Banking on a sustainable future

Financial players need to rise up to the challenge of financing a sustainable economy

THE mounting pressure for businesses and individuals to address the looming climate crisis has pushed sustainability into the mainstream.

Still, the work to be done within the space is immense and financial institutions have an important role to play in financing the transition towards a sustainable economy.

"What the world is collectively trying to do is structurally transform and reinvent the entire modern economy from one that creates 50 gigatonnes of greenhouse gases to one that is net zero or carbon neutral," says Eric Lim, UOB's chief sustainability officer.

New business models and technology are required to drive this transformation all of which require financial players to rise up and inject substantial amounts of investments and capital expenditure.

Driving change

Sustainable financing and investing have gathered pace in recent years with public and private sectors coming to terms with the fact that sustainability does not necessarily come at the expense of profits. Rather, it will play a crucial role in supporting future growth.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

"Companies realise that in order to prepare themselves for the future and win market share... they have to be able to demonstrate genuine, authentic sustainability efforts within their business models, products and services," says Lim.

UOB's sustainable finance portfolio has nearly tripled from S$6.6 billion at the end of 2019 to S$18 billion in Q1 this year. In comparison, UOB's overall loan portfolio grew at just under 10 per cent a year.

The bank had in February this year raised its sustainable finance target for 2025 to S$30 billion after it exceeded its target to build a sustainable finance portfolio of $15 billion by 2023.

To add, some 60 per cent of investors in UOB's US$1.5 billion sustainability bond offering in April 2021 were sustainability-focused investors.

"It's a sign that the main economy is shifting and that's where a lot of growth opportunities are," says Lim.

Sustainable growth is particularly crucial in Asean. The region's reliance on natural resources means that it is even more vulnerable to the detrimental effects of the climate emergency.

"It is critical that we support our Asean economies and customers in their sustainability journey, so that we can continue to contribute to the region's growth," says Lim.

Incorporating sustainability, however, needs to be authentic and core to the business strategy of companies.

"Anything less than that would simply be greenwashing," says Lim.

"We still need to do proper due diligence to make sure that we're financing and investing in the right technologies and business models and to ensure that our clients are offering high quality sustainable products and services."

Meeting sustainability needs

Loans extended under UOB's sustainable finance frameworks are directed towards projects and activities that can help combat the climate crisis and drive social development. These frameworks also serve to help clients shape and develop sustainability strategies for their businesses.

The loans are conditional on companies achieving their sustainability performance targets or channelling the proceeds to green projects.

Businesses with a clear sustainability strategy are more likely to get a boost in credibility and reputation and have an edge in building relations with customers globally. Transitioning towards more efficient business operations will also translate into significant cost savings.

