OCBC to stop backing upstream oil and gas projects approved after 2021

SOUTH-EAST Asia’s second-largest lender, OCBC , will aim to reduce by 2050 the absolute emissions for the oil and gas sector attributable to the bank by 95 per cent from its 2021 levels. It will also stop financing upstream oil and gas projects that were approved after 2021.

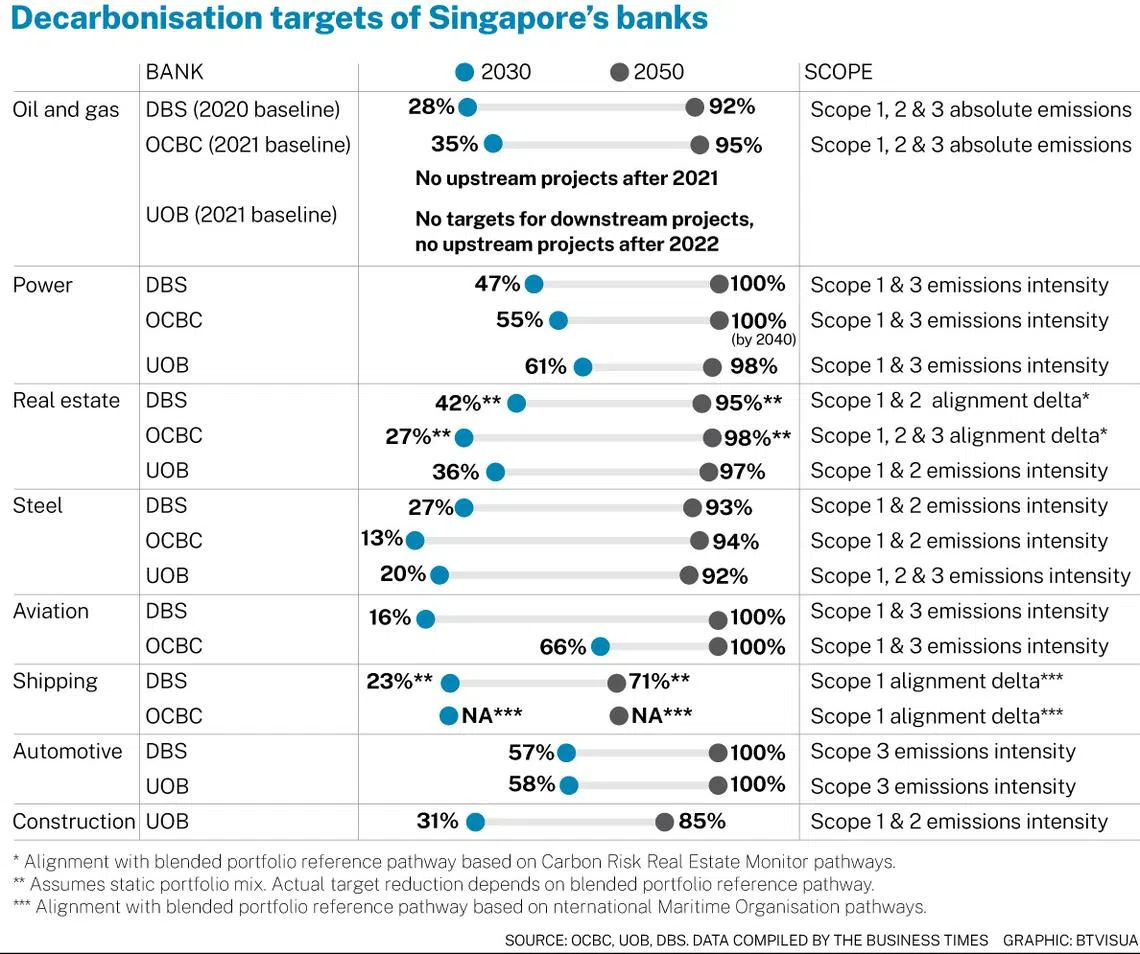

In addition to the oil and gas sector, OCBC also announced decarbonisation targets for five other sectors – power, real estate, steel, aviation and shipping – as part of its wider net-zero commitments by 2050.

These six sectors make up about 67 per cent of OCBC’s corporate and commercial banking loan portfolio. But the targets themselves account for 42 per cent of the portfolio, as the bank focuses on parts of the value chains that make up the bulk of emissions.

Out of these six sectors, real estate is the largest contributor to the bank’s revenue.

OCBC is the last of the three Singapore banks to announce its net-zero targets, as it joins a wave of global financial institutions facing pressure to cut financing of “dirty” projects or companies, and to mitigate climate-related risks within their portfolios. DBS was the first local bank to do so last September, followed by UOB about a month later.

