Temasek’s GenZero challenges idea that only carbon removal solutions matter

It says there is evidence that high-quality credits are being generated from a range of projects, from nature-based ones to technological solutions, as well as projects that focus on emission reductions and removals

[SINGAPORE] Temasek’s investment platform GenZero has pushed back against some segments of the sustainability community for their position that only carbon credits generated from carbon removal technologies are credible.

The state investor’s decarbonisation-focused investment vehicle said that such “debates over whether one particular type of carbon credits counts and others do not are not productive”, in its latest sustainability report released on Monday (Sep 1).

While GenZero subscribes to the principle that carbon credits should be a means to tackle residual emissions and serves as a complement to the bigger priority of governments and corporates reducing their own emissions as much as possible, it does not mean that credits generated from non-removal projects or solutions are not a valid avenue.

According to GenZero, there is evidence that there are high-quality credits being generated from a range of projects, from nature-based ones to technological solutions, as well as projects that focus on emission reductions and removals.

“So we cannot discount and we cannot go upfront to say that only removals, or 10-day removals or durable removals matter,” said Anshari Rahman, director of policy and analytics at GenZero’s strategy and development group.

Speaking during a media briefing, he added: “You need to tackle the issue on a principles basis. If the issue is reversals or permanence, we should look at how standards and methodologies can... use the best available science and technology to improve monitoring, and address some of these pain points.”

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

There has been continued debate over the credibility of carbon credits generated from the reductions of emissions. Such projects include nature-based ones such as avoided deforestation, or technology-based ones like the use of sustainable aviation fuel in aircraft.

While such criticisms have been around since the formation of carbon markets, the debate resurfaced recently as various scandals challenging the integrity of various carbon reductions projects emerged. Criticisms that credits that have been generated and used do not represent actual emissions reductions have sent the prices of carbon credits and the trading volume plummeting over the last few years.

There have been calls by some that carbon removal projects – which involve actively taking carbon dioxide out of the atmosphere and storing it – is more permanent, and therefore, more credible.

SEE ALSO

Carbon removals projects include direct air capture, which is currently limited in supply and very costly.

While work still needs to be done in improving regulatory framework – by national governments and international bodies – around this nascent industry, GenZero noted that there has been progress over the last few years in response to credit buyers pulling back on concerns over their integrity.

“We must not let the pursuit of perfection slow down climate action. Although carbon markets are still evolving, uncertainty should not justify paralysis,” said the report.

In light of the ongoing evolution of carbon markets, GenZero said that it has bolstered its risk management framework with enhanced due diligence measures including third-party audits and verifications conducted both pre and post- investment.

On the issue of integrity, GenZero chief executive officer Frederick Teo has confirmed that the investor no longer has a stake in the former C-Quest Capital – which has been rebranded to Bridge Carbon – after its former chief executive officer Kenneth Newcombe became embroiled in fraud charges over one of the cookstove programme it is running.

GenZero’s investment thesis

The carbon market downturn has led GenZero to adjust its investment process.

While it initially would invest in carbon projects in the belief that demand for credits will come once the supply is generated, the investor is now more proactive in securing buyers from the get-go, said Kimberly Tan, head of GenZero’s investment group. One example is its partnership with Chinese tech company Tencent to offtake at least one million carbon credits from GenZero’s investment portfolio over 15 years.

“The idea of some of those initiatives is... to understand what buyers want, to align upfront, and then to... invest in projects where we can be reasonably certain that there will be demand – in the form of a multi-year off-take that will give our project that base load of financial returns, or at least capital protection,” said Tan.

As for how the investor will continually make these adjustments in the current environment where climate action is potentially reduced due to policy actions by US President Donald Trump, Tan said that it will continue to look for investments that are “regulation-proof”.

“A lot of the climate tech innovation does happen in the US, and I think that will remain and probably will not change, regardless of the political environment. I think what we do have to take into account is then given the current existing exposure, how do we then very selectively add on,” she added.