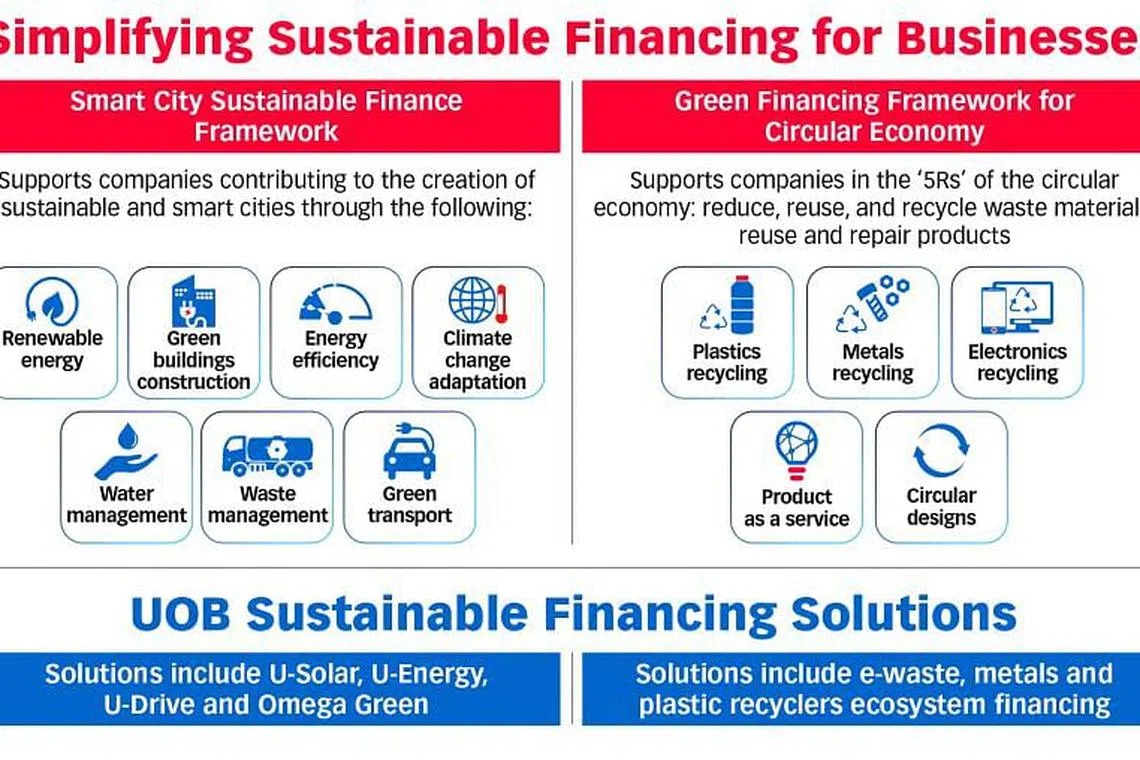

UOB's sustainable finance frameworks and solutions are designed to address the needs of specific sectors. The bank's U-Drive, for instance, is an integrated green financing solution for electric vehicle businesses and end-users, including automotive brand owners and car dealers. U-Drive is part of UOB's suite of sustainable financing solutions under its Smart City Sustainable Finance Framework.

The bank's 3 other key financing frameworks are the Sustainable Finance Framework for Green Building Developers and Owners, Green Financing Framework for Circular Economy and the Green and Sustainable Trade Finance and Working Capital Framework.

For the hard-to-abate carbon-intensive sectors, UOB will continue to develop solutions to support these companies in their decarbonisation plans.

Building ecosystems

But just offering the money sometimes isn't good enough.

Beyond financing solutions, these frameworks serve as a platform for green solution providers and prospective customers to connect with one another.

"Together with our financing capabilities, we are able to bring companies and individuals together through these ecosystems," says Lim, adding that it is UOB's philosophy to go beyond banking and to become a sustainable partner.

UOB's The FinLab also recently launched the Greentech Accelerator programme that will support innovative greentech solution providers globally and link them up with businesses to progress their sustainability agendas.

"We hope to be able to bring value to the entire value chain, all the way from startups, to mid-sized companies, large companies, and even individuals," says Lim.

Plugging the gap

Such solutions are especially crucial for smaller companies that often do not have the same resources that large corporations do.

"Large companies can see the writing on the wall and they're already moving to strengthen their business models. It is the smaller companies that we need to find solutions for," says Lim, adding that many are often unsure of what the current infrastructure has to offer.

Data too is a pain point when it comes to lifting the sustainability efforts of small to medium sized companies.

"In order to be able to understand the environmental impact of our lending activities, it's very important that we can access the environmental footprint information of our clients," says Lim.

The industry has made significant headway in tackling environmental, social and governance (ESG) data gaps.

In May this year, a blockchain-based platform called ESGpedia was launched in a bid to make companies' sustainability data more accessible to financial institutions through a single registry with global verified sources.

ESGpedia powers Greenprint ESG Registry, one of the four digital utility platforms housed under Project Greenprint, which the Monetary Authority of Singapore (MAS) is developing in partnership with the industry.

As part of Project Greenprint, the Singapore Trade Data Exchange and a UOB-led consortium of 4 banks, including DBS, OCBC and Standard Chartered, are also working to develop digital solutions for more consistent green trade-financing standards across industries.

Aligning goals

Meanwhile, regulatory arbitrage persists given that sustainability efforts are advancing at an uneven pace across economies.

But initiatives such as the Paris Agreement has put nations on a path to reduce global greenhouse gas emissions.

"What we hope is that, over time, standards continue to become more consistent and aligned, so that the entire value chain can move forward together," says Lim.

"These are the kind of efforts that will be able to help us to move forward in a meaningful way."

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.