'On-demand salary' apps gain pace in South-east Asia, but questions loom

Such apps have drawn investors, but opinion is divided on their benefits to low-wage workers.

Sharanya Pillai

WANTING a salary advance often requires an awkward conversation with the boss, and if this fails, could push cash-strapped workers to take up payday loans or incur overdraft fees.

A new crop of South-east Asian fintechs say they have an alternative: apps that allow workers to track their earnings on a day-to-day basis and withdraw a portion on-demand, before payday. Workers pay a fee for this, unless their employers absorb it.

Mitchell Goh, co-founder of one such local startup called GetPaid, believes that the monthly pay cycle is ripe for disruption.

“In a climate where we’ve got on-demand TV and on-demand food, why do we not have on-demand pay, particularly when a big segment of the workforce could be living paycheck to paycheck and cash flow is a huge problem?” he said.

This on-demand salary service, also known as earned wage access (EWA), is popular in the US and Europe. But opinion on it is split. Some see EWA as a useful resource, without the exploitative interest rates of payday lenders. But others worry that unscrupulous players could still charge steep fees and spur over-reliance on the apps.

This debate is growing as EWA adoption rises globally. The service has been around for a decade, but usage boomed after 2017, when retail giant Walmart partnered fintechs PayActiv and Even to offer on-demand wages as a perk to 1.4 million workers.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

In the past 2 years, several new South-east Asian startups have popped up seeking to introduce EWA for the region, such as Singapore-based GetPaid, Indonesia’s Wagely and GajiGesa, Malaysia’s HariGaji and Gimo in Vietnam.

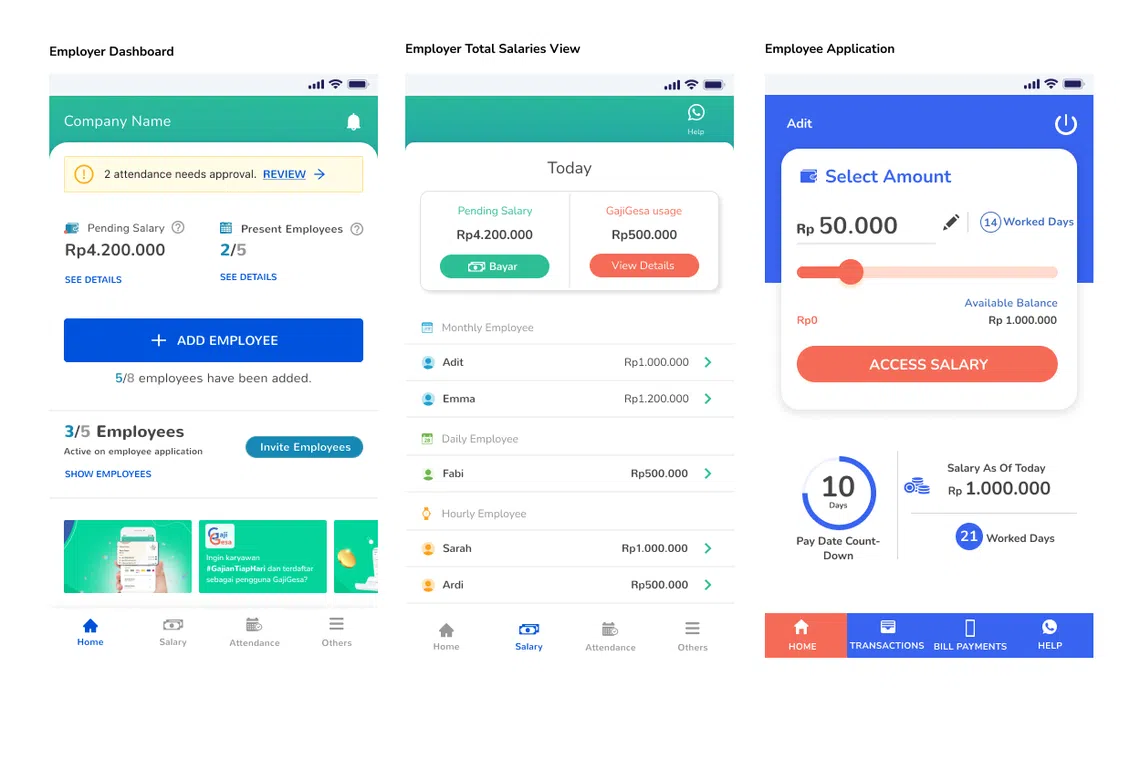

EWA business models vary widely, but a common structure in South-east Asia is for startups to work with employers to offer workers the app as a HR service, rather than targeting workers directly.