Mike Ng, head of the bank’s global wholesale banking sustainability office, said on Tuesday (May 16) that the magnitude of targets set for the oil and gas sector is “significant and ambitious”. The targets also include a 35 per cent reduction by 2030.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

“According to the International Energy Agency (IEA), to be compatible with a 1.5 degrees Celsius world, oil and gas that are in fields that have not obtained approval before 2021 should continue to stay in the ground and not be extracted. So what we are doing is that we are drawing a line in the sand,” he added.

Tan Teck Long, head of global wholesale banking at OCBC, said that the bank’s exposure to upstream oil and gas projects has been reduced to an “immaterial amount”, given that it was avoiding such projects even before announcing its decarbonisation targets.

Nevertheless, Ng acknowledged that the targets set for the sector will definitely have an impact on revenue, given that the bank does have some upstream financing projects.

However, OCBC’s chief executive officer Helen Wong said that this does not stop the bank’s revenue as a whole from growing, because other parts of the portfolio will bring in business.

She said: “Today, what we are talking about is focusing on really how to help our customer to (make the) transition. So there will definitely be some revenue forgone because you’re changing your portfolio. But in a way, we’re actually rebuilding our portfolio in a less carbon-emitting manner.”

In contrast to the oil and gas sector, where decarbonisation targets are set based on absolute emissions, other sectors are guided by emission intensity targets. For such sectors, the bank will aim to lower emissions per unit of output or activity, though this may not necessarily lead to a lower absolute level of emissions.

Unlike other sectors where an emission intensity reduction target has been set for 2050, OCBC aims to reach net zero by 2040 for the power sector.

Ng said that this is because of the enabling nature of the power industry to decarbonise other sectors, including transportation, manufacturing and real estate.

Justin Tan, partner at financial service consultancy Arthur D Little, said that this target is “a highly laudable and lofty ambition”, premised on the rationale that renewable energy technologies are already significantly more mature and deployable at scale, compared to other more nascent sectors for green technologies.

OCBC said it is focusing on these six sectors based on each sector’s emissions intensity and whether it occupies a significant portion of the bank’s portfolio.

The bank will also be making public whether it had achieved its financed emissions targets annually. These targets will also be reviewed at least once every five years as climate science evolves and more data from clients become more available.

Tan said that the bank is looking to focus on the agricultural sector next and will soon begin collecting data. The agricultural sector is not included in the first phase of OCBC’s decarbonisation targets due to difficulties in data collection.

When asked how OCBC will manage clients who are unable to meet their decarbonisation targets, Tan said that the bank works with its clients closely on their transition journey, and it will try to understand why some of them are unable to meet the bank’s expectations.

“As long as they show good faith in bringing the decarbonisation target to meet it along the pathway, then we are fine. Now, if we find a customer, who doesn’t want to be part of the journey, who refuses to be in the executed transition, that’s a different thing altogether. And we might have to consider, as a last resort, after constant discussion with the customer, to phase out the relationship,” he added.

OCBC had achieved S$47 billion in sustainable financing commitments by the first quarter of 2023; of this sum, S$32 billion, accounting for 11 per cent of the bank’s total loan book, has been drawn down.

Market watchers have commended OCBC’s decarbonisation strategy. Tan from Arthur D Little said the bank has set a high bar, while Kevin Milla, carbon specialist at sustainability consultancy firm Paia Consulting, said that its targets are either meeting or exceeding those of the other two local banks.

For one, the decision to end project financing for upstream oil and gas projects from 2021 — a target which DBS has not yet set — is endorsed by the IEA’s net-zero pathway.

Milla noted that the financial sector may have some indirect responsibility in assuring current fossil fuel infrastructure assets are not stranded from divestment, and that emissions leakages from divestment are minimised. Hence, some fossil fuel infrastructure may have requirements in the interim.

While all three banks include operational emissions of building assets under their real estate targets, Milla pointed out that only OCBC captures tenant electricity use that is typically not covered under Scope 2 reporting.

“OCBC extending the target to tenant electricity use is a step in the right direction to include the value chain emissions of real estate. Many of the key sectors cut across each other such as power and steel with real estate, so it is a welcome development, albeit downstream with tenants rather than upstream with the power and steel,” he added.

Milla also noted that OCBC’s target for the power sector may be more ambitious than other financial institutions. He pointed out that decarbonising this particular sector would create a domino effect in the economy as every industry’s power mix may also decarbonise, which in turn could lead to more green power generation.

“OCBC’s senior management has recognised not only the complexities of making this successful transition, but also the potential impact on revenue and even client relationships – it is a strategic trade-off which the bank seems be very clear-eyed about,” said Tan from Arthur D Little.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.