Research finds that no carbon project checks all the boxes

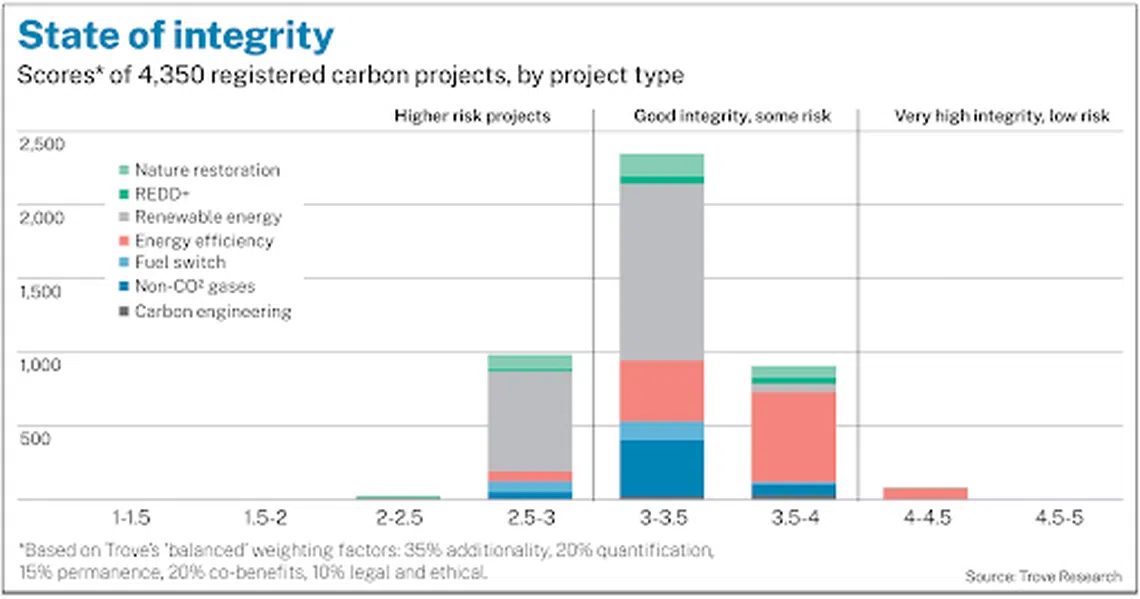

VERY few carbon projects can be considered to be of high integrity, if standards largely aligned to that of the Integrity Council for the Voluntary Carbon Market (ICVCM) were applied today, Trove Research has found.

Market participants would thus have no choice but to practise pragmatism over perfection, as there can only be “good projects, but no perfect project”, the data and analytics firm’s senior analyst Konstantina Stamouli said.

The study comes ahead of governance body ICVCM’s own assessment for carbon credit categories based on its core carbon principles (CCPs) in the third quarter of the year, to make it easier for market participants to identify high-quality carbon credits.

As ICVCM’s assessment framework has not been published in full, Trove arrived at its finding by scoring more than 4,000 registered carbon projects on a scale of 5, based on factors that map the CCPs to a great extent, and played around the factors’ weightages.

If the weighting is “balanced” – meaning the integrity of emissions impact and implementation are valued on a 7:3 ratio – only about 47 projects are assessed to be of “very high integrity”, notching a score higher than 4. These are largely clean cookstove projects. None scored above 4.25 though.

Projects linked to the United Nations programme to reduce deforestation and forest degradation (Redd+), which have been affected by recent negative publicity around their validity, mostly fall in the “good integrity, some risk” band, tied to scores between 3 and 4.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

While a handful of these Redd+ projects received a failing score of 2 to 2.5, many other project types are in the band as well, including those related to nature restoration, renewable energy, energy efficiency, and fuel switch.

