Food, grocery delivery startups struggle with order deluge amid virus outbreak

Singapore

THE Covid-19 outbreak has sent demand for grocery and food delivery services spiking, testing the resilience of their logistics capabilities. The pressure could spur these players to strengthen their systems, but there is a risk of ending up with excess capacity once the outbreak is over, say industry watchers.

In the latest sign of logistical strain, RedMart on Thursday announced a two-day suspension for new orders. The firm is changing its product assortment and updating its system, to ensure that delivery slots remain available.

RedMart also told The Business Times it has been ramping up its fulfilment abilities. "One of the ways that we are coping with the surge in demand is to increase our delivery capacity, (in terms of) vehicles and drivers," a company spokesperson said, but did not reveal figures.

Other players in the food and grocery delivery ecosystem told BT that they are similarly experiencing a demand surge and making sure that their logistics can keep up.

One key aspect is in maintaining a sturdy pool of last-mile delivery persons. foodpanda and Deliveroo both told BT that their rider pools, which now stand at 8,000 and 6,000 respectively, are sufficient for meeting any surge in demand. foodpanda does both food and grocery delivery, while Deliveroo focuses on food.

A NEWSLETTER FOR YOU

Garage

The hottest news on all things startup and tech to kickstart your week.

Data analytics is also core to ensuring efficient deployment, the players said. GrabFood, the food delivery unit of super-app Grab, said it has introduced technology to optimise food orders batching, so that riders fulfill more orders within a given hour.

Similarly, foodpanda is relying on its self-learning dispatch algorithm that can account for surges in demand to plan rider deployment.

The emphasis on logistics comes as demand for grocery and food delivery spikes measurably. RedMart said its weekly average order volume tripled from the "panic buying" in the week after Singapore raised its Dorscon alert level to orange, with further bursts at key escalation points of the outbreak.

Both GrabFood and Deliveroo said their food orders have increased by about 20 per cent over the past few weeks. foodpanda similarly said that it has seen "week-on-week" increases in demand for food and grocery delivery, but declined to share specific figures.

