Singapore ESG indices slightly outpace STI in 2023, buoyed by renewables

Climate reporting and carbon tax will be key issues for ESG equity investors to watch in 2024

Sharanya Pillai

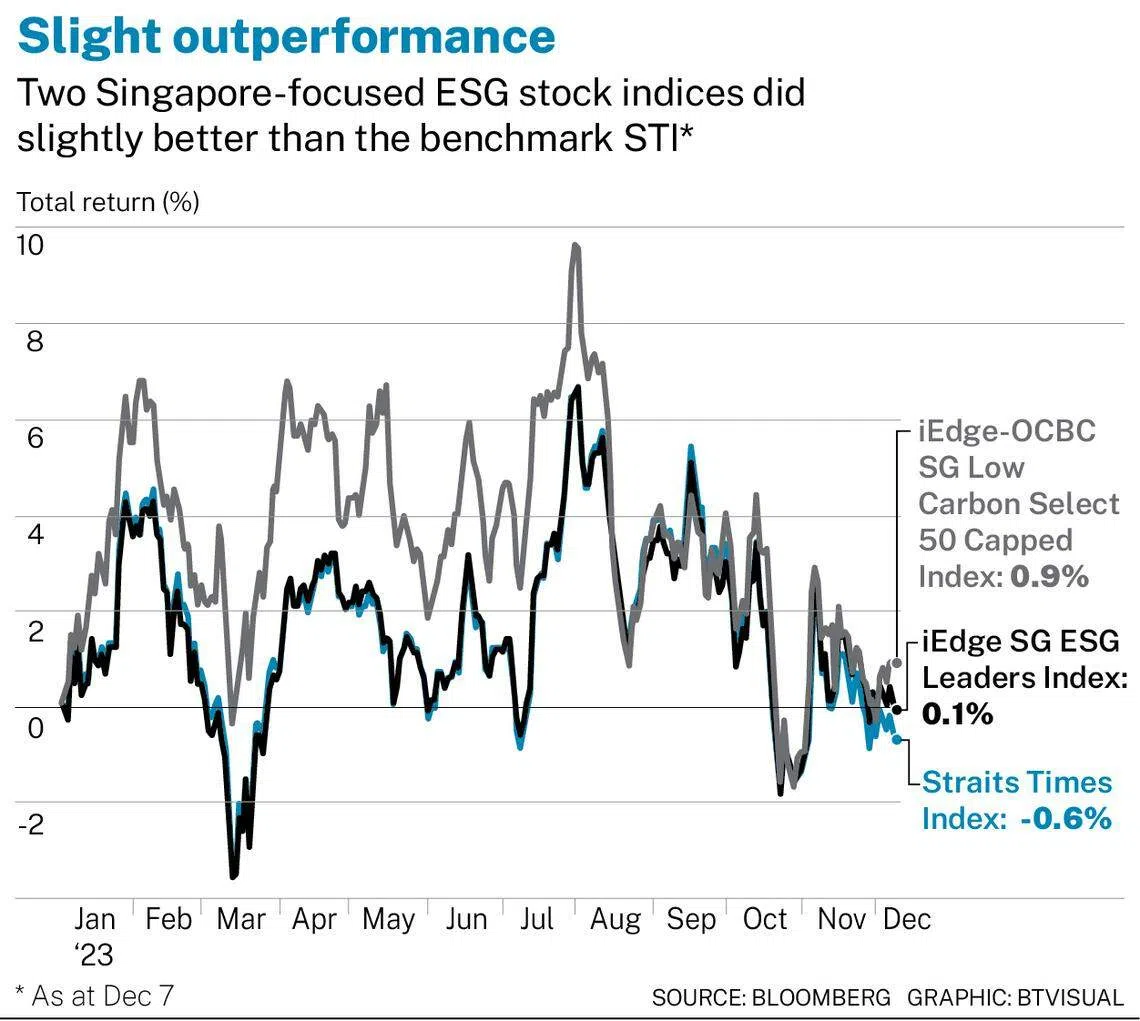

SINGAPORE stock indices focused on environmental, social and governance (ESG) strategies slightly outpaced the benchmark Straits Times Index (STI) in 2023, potentially benefitting from the bullishness over renewable energy.

The iEdge-OCBC Singapore Low Carbon Select 50 Capped Index had 0.9 per cent in total returns this year as at Dec 7, while the iEdge SG ESG Leaders Index returned 0.1 per cent. Both indices slightly outperformed the STI’s drop of 0.6 per cent in the same period.

Renewables are a common theme in the underlying constituent stocks of the two indices, noted a spokesperson for the Singapore Exchange (SGX). Notable stocks include Keppel Corp, which is up 52.7 per cent year-to-date as at Dec 7, as well as Sembcorp Industries and Yangzijiang Shipbuilding, which rose 49 per cent and 12.5 per cent, respectively, in the same period.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.