Price separation

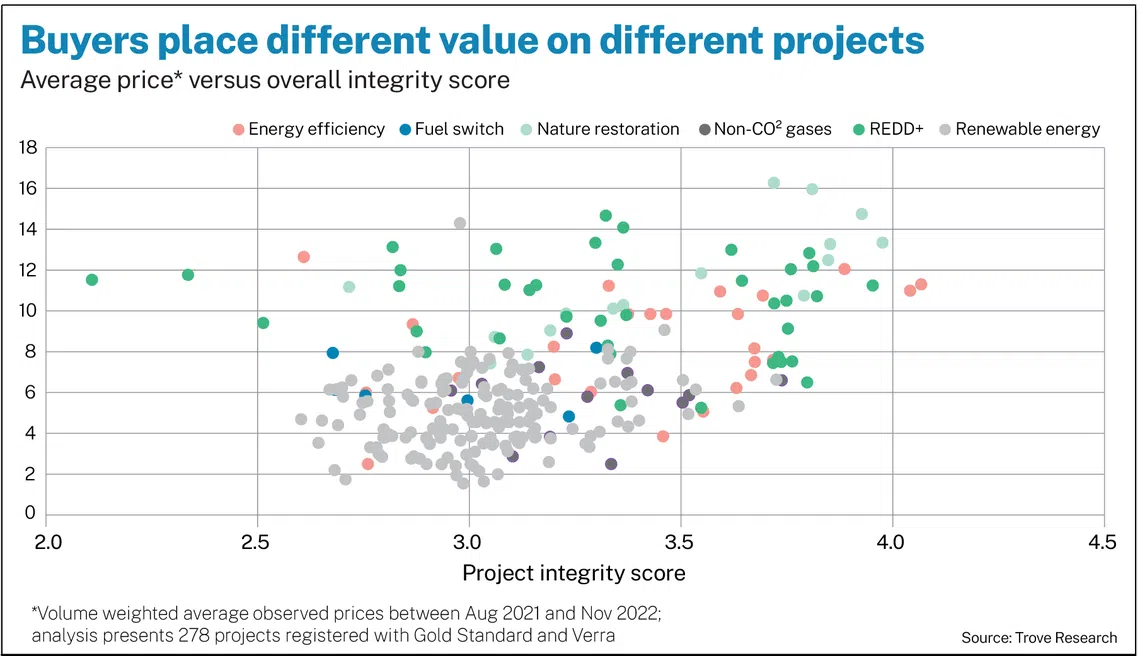

Notwithstanding that, the prices of Redd+ credits have fallen 19 per cent since coming under intense scrutiny earlier this year, Trove noted. In January, an investigative news report by The Guardian argued that more than 90 per cent of Redd+ projects certified by leading verifier Verra do not represent genuine carbon reductions.

At one point in 2022, the prices of nature restoration and Redd+ projects were neck and neck. However, with the negative publicity, that changed. As of end-March, Redd+ projects traded around US$8.30 a ton on average, while nature restoration projects traded above US$13 a ton, after rising 47 per cent in the first quarter of 2023.

Trove’s analysis also found that integrity priorities matter, and change the perception of which projects may be considered to be of high integrity.

For instance, if its carbon integrity weighting skews towards the projects’ emissions impact, projects that would score above 4 are mainly those tackling non-carbon dioxide emissions.

A majority of nature restoration projects would become what Trove calls “higher risk projects”, with scores under 3, when the bulk of them fell under the “good integrity, some risk” category under the “balanced” weighting.

Q1 movements

Nevertheless, it is encouraging that the average integrity scores of projects that started between 2019 and 2023 so far have risen to 3.5, from 3.3 among projects that started between 2000 and 2009, Trove said.

In the first quarter of 2023, the number of carbon credit issuances diminished by almost half, from 140 metric tons of carbon dioxide equivalent (MtCO2e) in the last quarter of 2022 to 75 MtCO2e.

The number of carbon credits retired for offsetting purposes held steady, at 48 MtCO2e, while a gradual downward momentum in carbon credit prices continued.

The monthly weighted average voluntary emission reduction price of all projects across all vintages fell 9 per cent on the quarter to US$6, from US$6.30. Trove said the price fall, first sparked by the Ukraine war, is compounded by integrity concerns.

A bright spot for the voluntary carbon market could be the 19 per cent increase in the number of companies that have set a Science-Based Target initiative (SBTi) approved target, or have committed to setting one, to 4,797, Trove added.

Companies making an SBTi net zero target commitment in the first quarter include KPMG, Red Bull, Lotte Department Store, Lenovo and Dell Technologies.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.