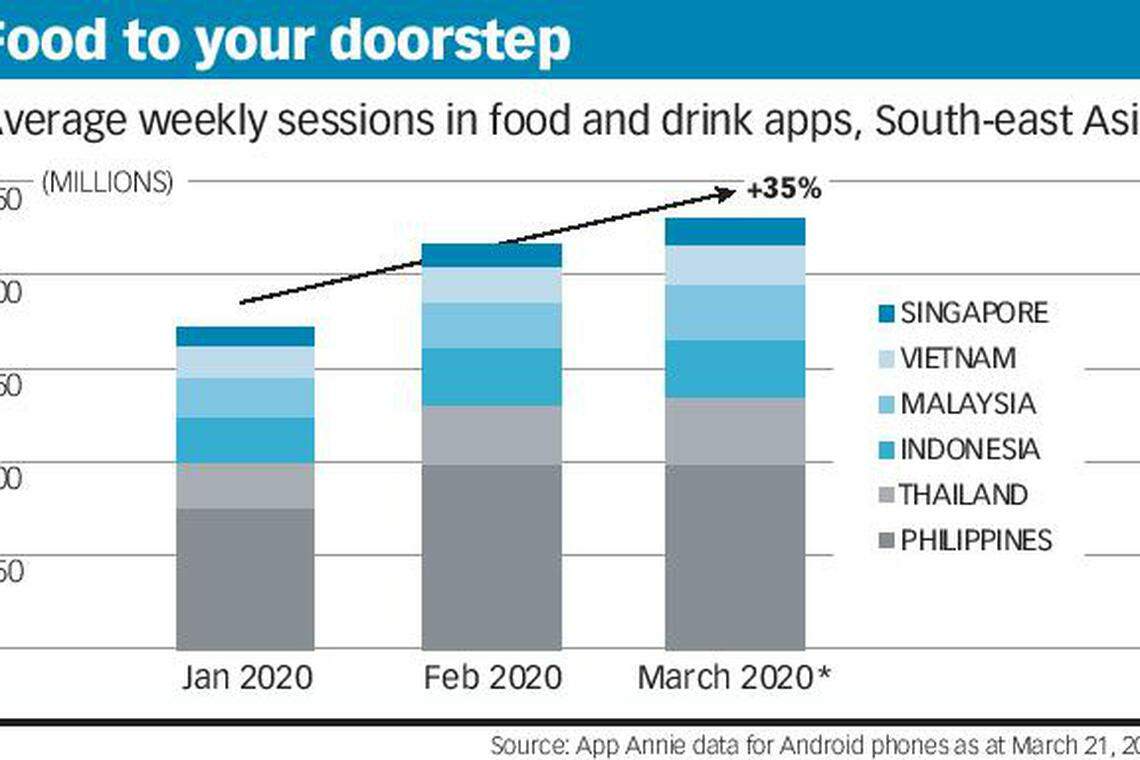

App metrics also reveal a surge in demand. In Singapore, the average weekly user sessions in Android apps under the food and drink category - which apps such as foodpanda and Deliveroo fall under - rose 37 per cent from January to March, said app analytics firm App Annie. (Such usage metrics, which were captured as at March 21, are only available for Android phones.)

This trend is also playing out across South-east Asia, where average weekly sessions in food and drink apps grew 35 per cent from January to March.

If grocery and food delivery startups manage to rise to the logistics challenge and meet demand, a sales windfall awaits.

Unlike their traditional peers, many of these players are uniquely positioned to scale in last-mile logistics, said Shiv Choudhury, a managing director and partner at Boston Consulting Group.

Those that use gig labour are especially at an advantage.

"Having an on-demand workforce gives them an ability to scale rapidly at almost a fraction of the cost of the physical retailers, and use temporary boosts like surge fees and incentives," he said.

But the size of Singapore's gig labour pool also becomes a limiting factor.

Players who tap purely on freelance riders face increased competition for a limited labour pool, which could result in a "bidding war for rider capacity", said Ali Potia, a partner at McKinsey and Co.

This may force a rethink of pure reliance on the gig workforce, he reckons. The food delivery players, in particular, could start to employ some full-time riders to hedge against the volatility of the gig workforce.

"The crisis is an opportunity for (them) to lock in riders much more tightly, as opposed to (having) freelance contractors that have seven different apps on their phone randomly taking jobs," Mr Potia said.

The government has taken some steps to try to augment last-mile manpower, but it is unclear if this could move the needle much.

On Sunday, Transport Minister Khaw Boon Wan announced that taxi and private-hire car drivers can do food and grocery delivery up to end-June. Even before this, some Grab drivers have been taking up food and parcel delivery jobs under a pilot programme.

But challenges remain, as cars are still ill-suited for on-demand delivery, and incur relatively higher costs compared to motorcycles or bicycles.

Deliveroo told BT that it is developing a rider fleet of motorbikes, bicycles, e-bicycles and on-foot delivery persons, with no current plans to take on car drivers.

Then there are supply risks. For instance, the shuttering of restaurants amid the economic downturn could squeeze the pool of vendors on these platforms, while also depressing the commissions the delivery platforms can charge.

Some startups are helping vendors stay afloat. Deliveroo, for instance, said it is guiding restaurants to transition to a delivery-only model, by providing advice on packaging and hygiene practices, as well as online marketing tools.

But there could be other strategic means to address this risk. For instance, the players could consider investing in more physical assets, such as central kitchens, instead of relying on third-party vendors, said Mr Potia.

The flipside to this, however, is that startups must be cautious not to "scale indiscriminately", bearing in mind the uncertainty over how long the outbreak will last, said Patrick Yeo, PwC Singapore's Venture Hub Leader.

Once the crisis is over, firms might face having excess capacity.

If grocery and food delivery players calibrate their efforts well, the Covid-19 outbreak could be an unparalleled opportunity to invest in resilient logistics systems.

The silver lining is that "customer acquisition costs are now very low", said Mr Potia, as consumers no longer need much incentive to try out delivery services.

Ultimately, the pandemic could also be a test of which players "have the most staying power", said Howard Yu, a professor of management and innovation at IMD Business School.

For now, there is enough demand to test out a variety of models.

"One can imagine the situation will trigger the consolidation of the industry where the larger startups, who are able to pivot correctly based on data analytics will gain a bigger market share, he said.

"Which, in turn, will discourage investors from providing additional funding to the newer, less established ones."

READ MORE: Red hot demand forces RedMart to suspend new orders, Specialty Stores marketplace

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Startups

Gojek and ComfortDelGro Taxi to send untaken rides to each other’s platforms

SG fintech firm Bambu shuts down after missing profit targets, says founder

Telemedicine platforms evolve beyond virtual consultations

Funding concentration seen in emerging tech startups: SGInnovate report

Decarbonisation startup Accacia raises US$6.5 million

A cheat sheet of startup and tech M&As in South-east Asia