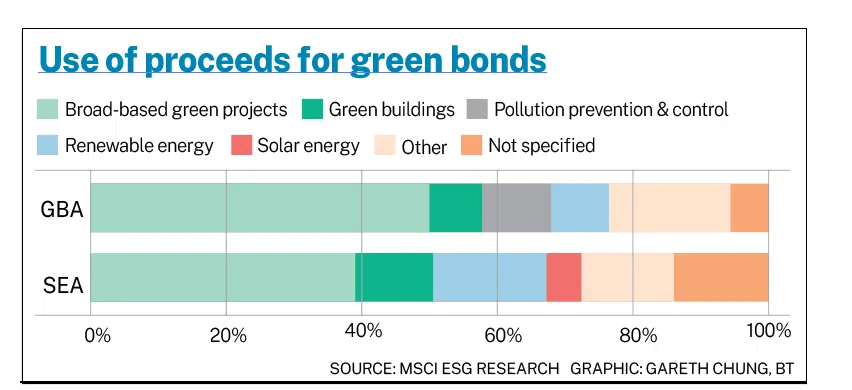

While green bonds account for the bulk of the issuance, the report noted that diversification is also emerging with transition and sustainability-linked bonds.

Although the volumes of these bonds remain small, they are poised to grow as corporate decarbonisation strategies evolve and demand for performance-linked finance rises.

Green bond proceeds among South-east Asian issuers reflected more targeted allocations, with 17 per cent going to renewable energy projects, 12 per cent to green buildings and 5 per cent to solar energy.

South-east Asia also has a higher share of unspecified proceeds at 14 per cent, compared with 6 per cent among Greater Bay Area issuers. This suggests scope for stronger classification standards and disclosure, said the report.

The growth of sustainable bond markets in both South-east Asia and the Greater Bay Area reflects growing capacity to channel private capital towards environmental and social objectives.

In the Greater Bay Area, regulatory alignment is advancing through work on green taxonomies and disclosure standards, while South-east Asia is making progress towards alignment with international frameworks.

“These developments are essential for attracting institutional capital and advancing credible, locally relevant transition pathways,” said the report.

Climate policies in Asia uneven

Though climate-related policy signals across the Greater Bay Area and South-east Asia have sharpened in recent years, the pace of implementation and alignment with global goals remains uneven, indicated the report.

Across South-east Asia, the policy landscape reflects differences in institutional capacity, development priorities and national exposures to climate risk.

Policy in the Greater Bay Area and across China remains anchored in national dual carbon goals of peak carbon emissions before 2030 and carbon neutrality by 2060.

While these national and sub-national strategies offer a progressively stronger regulatory foundation for climate-aligned investment, companies and investors still have to confront disparities in the depth of practicable policies, the maturity of disclosure regimes, the availability of financing mechanisms and the ambition of national climate carbon commitments.

Bridging these gaps will be critical to translating policy into credible, investable decarbonisation pathways regionwide, said the report.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.