Philippines overtakes Indonesia in coal dependence

Both countries are also meeting most of their additional electricity demand with coal, rather than renewables

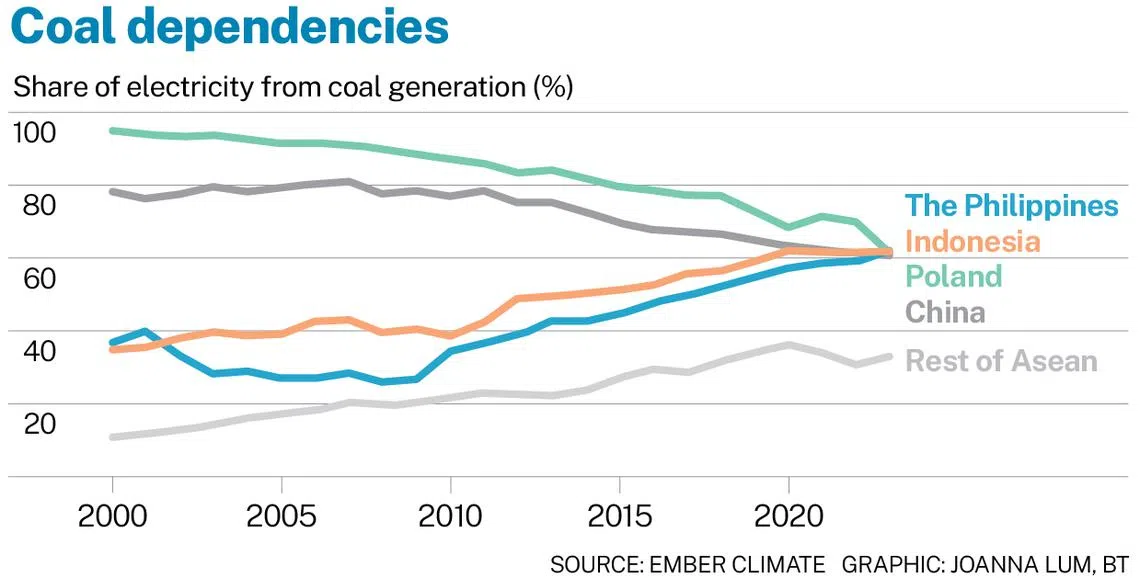

BOTH Indonesia and the Philippines increased their dependence on coal for power generation last year, suggesting that the two countries are failing to expand renewable energy capacity at a pace sufficient to keep up with growing demand.

The numbers from energy think tank Ember Climate reflect that the Philippines is now the most coal-reliant country in South-east Asia; and the third highest in Asia, after India and Kazakhstan.

The share of electricity generated from the burning of coal hit 61.9 per cent in the Philippines – up from 59.1 per cent in 2022. In Indonesia, the ratio rose “marginally” to 61.8 per cent.

These ratios are high relative to the average for the Asean region, which stood at 33 per cent in 2023 and 31 per cent in 2022.

“Indonesia and the Philippines are the two most coal-dependent countries in South-east Asia, and their reliance on coal is growing fast,” said an Ember Climate report released on Monday (Jul 1).

The report highlighted that while some of the world’s heavily coal-reliant countries are raising their renewable energy capacities, Indonesia and the Philippines have significant room for improvement.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

China, for instance, was once the most coal-dependent country in Asia; and Poland was the most coal-dependent in the European Union.

Last year, China’s solar and wind facilities met 46 per cent of the 613 terawatt hour (TWh) rise in electricity demand.

Poland has done even better: Electricity demand fell by 5 TWh while solar and wind power generated grew 26 per cent. Coal-powered output, meanwhile, fell 22 per cent.

SEE ALSO

In comparison, Indonesia met 67 per cent of the 17.1 TWh rise in electricity demand with coal-powered energy. Solar and wind generation met a mere 2.3 per cent (0.4 TWh) of the increased demand. The rest was mainly met by natural gas.

