Carro and Carsome: Valuations run fast and furious, but true test lies in fintech

IN JUST the past month, two South-east Asia-focused car marketplaces have announced deals with eye-catching valuations. This has stirred curiosity: in the age-old business of used car sales, what exactly are these startups - Carro and Carsome - doing differently?

Observers The Business Times spoke to all pointed in the same direction: the potential of fintech. If these startups can collect and analyse car sales data across South-east Asia, this will make their ancillary business of automotive financing more lucrative than what traditional dealers can achieve.

Both Carro and Carsome already offer financial services. How they continue to expand on this across the region is now the key test, especially in the fragmented South-east Asian market.

In June, Singapore-based Carro said that it has raised US$360 million in a Series C round led by SoftBank Vision Fund 2, taking its valuation past the unicorn status of US$1 billion. This is more than triple the startup's last valuation of US$291.9 million in February 2020, according to data platform VentureCap Insights.

More recently, on Tuesday, Carsome disclosed that it is pursuing a US$200 million privatisation of ASX-listed iCar Asia, in collaboration with Catcha Group. The latter is an investment company led by the co-founders of iCar Asia, Patrick Grove and Luke Elliott.

The deal value of US$200 million is about 19 times iCar Asia's FY2020 topline of A$14.1 million (S$14.3 million). The car listings network posted a A$10.7 million net loss that year.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

"Even factoring in the growth prospects of South-east Asia, the deal valuation definitely sounds rich," said Hwee Ang, founder and principal consultant of Anagram Advisors, which works with private market investors.

Carsome also said that it has hit unicorn status, but declined to share specifics on the exact funding, when queried by BT. VentureCap had put the Malaysian startup's valuation at US$250 million last year.

The buzz around these startups is driven by the unrealised potential of South-east Asia's used car industry, said Yorlin Ng, chief operating officer of Momentum Works. The venture builder estimates that six million used cars were sold in the region in 2019, with a total value of US$55 billion. "We believe the number will be higher in 2020 with people selling their cars, and buying fewer new cars. Trust, pricing standard and data were missing before transactional platforms Carsome and Carro went in. There is significant value these platforms can build and capture," said Ms Ng.

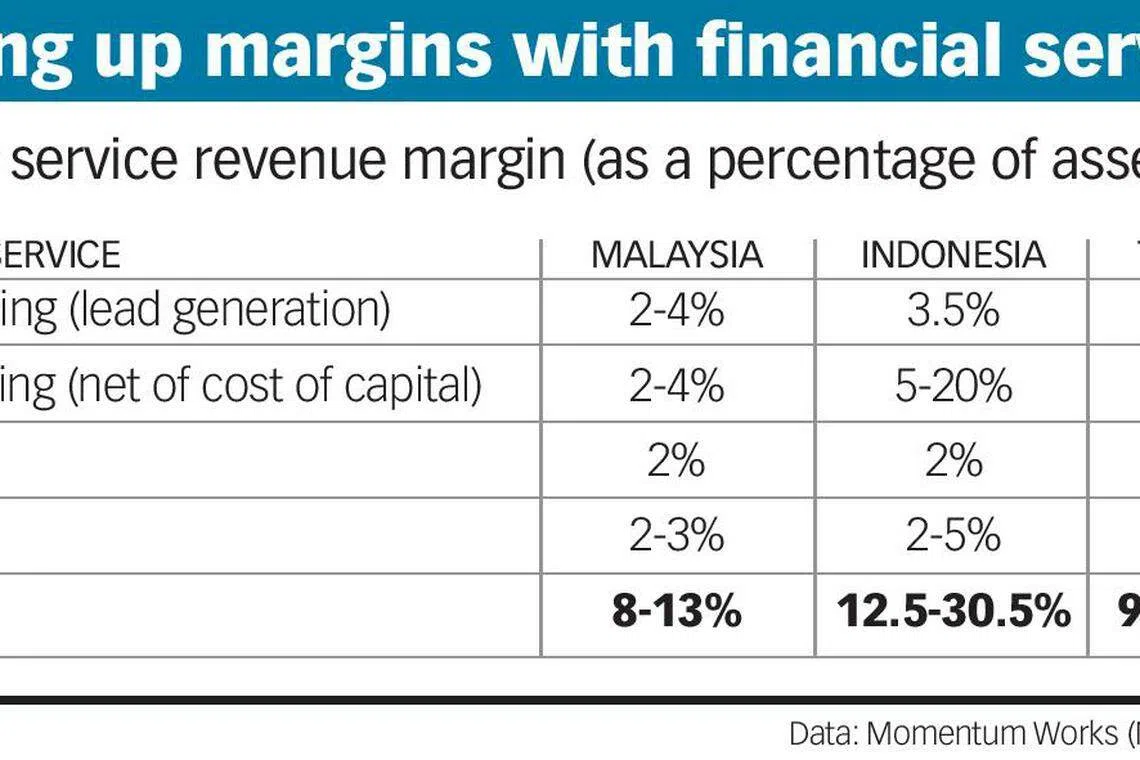

With transactional data, these platforms can expand their financial services rather than just taking a cut of online transactions. Margins can be as high as 20 per cent for B2B financing in Indonesia, according to estimates by Momentum Works (see table).

Providing financial services is a key piece of the puzzle, agreed Ms Ang. "I do think what will happen is a very few key players will eventually emerge from this competition... The biggest winner of them all will be the player who can extend its business into adjacencies such as financing, so as to upgrade the business model from an inherently low-margin business."

Patrick Stokvis, vice-president at research firm Third Bridge, similarly thinks that financing "is an opportunity to perfect the online transaction model", adding: "It's going beyond just having the portal that will allow these businesses to become profitable over time."

Carsome's latest financials are not available, but according to VentureCap, its Malaysian entity posted a US$206.8 million topline in 2019, with about US$195 million in cost of sales. Its loss stood at US$14.3 million.

Carro was also in the red in most-recently available data. According to a regulatory filing of Trusty Cars Pte Ltd, Carro's legal entity, it posted revenue of S$117.8 million, and a S$5.2 million net loss for FY2020.

In any case, this isn't a straight-up battle between Carro and Carsome, given that there are other players like sgCarMart.

Mr Stokvis reckons that another interesting contender is the "horizontal marketplace" Carousell. In April, it launched the Carousell Auto Group, with operations spanning Malaysia, Vietnam, the Philippines, Hong Kong and Singapore.

Carousell had then said that it plans to invest "aggressively" in the automobile space, which it cited as its largest vertical, contributing a third of revenue.

It will be interesting to watch whether Carousell is able to reap "network effects" from its broader classifieds business to do well in used car sales, or if vertical players like Carro and Carsome have an edge, Mr Stokvis said.

Another issue to watch is whether the spike in online used car purchases will continue after the pandemic, said Tuck Siong Chung, associate professor of marketing at ESSEC Business School Asia-Pacific,

"Generally, what we see from other product categories is that even after lockdowns have lifted, consumers continue to buy online as the behaviour has become a habit. Thus, there should be an increase in online used car purchases even after the pandemic," he reckoned.

Carro investor Tan Yinglan of Insignia Ventures Partners is hopeful. "The industry still faces challenges due to the lockdowns across South-east Asia.

"Even then, with the challenges higher up the supply chain that have still persisted from last year, like factory shutdowns and the lack of chips in new cars, the used car market can expect to see good growth overall."

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.