Keppel eyes ‘alpha returns’ in riding sustainability megatrend

The asset manager believes in doing good for the environment without having to compromise returns

[SINGAPORE] Keppel’s big push on sustainability isn’t just about doing good, but also about generating “alpha returns” for investors, said its chief executive officer Loh Chin Hua.

Once the world’s largest offshore rig builder, Keppel has transformed into an asset manager and operator going big on sustainability, from renewable energy to green buildings and data centres.

It has also set ambitious green targets, such as increasing its portfolio of renewable energy assets to 7 gigawatts (GW) by 2030. By 2050, the company aims to hit net zero on Scope 1 and 2 emissions, which arise from direct operations and power consumption, respectively.

“Everyone wants to do good. But if you can do well in the process as well, then I think it becomes even more compelling,” Loh tells The Business Times in an interview.

“For (those who) invest with us, they know that they can do good for the planet, do good for the environment, but without sacrificing returns. In fact, in the process, we are able to generate alpha returns, which they find appealing,” he said.

Keppel was recognised as the Impact Enterprise of The Year under the large enterprise category at the 2025 Sustainability Impact Awards, jointly presented by BT and UOB.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Loh sees sustainability as a “megatrend that’s going to be with us for many decades”, given the reality of climate change. “Despite some pulling back in some quarters, we still believe that this is still a very important thing that the world has to confront,” he said.

Green energy imports

Keppel’s renewables portfolio stands at 3.8 GW, including projects under development, as at end-2024 – more than half the 7 GW target. Even in the challenging landscape for green energy, the company remains steadfast in expanding its footprint.

“Renewable projects globally are also under a bit of stress, in the sense that for some countries the returns have diminished,” Loh acknowledged.

Keppel will therefore be moving “on a more selective basis” to ensure that the projects it undertakes can provide the returns that investors are seeking, he said, adding: “You cannot just do it just to say, okay, I have 7 GW.”

Despite the challenges, Loh sees good opportunities. Keppel is playing a key role in the development of the Asean Power Grid. It is a pioneer in importing low-carbon power into Singapore, with its involvement in a breakthrough project to bring hydropower from Laos to the city-state, via Thailand and Malaysia.

Keppel has also obtained a conditional licence from Singapore to import 300 megawatts (MW) of solar power from Indonesia and conditional approval for the import of 1 GW of low-carbon power from Cambodia.

Loh noted that such projects create investment opportunities for several groups: those keen to back upstream assets, such as solar farms and energy storage, as well as those seeking exposure to the midstream cable systems and to the data centres that consume the imported green power.

Keppel itself is in a good position to pursue clean energy import projects, given that it is active across the energy value chain.

For instance, its unit Keppel Electric retails electricity in Singapore, while the company’s data centres segment provides “a good source of customers who would be keen to avail themselves to this green power”, Loh said.

The economics of solar power are also compelling. Loh highlighted that solar power is now almost at grid parity in many countries – meaning that the green technology is cost-competitive with fossil fuels. That said, some import projects will come with greater capital expenditure requirements, such as for laying undersea cables. “(We) will have to ensure that the economics and investment returns are there,” Loh said.

Preparing for hydrogen

Keppel is also preparing for hydrogen as a future clean fuel. It is building the first hydrogen-ready gas power plant in Singapore, the Keppel Sakra Cogen Plant, on Jurong Island. The plant is more than 90 per cent completed and on track to start operations in the first-half of 2026.

It is set to be Singapore’s most energy efficient power plant, and estimated to save up to 220,000 tonnes of carbon dioxide per year, as compared to Singapore’s average operating efficiency for equivalent power generated. This is equivalent to taking some 47,000 cars off the road per year.

“At the same time, we are also planting something that is future-proof,” said Loh, noting that the plant will be able to run on gas with 30 per cent hydrogen content from the start, with the ability to later transition fully to hydrogen.

“In the future, when hydrogen becomes available at a rate that’s compatible to natural gas, we can then replace (natural gas) with hydrogen. It’s again a win-win,” he said.

Floating data centre

Connectivity is another big trend for Keppel, boosted by the rise of artificial intelligence.

“Especially now, with geopolitics being what it is today, I think it’s even more important for continents (and) countries to be connected digitally,” Loh said.

Data centres are a key enabler of connectivity, but are notorious for their intensive carbon footprint and water needs. To tackle the issue, Keppel has been focused on green innovation for data centres.