GenZero said in its report that government and corporate pullbacks have contributed to a slowdown in climate investing.

It sees a real risk that governments managing tight fiscal budgets with multiple competing needs will choose to cut back on investments in climate.

With tariffs leading to cost increases and supply chain disruptions, companies will also be less willing to adopt fundamental decarbonisation technologies given the weaker appetite for capital expenditures.

They will also be less likely to embark on ambitious net-zero plans involving the use of carbon credits to address residual emissions, given the fear of greenwashing accusations.

Of the S$5 billion of startup capital that Temasek provided to GenZero since its inception in 2022, less than half has been deployed, although Teo declined to give an exact figure when asked by reporters.

Its capital is channelled into three main decarbonisation pillars: nature-based projects, technology-based ones, as well as carbon ecosystem enablers. This includes companies that support the scaling of the carbon markets, such as carbon exchange Climate Impact X.

While its funds are split relatively equally across all three pillars, Teo said, GenZero’s portfolio construction is a dynamic process.

The ability to scale and generate commercial returns, the potential for climate impact to be realised in the near term are some of the factors that the investor looks at when making its investment decisions. It does not have a set target on how much capital should go to each of the three pillars.

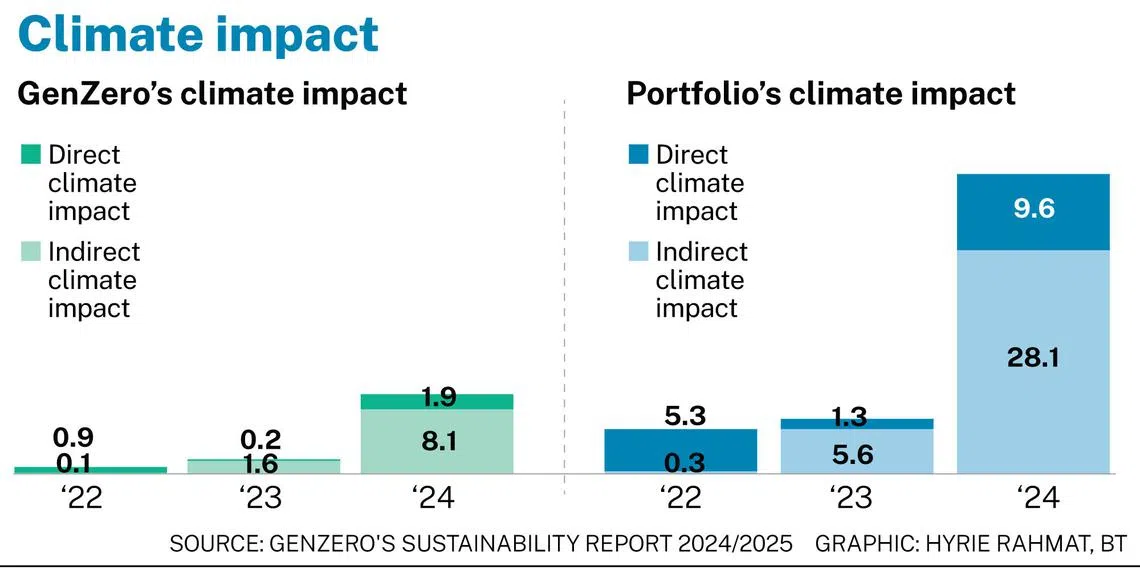

Climate impact

GenZero revealed in its inaugural sustainability report that it has set a target to achieve reductions or removals of at least seven million tonnes of carbon dioxide equivalent (tCO2e) cumulatively by end-March 2028.

It has achieved direct climate impact of three million tCO2e as at Dec 31, 2024 cumulatively since 2024. This just takes into account its stake in its investee companies across its portfolio.

This number goes up to 12.9 million tCO2e when including indirect realised climate impact.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.