Apac venture deals likely weaker than 2021, but could beat prior years: KPMG-HSBC report

Sharanya Pillai

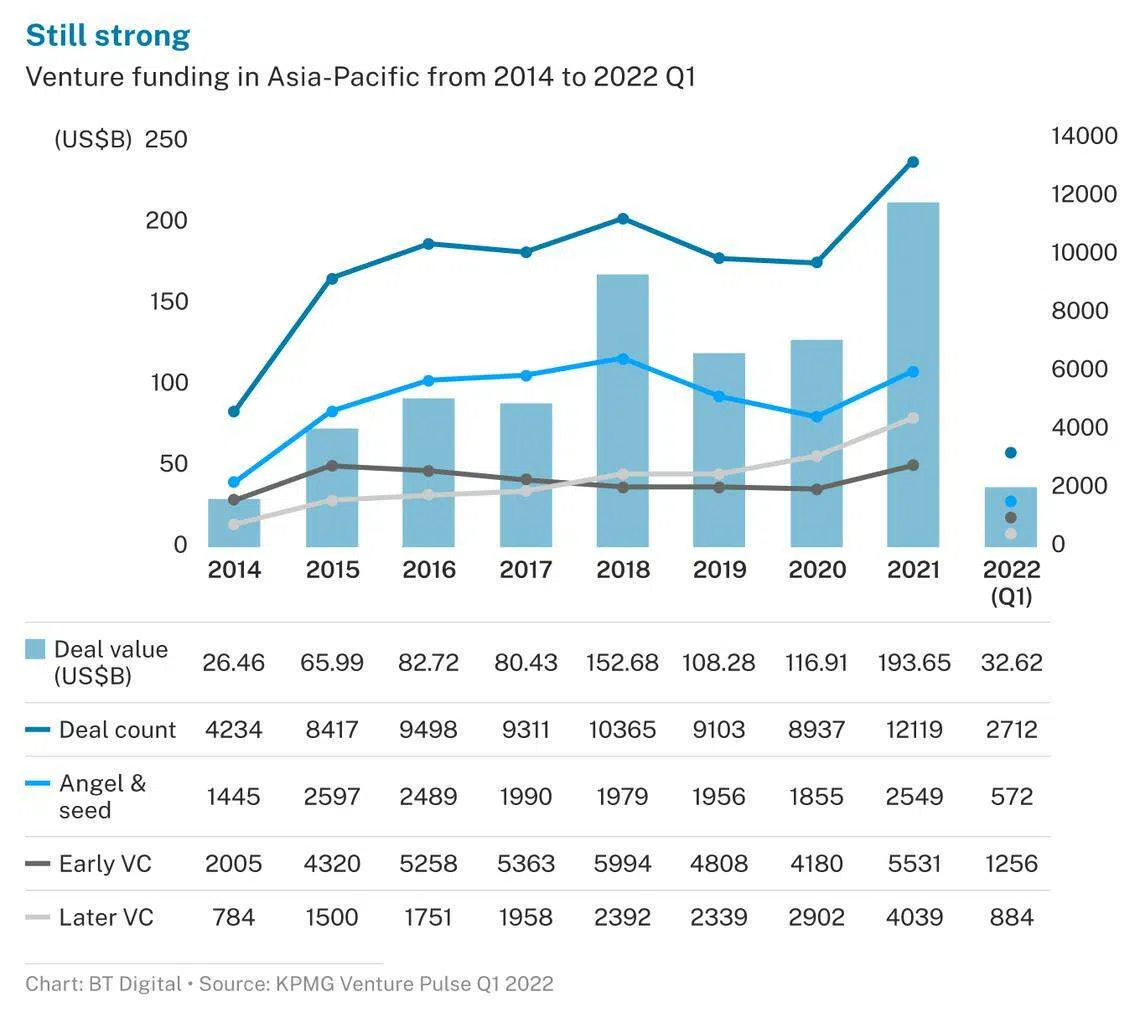

VENTURE investments in Asia-Pacific this year are unlikely to exceed the US$193.7 billion record-high in 2021 – but they still could be on track to top the prior 2 years, according to a report released on Monday (Jul 18) by KPMG and HSBC.

In Q1 this year, investors pumped US$32.6 billion in venture financing across 2,712 deals in Asia-Pacific, with nearly half comprising early-stage venture investments. Australia, Malaysia and South Korea have already seen deal values in Q1 this year pass or nearly pass 2020 totals.

“Although 2022 looks unlikely to repeat the highs of 2021, Q1 2022 figures suggest that 2022 is on target to exceed both 2020 and 2019 funding levels for Asia-Pacific as a whole,” the report said.

Consumer-facing companies and fintechs are expected to continue attracting the largest share of investments, as “super apps”, comprising e-commerce, payments, delivery and personal finance services, are rolled out in emerging markets.

More attention will also be paid to business-to-business (B2B) startups as the market matures, particularly in the fields of enterprise productivity, education, healthcare and cleantech, the report said, highlighting Australia as a key market in these areas.

Opportunities are on the rise in sectors addressing environmental, social and governance (ESG) factors, as countries embrace the need to track and analyse carbon emissions, install smart renewable energy systems and implement green finance solutions.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

ESG-related startups are on the rise in Singapore, with the country making sustainability a key part of its policy agenda and special government incentives available for companies aligned with this, the report added.

Emerging giants

The report also studied over 6,472 startups with valuations of up to US$500 million across 12 Asia-Pacific markets, and identified 10 “emerging giants” in each country. Mainland China’s 10 emerging giants – which include medical AI provider BioMind and e-sports platform HuoMaoTV – have the largest combined value of US$5 billion.

This is followed by India and Japan, whose 10 emerging giants have combined values of US$4.6 billion and US$3.5 billion respectively. Singapore came in fourth, with its 10 emerging giants having a combined valuation of US$3.2 billion.

The 10 Singapore startups are fintechs Spenmo and Aspire, HR platform Multiplier, music-making software BandLab, edtech GeniusU, property platform 99.co and crypto and blockchain players Stader Labs, imToken, Multiverse Labs and DeBank. Spenmo ranked ninth overall among the top 100 emerging giants in Asia-Pacific.

The rise of these startups comes as capital flows into Singapore remain robust. Within South-east Asia, the city-state is the top fundraising destination for startups, with US$8.02 billion raised last year, double the level of 2020. It also topped the region in the number of startups – with over 9,300 players and 12 unicorns, or startups valued over US$1 billion.

“From Singapore’s position as a global and regional financial centre, we’ve observed increased interest in venture capital participation in Series A and B rounds of innovative firms in either B2B software or financial services sectors across Europe and Asia,” said Kee Joo Wong, chief executive of HSBC Singapore.

Ong Pang Thye, managing partner of KPMG in Singapore, said the challenge ahead will be to continue attracting unicorns to reside here. Public and private programmes and incentives for hot sectors, as well as an environment that attracts and grooms top talent, will be needed, said Ong.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.