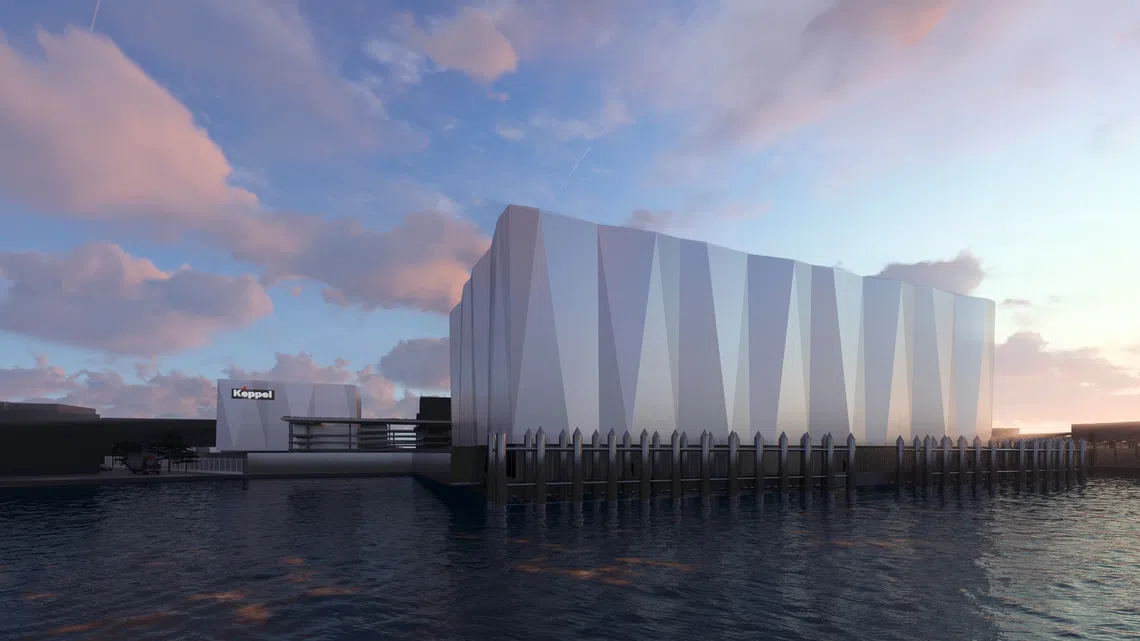

One key innovation is Keppel’s planned floating data centre in Singapore. The facility will use seawater instead of potable water for cooling, improving power usage effectiveness and contributing to water resilience.

“It’s going to be the first of its kind in Asia-Pacific; there are other floating data centres that have started in Europe and in the US, but not of this scale,” Loh said, adding that Keppel already has a customer for it.

Keppel has completed an environmental impact assessment for the floating data centre, and the project is pending final approval from the authorities. Construction is expected to start in Q4 this year, subject to approvals, and finish by end-2028.

Loh sees potential for more floating data centres abroad.

“We can potentially build large modules in Singapore and ship them to other countries – anywhere that you have cities that are near the sea or rivers,” he said, citing Tokyo, Hong Kong, Shanghai and New York as examples.

Green real estate

Beyond clean energy and connectivity, sustainable urban renewal (SUR) is a key strategy for Keppel. The company’s SUR solutions involve using technology to improve buildings’ energy and water efficiency, while reducing their operational and embodied carbon.

Embodied carbon refers to carbon emissions associated with a building’s materials and construction process.

Keppel’s SUR strategy has attracted considerable interest from its limited partners, with about S$4.3 billion of cumulative funds under management.

Sustainability in the built environment boils down not just to tech solutions, but also choosing to retrofit buildings, rather than constructing new ones.

As an example, Loh cites that very building where he is speaking to BT, Keppel Bay Tower. In 2018, Keppel undertook a major refurbishment of the property, rather than demolish it and build anew.

“We could have knocked it down, but if you do so, you release a lot of embodied carbon,” he said, adding that construction of a new building adds to the carbon footprint, with the use of steel and concrete.

The refurbishment led to the avoidance of 40,000 tonnes of embodied carbon. At the same time, it improved Keppel Bay Tower’s net operating income by 31 per cent from 2018 to 2022.

“The rent in this building commands a premium of about 10 to 15 per cent because of its green and smart features. At the same time, our operating expenses are also lower, because we consume less energy. So you have income going up, expenses coming down,” Loh explained.

With the rise in net operating income, Loh estimates that the valuation of the building increased by S$150 million – once again illustrating how Keppel can do good while generating attractive returns.

Measuring progress

As Keppel pursues sustainability, the company is also tracking its progress towards its green targets.

Loh believes that Keppel will achieve its net-zero emissions target “much earlier than 2050”. The company has already slashed its Scope 1 and 2 emissions by about 81.6 per cent in 2024, from the 2020 baseline.

Keppel has not set a target for Scope 3 emissions – which arise from the company’s value chain – but has been tracking this category of emissions. In 2024, its Scope 3 emissions stood at six million tonnes of CO2 equivalent.

“Scope 3 is notoriously more difficult to manage because it is not all within your control,” said Loh, noting that the bulk of Keppel’s Scope 3 emissions come from the sale and use of natural gas to meet Singapore’s electricity needs.

But he added: “I think over time as the grid decarbonises in Singapore, I would expect this six million tonnes to reduce… and so that would help us manage our Scope 3.”

Loh noted that Keppel is an active participant in efforts to decarbonise the grid – not just with renewable energy, but also other cutting-edge technologies.

For instance, the company was selected by Singapore’s energy regulator to conduct feasibility studies for carbon capture and storage.

It is concurrently focused on social impact. For instance, the company’s Living Well initiative provides vulnerable communities in Vietnam and India with access to clean water, and has benefited over 90,000 people thus far.

As Keppel steps up its green transformation, Loh acknowledges that getting all stakeholders on board will be important. “(We) also mustn’t incur a lot of additional costs because to be fair, not all our stakeholders will agree,” he noted.

To this end, demonstrating that sustainability can produce alpha returns will be vital.

“If we can make sustainability part of our strategy, and it can actually create alpha returns, then it is a lot more sustainable; something that we can persist in.”

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.