Green investments in Asean rise 20% to US$6.3 billion in 2023: Bain, Temasek report

PRIVATE sector investments for the purposes of the green economy transition in South-east Asia increased 20 per cent to US$6.3 billion in 2023, compared to US$5.2 billion the previous year, a joint report by Bain and Temasek indicated.

This comes after green investments into the region fell for two consecutive years between 2021 and 2022.

Dale Hardcastle, management consultant at Bain, attributed the reversal in capital flows to the emergence of innovative finance, as well as companies’ greater interest in green power opportunities.

Renewed interest in electric vehicles, as well as growing awareness of the need to address power consumption of data centres were other contributing factors, said Hardcastle.

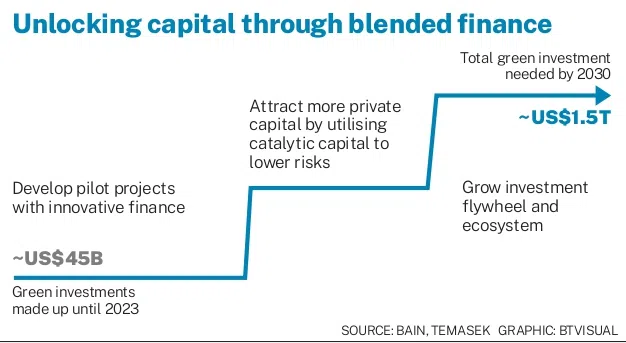

However, the level of investment remains far short of the US$1.5 trillion needed to fund South-east Asia’s transition by 2030, noted the report released on Monday (April 15) at the Ecosperity sustainability conference. Thus far, only US$45 billion in cumulative investments from both public and private sources have been made since 2021.

Yet, governments in the region have committed to cut emissions by 32 per cent by 2030 to meet country national targets – known as nationally-determined contributions. This means having to cut 2.4 giga tonnes of carbon emissions from a forecasted level of 7.3 giga tonnes in 2030.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

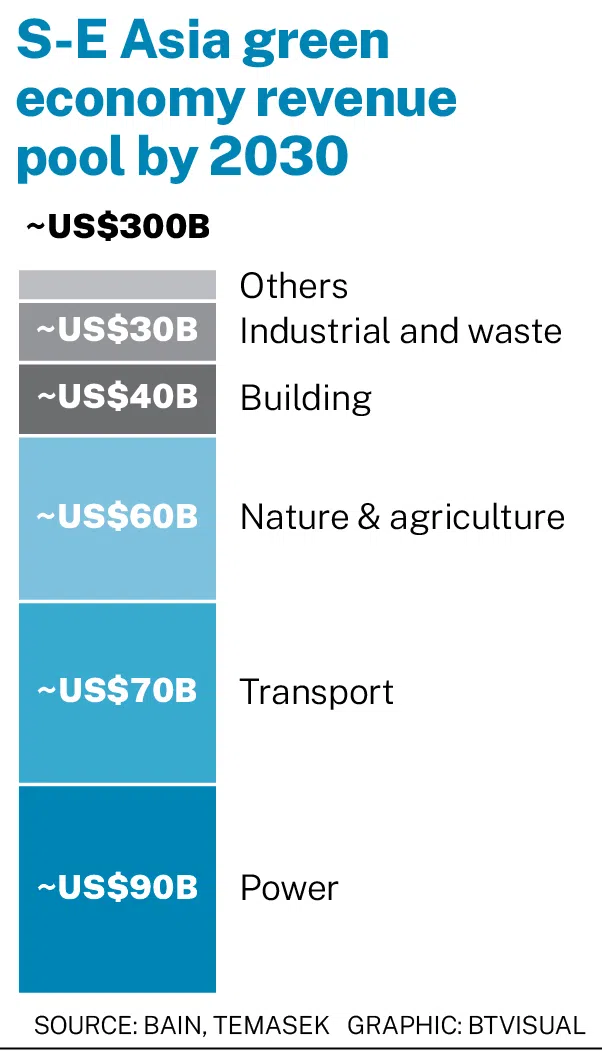

To accelerate the pace of decarbonisation, the report identified 13 investable opportunities which could generate an additional US$150 billion in annual revenue by 2030, and also reduce 1,000 tonnes of carbon emissions. This is assuming these have been fully implemented.

These 13 opportunities can be found across sectors ranging from agriculture to real estate. It includes ideas such as regenerative agriculture, utility-scale solar and wind power, as well as electric vehicles and charging infrastructure.

The authors of the report, which also include Standard Chartered and decarbonisation investment platform GenZero, looked at over 100 decarbonisation investable ideas in South-east Asia and prioritised them because of its high-impact and deployability.

Beyond these top investable ideas, the report estimates that South-east Asia’s green economy potential, if fully unlocked, could generate annual revenues of US$300 billion by 2030, which is about 5 per cent of the region’s total gross domestic product.

However, scaling capital flows into South-east Asia is constrained by multiple factors. These include risk-weighted returns that are lower than what investors typically expect, and emerging markets risks involving political stability, currency volatility and the depth of capital markets.

Other challenges include a dual need to continue growing the economy while decarbonising at the same time, its heavy reliance on fossil fuels, as well as the lack of a large-scale climate incentive programme, such as the Inflation Reduction Act in the United States.

The report lays out several ways to scale green investments into South-east Asia.

These include:

- Governments prioritising green investments on areas where they have a strategic advantage or where there are immediate needs to maximise impact

- Developing domestic carbon markets and having some alignment on standards within the region

- Developing repeatable playbooks on how catalytic capital can be utilised so that the right innovative finance mechanisms can be identified and scaled

- Strategically allocating funds to priority projects due to limited low-cost capital

- Companies shifting their approach towards sustainability from compliance to value creation, and building future-proof portfolio of green products

- Targeting industrial clusters for green investment that could accelerate impact and aligning these clusters into a national net-zero roadmap

- Deploying renewable energy into these industrial clusters

- Collaborating on cross-border renewables and grid infrastructure

Green Economy Index

For the first time since the report’s first iteration in 2020, it ranked the decarbonisation progress of the 10 South-east Asian countries by assessing metrics such as targets set, regulatory framework, net-zero roadmaps and emission levels.

Vietnam had made the biggest progress, in 2023, with its overall score going up by five points to 38. Setting a national net-zero roadmap was the biggest contribution to its improved scoring.

Singapore’s score improved by four points to 55. The city-state was top of the index overall.

Malaysia came in second at 43 points, with Indonesia closely behind at 41 points.

As a whole, the region has made progress with more countries establishing roadmaps and companies setting net-zero targets, according to the report. Almost all countries are experiencing a steady reduction in deforestation.

But solar and wind energy generation capacity still remains low at 4 per cent and is not increasing fast enough.

While there is significant progress in defining what needs to be done, the “how” is still unclear due to insufficient regulations and incentives to facilitate the implementation of plans.

Given the lack of time to deliver its 2030 net-zero commitments, the report highlighted the urgency for South-east Asia to seize the opportunities arising out of the green economy transition.

The first few steps are already known and achievable, as no new technologies or solutions are required for South-east Asia to decarbonise since it is still at the early stages of the energy transition.

South-east Asia could also emerge as the centre for green exports, markets and investments, amid geopolitical tensions between the United States, the European Union and China as each power bloc seeks to influence the pace of decarbonisation.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.