Banking for a better world

As more clients seek to 'do good', DBS's role has moved beyond growing and managing clients' wealth

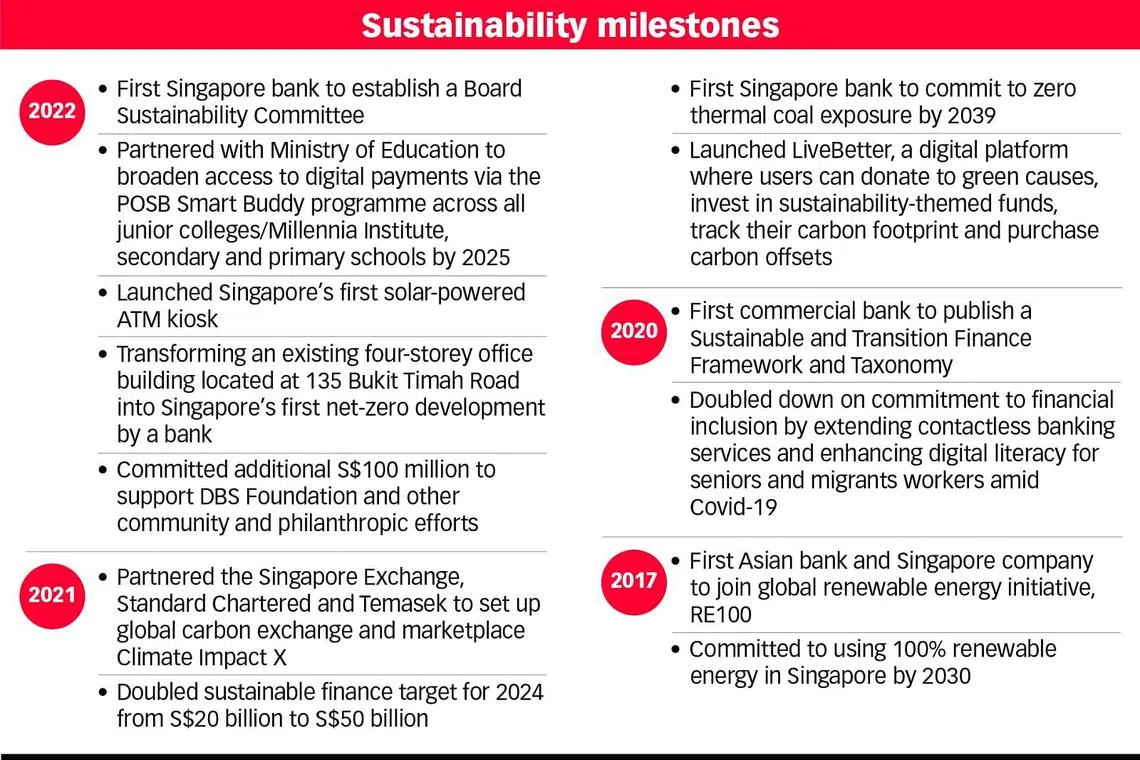

AS IT works towards being a bank for a better world, DBS has centered its sustainability efforts around the pillars of responsible banking, responsible business practices, and impact beyond banking.

On responsible banking, it is focused on accelerating the transition to a net-zero future, and was the first Singapore bank (and among the first 100 banks globally) to commit to reaching net-zero in its financed emissions by 2050. The bank's priorities also include advancing financial inclusion, as well as empowering customers to be more sustainable through their investments and lifestyle choices - take for example DBS LiveBetter, a one-stop platform where customers can learn about climate change via Instagram-style stories, track their carbon footprint based on their daily spending, offset it by purchasing carbon credits, invest in ESG funds, and also donate to social and environmental causes.

"We believe in doing the right thing by our people and embedding environmental and societal factors in our business operations," says Helge Muenkel, Chief Sustainability Officer, DBS Bank.

DBS is committed to achieving net-zero operational carbon emissions across the bank by the end of 2022, with Singapore's operations to rely solely on renewable energy by 2030.

With the pandemic casting a spotlight on the pressing environmental and socio-economic issues in our midst, the bank has also seen a growing pool of clients keen to "do good" with their wealth.

Some do so by channelling their resources into sustainable investments, while others do so in more direct ways such as supporting hard-hit segments in their communities or providing funding for social enterprises.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

In March last year, DBS Private Bank announced its goal to have more than half of private banking assets under management (AUM) in sustainable investments by 2023. By end 2021, the bank had more than achieved this goal, clocking 53 per cent in just 8 months.

In particular, growth in environmental, social and governance (ESG) funds was especially strong, with AUM for these surging five-fold year-on-year.

Growing interest among the wealthy to "do good"

Joseph Poon, Group Head of DBS Private Bank, says: "We're in the enviable position of working with clients who are business owners or in positions of influence, and who are well-placed to drive positive change through their businesses. Many clients have the means and the desire to give back to society, not only through traditional philanthropy, but also by supporting social enterprises dedicated to addressing pertinent societal gaps."

