S-E Asia’s largest LNG power plant developer faces ‘significant’ financial risks from fossil plans: think tank

Wong Pei Ting

AMBITIOUS fossil fuel expansion plans of San Miguel Global Power Holdings (SMGPH), touted as the top post-Paris developers of gas-fired power plants in South-east Asia, appear to be backfiring on it.

US-headquartered think tank Institute for Energy Economics and Financial Analysis (IEEFA) released a new report on Monday (Sep 18) showing that the company, which started importing liquefied natural gas (LNG) this year, is at risk of locking in financial instability caused by an overexposure to volatile fossil fuel prices.

SMGPH is the wholly-owned energy arm of Philippine-listed conglomerate San Miguel Corporation. It controls 4,719 MW of operational power capacity, making it the largest power generation company in the Philippines by installed capacity.

As at June 2022, coal contributed 62 per cent of its capacity, LNG accounted for 25 per cent, with hydropower and battery energy storage system making up the rest.

Taking into consideration projects in its pipeline – 1,900 MW of new coal capacity and 1,313 MW of new gas-fired capacity by 2025 – its mix in 2025 is forecast to be 28 per cent LNG, 46 per cent coal, 11 per cent battery energy storage systems, and 15 per cent hydro and solar power. LNG’s share is expected to grow substantially beyond 2025, with over 10,000 MW of gas-fired power plants proposed.

The IEEFA study looked at the 2022 financial year operating results of SMGPH’s key power plants to find that higher coal and gas costs resulted in large losses among many of the company’s largest facilities.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

This was because even when net generation of plants increased, its operational income fell due to its inability to pass on higher fuel costs to consumers.

This can be seen at its Sual coal plant, where a 36 per cent year-on-year growth in generation was met with a 52 per cent decline in operating income, IEEFA stated.

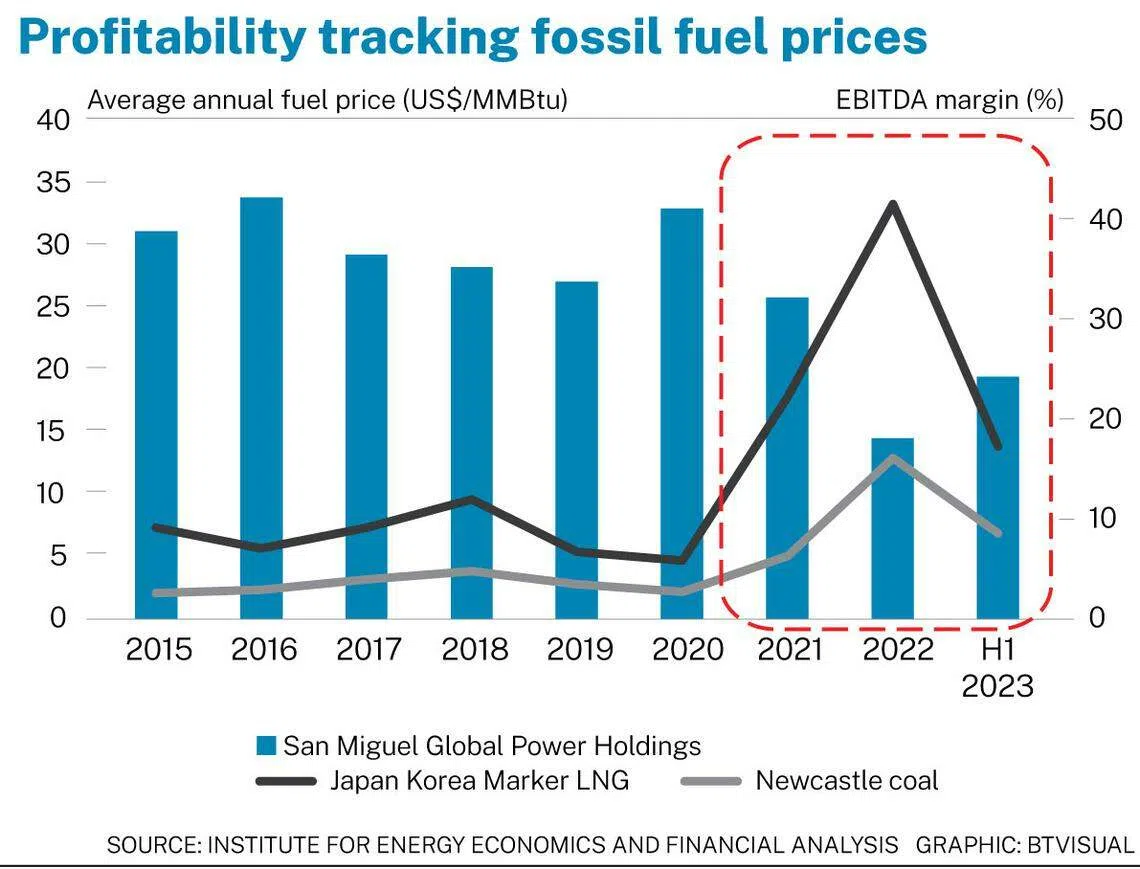

SMGPH’s operating profitability is also down, the report noted. While its earnings before interest, taxes, depreciation and amortisation (Ebitda) margin returned to 24.2 per cent on lower commodity prices in the first half of this year, it posted an all-time low Ebitda margin of 18.2 per cent last year.

The think tank also highlighted that the company is expected to take almost twice as long – nine years, instead of four – to service its current debt based on current earnings. This signals that the company’s ability to service its debt may be under pressure, it said.

IEEFA also uncovered major challenges in covering interest payments and capital distributions for perpetual securities holders.

Yet, SMGPH is shifting from coal to the more expensive LNG, hindering its ability to meet the growing financial obligations, it said. LNG averaged nearly three times the price of coal in Asia since 2021.

To make matters worse, SMGPH does not have any active long-term LNG supply contracts, leaving it entirely exposed to extreme volatility in global LNG spot markets, IEEFA stated.

Also, none of SMGPH’s existing or proposed LNG-to-power plants have power offtake contracts beyond 2024 that might ensure long-term recovery of fuel costs. This presents a significant risk to the company’s financial well-being, it said.

In the near term, SMGPH’s liquidity crunch could evolve into a longer-term funding shortfall, with US$3.4 billion worth of perpetual securities callable till 2026, it added. Moreover, its access to low-cost capital could be constrained as global financial institutions increasingly recognise climate-related investment risks, it pointed out.

IEEFA energy finance analyst Hazel James Ilango, who co-authored the report, thus noted that SMGPH investors should tread cautiously. “The company’s elevated net debt-to-earnings, potential difficulties meeting financial obligations, and high fossil fuel exposure create additional risk of devaluation, particularly in the long term,” she added.

Fellow co-author Sam Reynolds, who leads LNG research at IEEFA, said the company begs an immediate, material pivot to renewables. It represents the “best hedge” against exposure to imported fossil fuels, the report noted, while highlighting that the company does not yet own any operational wind or solar assets despite a 2018 goal to complete 10,000 MW of renewables capacity by 2028.

“As the largest power generation company in the Philippines, SMGPH should be well-positioned to benefit from the country’s accelerating shift to renewable energy,” Reynolds added.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.