These startups usually tap financing companies for the upfront capital that funds early withdrawal requests from workers – but in some cases, employers themselves are willing to provide this capital.

EWA startups charge fees to either the workers or the employers, on a per transaction or membership basis. At the end of the cycle, the employer pays back the withdrawn sums – a model that bears some similarities to payroll financing. There may be limits set on how much workers can withdraw in advance.

Early buzz

EWA is still nascent in South-east Asia, but investors are showing interest. Wagely, which operates in Indonesia and Bangladesh, raised US$14 million from investors including Indonesia’s East Ventures and the Asian Development Bank in the past 2 years.

Similarly, Indonesia-focused GajiGesa raised US$6.6 million in a round led by MassMutual Ventures and joined by UK-based EWA giant Wagestream. The 2-year-old startup was founded by husband-and-wife team Vidit Agrawal and Martyna Malinowska, both former fintech executives interested in bridging credit access.

“In our internal research, we’ve seen that (among) employees making less than S$1,000 per month, over 30 per cent of them were taking money from loansharks or predatory lenders,” Agrawal said. GajiGesa serves workers in sectors such as healthcare, retail and hospitality.

The startup customises its fee structure for each company, some of whom offer their workers EWA as a free benefit. In cases where employees bear the cost, a withdrawal of S$10 to S$15 would generally incur between S$0.20 to S$0.30 in fees, Agrawal said. The average withdrawal is S$25 and fees charged to employees typically do not exceed S$1 per transaction.

Over in Malaysia, HariGaji co-founder and chief executive Annamalai Thani similarly sees demand for EWA, particularly as an employee retention tool.

His startup charges either workers or employers a monthly fixed fee – for instance, paying 10 to 15 ringgit per month provides workers unlimited access to earned wages. But the total sum that can be withdrawn is capped at 50 per cent of the salary, under Malaysian law.

As HariGaji grew during the pandemic, it was sometimes mistaken as a payroll financing company, which advances employers the full sum of the payroll to ease business cash flow.

“A lot of companies would come to us and say, ‘You want to pay my salaries? No problem, happy to take your money and I’ll pay you back next month’,” Thani said.

“We didn’t want to serve them because… we’re a service for the staff to withdraw their salaries on-demand for only a certain portion, and alongside that, help companies recruit – very much HR fintech, rather than purely lending to companies.”

While many of the region’s EWA players focus on emerging markets, Goh of GetPaid also sees demand from a developed market like Singapore. His startup mainly serves workers who earn less than the S$30,000 annual income required for credit cards, and need short-term liquidity for big expenses.

GetPaid charges a 3 per cent transaction fee for salary withdrawals in Singapore, unless the employer absorbs the cost. Early withdrawals are capped at 80 per cent of gross salaries to account for deductions to the Central Provident Fund, the country's mandatory social security savings scheme.

Goh declined to reveal the fee charged in Indonesia, where GetPaid expanded last November and faces stiff competition.

“The space is very hot. Competition is actually a really good thing because we all can shout the same stuff and there’s less (customer) education required. Some of the companies that we’ve approached already know what it is and who the big players are; that makes it a lot easier,” he said.

There could be foreign players coming into the region too, such as Ceridian, a US-based HR tech company that also offers an EWA app, Dayforce Wallet. Singapore is “high on the list” of potential markets for international expansion in coming years, said Seth Ross, general manager of Dayforce Wallet and consumer services.

Regulatory need

While players are upbeat, questions loom on how EWA will be regulated. Industry standards will be key to ensure that workers are not charged exorbitant fees or become over-reliant on such apps. Investors are paying attention to the possibilities.

“These products exist because there is a genuine need… But it is a very delicate dance with not overburdening people in the guise of helping,” said Madhu Shalini Iyer, a partner at venture firm Rocketship.vc.

Iyer is bullish on EWA taking off in South-east Asia, pointing to the lack of credit access in the region’s emerging markets. But she also notes that startups must not begin to look like payday lending.

EWA startups also realise that they cannot just be all about on-demand cash. Some are expanding into more value-added services for both workers and employers, such as financial literacy programmes, payroll processing and employee management tools.

GajiGesa, for instance, positions itself as a broader employee wellness platform. “We started with vanilla EWA, (but now) we have a whole vertical around e-wallet (transfers)... and education on the product. The idea is to go horizontal and add more features,” Agrawal said.

As debate grows in the West over the regulation of EWA, the startups that The Business Times spoke to welcome conversations with regulators on how the sector should be governed.

“It’s important for governments to have that engagement with EWA players, get an understanding of the cost structure and set a limit, maybe, on how much to charge,” said Thani of HariGaji. “You want to be really protecting employees who bear the cost.”

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.