The bank's role has evolved beyond growing and managing clients' wealth.

"Increasingly, we help our clients to 'connect the dots' on multiple fronts so they can build meaningful and purposeful legacies for their future generations," Poon says.

The bank's ongoing education and engagement efforts include having relationship managers proactively review their clients' portfolios, and helping clients to understand the benefits of integrating ESG criteria into their investments. For those with lower ESG ratings, DBS Private Bank's advisers provide targeted advisory and recommendations and help replace lower-rated assets with higher-rated alternatives where suitable, or deploy new funds into sustainable investments.

Close to 5,000 such conversations were held in 2021.

The bank has also incorporated ESG ratings of clients' portfolios into their statements to help them better understand the ESG characteristics of their portfolios.

It is continually strengthening its sustainable investment product suite, and has onboarded more than 10 products over the past year, across a range of product types from exchange-traded funds, mutual funds, and private equity investments.

Poon says the entrenched perception that doing good would always result in a financial compromise is not the reality.

"Some clients see ESG as a new asset class or product type, but that's not all there is to it. ESG is an approach in screening the quality of an investment over and above traditional fundamental financial filters," Poon says.

When properly applied, it can contribute to optimising the portfolio's returns, and providing better protection against downside E, S and G tail risks, he notes.

Businesses that put in place robust ESG practices stand to benefit from a stronger corporate brand, access to cheaper financing and a larger pool of capital, as well as better stock price performance, while avoiding tail-risk controversies resulting from poor corporate governance.

With purpose embedded in the organisations' culture, these companies will be better able to attract and retain talent. In addition, with more institutional and sovereign investors, as well as financial institutions, integrating ESG criteria in their investment thesis, businesses that have robust ESG practices and successful outcomes will fare better in their access to capital and debt, Poon says.

Moving beyond investments to effect change

Philanthropy as we know it is changing as the wealthy seek newer, and more collaborative ways to give back to society, with more moving from "passive giving" to more sustainable means, such as venture philanthropy.

DBS Private Bank works with DBS Foundation by connecting private banking clients to social enterprises.

Social enterprises, with their dual bottom-lines of profitability and impact, are well placed to address many social and environmental issues that continue to persist today. However, Poon says they sometimes attract investors that do not share the same values.

"Should these funds or investors be under pressure to generate higher returns, conflicting agendas between the investor and the social enterprise could arise at some point, which could end with the latter having to compromise on their original objectives until they reach a certain level of profitability," he says.

The bank therefore encourages clients to think "impact-first" and see these social enterprises for the long-term growth and impact they are well-placed to achieve, he says.

With many of DBS Private Bank's clients being entrepreneurs themselves, some also step in to offer valuable mentorship on how these social enterprises can structure their businesses and access suitable financial sources.

The focus on doing good and doing well also adds value to wealth clients' family legacies.

Bringing family members together to work on projects with social impact can also increase their awareness of societal issues, help the younger family members to more keenly consider their privilege, while allowing the older generation to witness for themselves the positive impact of their investments.

Poon says: "Bridging social enterprises and wealth clients, many of whom are savvy entrepreneurs themselves, can spark numerous synergies. Bound by the common objective of achieving both financial and societal returns, both parties can be reassured that when values and objectives are aligned, they become mutually reinforcing."

DBS Foundation, Singapore's first foundation dedicated to championing social entrepreneurship, has disbursed over S$10 million in grants to 93 social enterprises in the region via its flagship grant programme, which is now in its eighth year. Building on this track record, the Foundation is innovating new solutions aimed at better supporting high-potential social enterprises that are seeking growth capital with which to scale their business andimpact, and enabling other ecosystem partners to participate in their journeys.

With the pandemic upending livelihoods and casting a spotlight on a wide range of social issues, DBS also announced earlier this year an additional S$100 million to support the Foundation's work, as well as other philanthropic and community efforts by the bank.

The Foundation has since gone beyond social enterprises to also support small and medium-sized enterprises (SMEs) looking to kickstart their transition towards becoming more sustainable businesses, through the launch of a new grant programme. Based on the bank's engagements with SME owners and their next-gens, many have expressed interest in adopting sustainable business models, but are often caught up with operational matters and thus lack the bandwidth or resources to begin. DBS Foundation therefore hopes to fill this gap with its new SME Grant Programme, which is accepting applications till 15 June.

Beyond supporting these businesses-for-impact on their sustainability journeys, DBS Foundation has also expanded its remit to include a new 'Community Impact Chapter'.

"This new chapter will focus on bolstering the bank's contributions to society by equipping communities with future-ready skills such as financial and digital literacy, and building food resilience," says Monica Datta, Head of Community Impact Chapter, DBS Foundation.

Copyright SPH Media. All rights reserved.