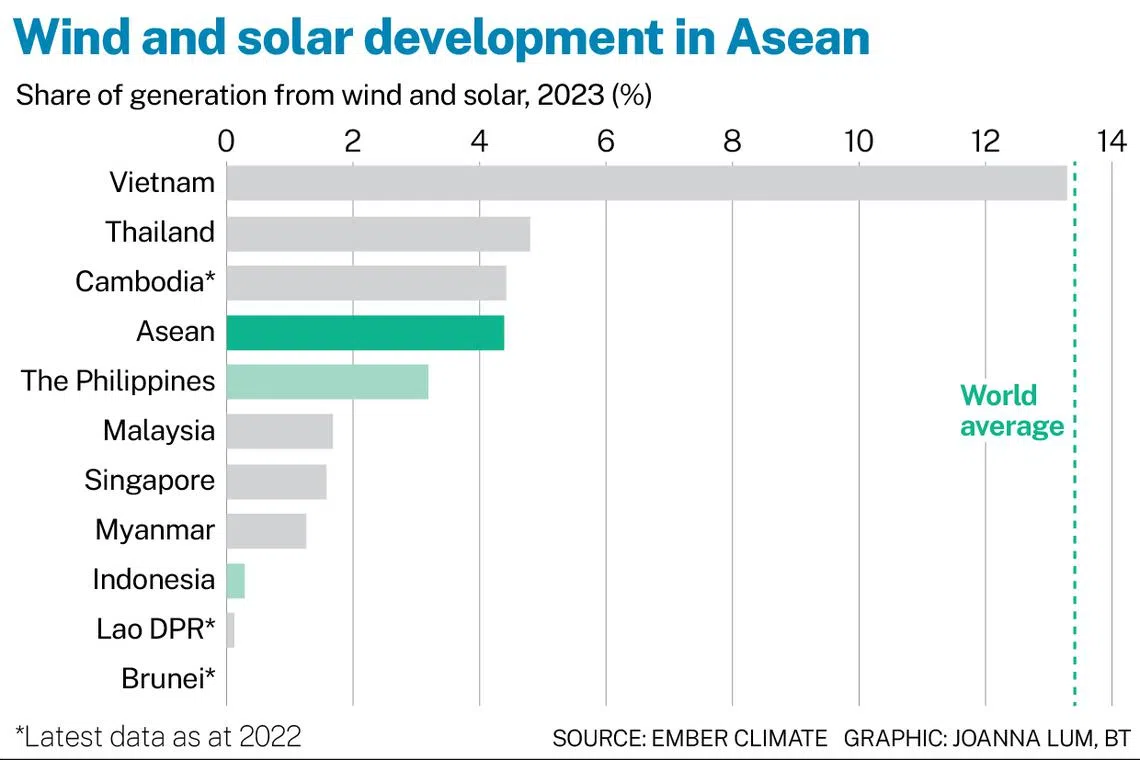

Ember Climate said Indonesia’s pace of building wind and solar capabilities has been “sluggish” – increasing by just 1.2 TWh since 2015, and accounting for 4 per cent of total renewable energy growth. Bioenergy generation accounted for 40 per cent, hydro for 34 per cent and geothermal for 22 per cent.

In the Philippines, electricity demand increased by 5.2 TWh last year. Coal generation rose by 6.5 TWh, however – more than what was needed to meet the demand rise. Wind and solar generation increased by only 0.9 TWh, covering only 17 per cent of that rise in demand.

The country has done better than Indonesia in developing wind and solar capabilities, however, raising this from less than 1 TWh in 2015 to 3.7 TWh in 2023 – representing 61 per cent of the total increase of renewables.

Indonesia and the Philippines have lower wind and solar shares in their electricity mix than other countries in Asean. The Philippines (3.2 per cent) is ahead of Indonesia (0.3 per cent), but still behind the regional average of 4.4 per cent.

The data emphasises the significant hurdles for Indonesia and the Philippines to reduce carbon emissions from the power sector, and suggests that greater efforts are needed to attract investment inflows.

Indonesia last year announced a Comprehensive Investment and Policy Plan (CIPP) with aggressive renewables targets and key areas for investment. BMI, the financial research arm of Fitch Solutions, said in a report at the time that the plan “gives clarity to developers and investors on the five areas of the power sector that the government will channel funding towards”, but that more details are needed.

An update to the CIPP consolidating feedback is expected this year.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.