April factory output beats forecasts with 6.7% growth; focus now on weaker clusters

Electronics, which has driven overall output growth, up by 48% year on year while semiconductors expands 69.1%

Singapore

SINGAPORE'S factory output in April performed better than expected, but economists are saying that it is near its peak performance. This is because the electronics cluster's expansion, which has driven much of overall output growth, is expected to slow down.

What matters now, they said, is when the weaker clusters will start catching up to stabilise economic growth.

Nomura economist Brian Tan said: "I expect it (electronics output expansion) to moderate, and it will moderate quite gradually. The problem is that if you look at the rest of the clusters, everything is negative."

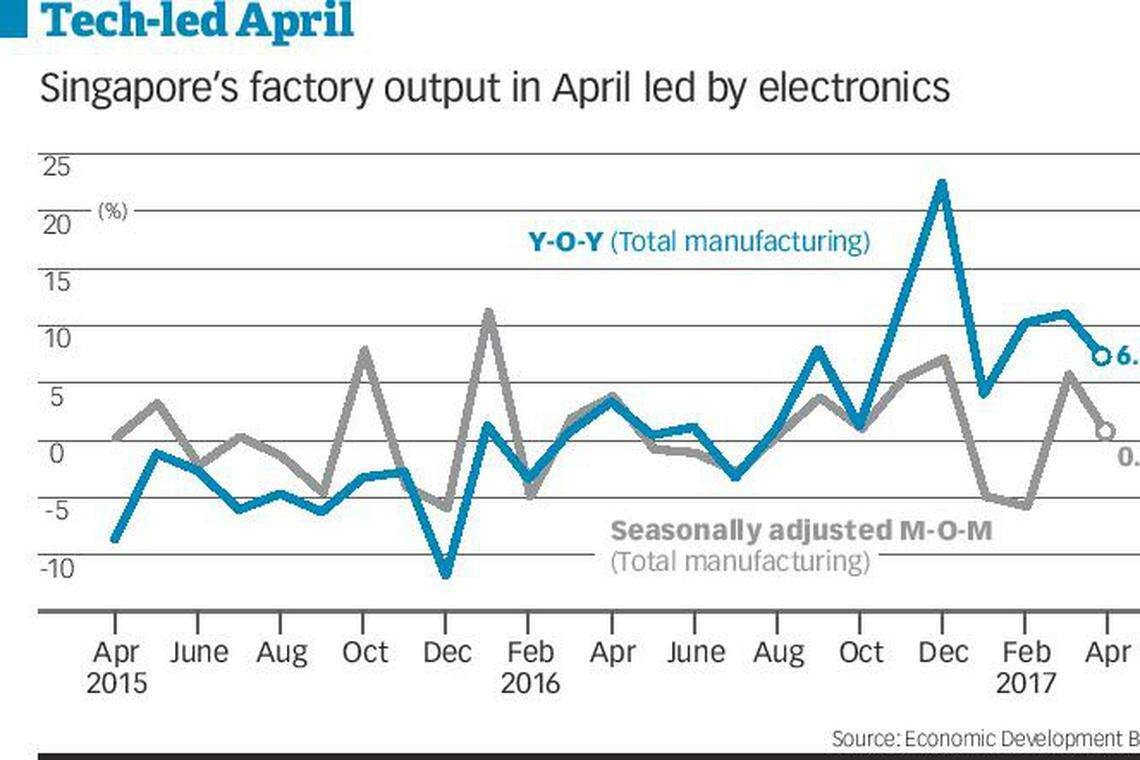

The Economic Development Board on Friday reported that total industrial output increased by 6.7 per cent year-on-year last month, beating the 6 per cent consensus estimate in a poll of economists by Bloomberg, and making it the ninth straight month of expansion. March's industrial output was revised higher to 11 per cent, from an earlier 10.2 per cent.

On a seasonally-adjusted, month-on-month basis, April's output still managed to expand by 0.1 per cent from a strong March, which grew by 5.7 per cent.

Excluding the volatile biomedical sector, output expanded by a larger 15.5 per cent year-on-year in April. On a month-on-month basis, it grew by 5.4 per cent from March.

The electronics cluster was again the star performer. Output increased by 48 per cent in April when compared to a year ago. In particular, the semiconductors segment posted a robust growth of 69.1 per cent.

The precision engineering cluster, whose performance is closely tied to the electronics one, was the only other cluster that saw its output grow. It registered a 15.7 per cent year-on-year expansion.

The volatile biomedical manufacturing cluster was the worst-performing one. Output shrank 23.3 per cent year-on-year.

Transport engineering cluster's output continue to contract, falling by 14.5 per cent on year. General manufacturing industries cluster's output fell 11 per cent, while chemicals cluster's output fell 1.8 per cent.

April's industrial production, which is closely linked to gross domestic product (GDP) growth, is the first major economic data for the second quarter.

It also comes just a day after fuller estimates of Singapore's Q1 GDP print, which showed that strong external demand for electronics had helped lift overall GDP numbers.

Calling April's data as further proof of industrial production having been "firing on a single engine" all this while, ANZ economist Ng Weiwen said the tech cycle seems to be maturing, as the US electronics unfilled order-to-billings ratio has fallen, albeit moderately.

"The current buoyancy is likely to lose steam," he said.

DBS economist Irvin Seah said this tapering off in the electronics output surge is to be expected, as he expects to see tighter credit conditions and stiffer regulations on the property market in China later this year. This will weigh on consumer sentiment, and then impact Singapore's exports of electronics components.

"Hope is now pinned on companies' capital expenditure to increase and for consumer demand in the US to be sustained," he said.

CIMB economist Song Seng Wun, while acknowledging that the lift in factory output was still narrowly concentrated in electronics, sees that performances in other clusters, particularly in transport engineering, bottoming out.

Maybank Kim Eng's Chua Hak Bin was considerably more optimistic as leading indicators show that global demand for semiconductors still remains strong. "We think growth will continue to broaden from electronics and trade-related segments to other segments of services."

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Economy & Policy

Singapore’s inflation eases more than expected in March, with headline inflation at 2.5-year low

8 in 10 firms in S-E Asia, Greater China positive about business environment: UOB survey

Flexi-work request guidelines not meant to prescribe blanket outcomes for employers or influence hiring of workforce: SNEF

Daily Debrief: What Happened Today (Apr 23)

Daily Debrief: What Happened Today (Apr 24)

Daily Debrief: What Happened Today (Apr 22)