April PMI in negative territory across all segments

Analysts expect pain to persist in months ahead, as revival of US-China trade tensions adds fuel to the fire

Singapore

THE societal shutdowns adopted to contain the deadly Covid-19 are weighing on factories in the region, and Singapore has been no exception.

Analysts also expect the pain to persist in the months ahead, as a resurgence of trade tensions adds fuel to the pandemic's fire.

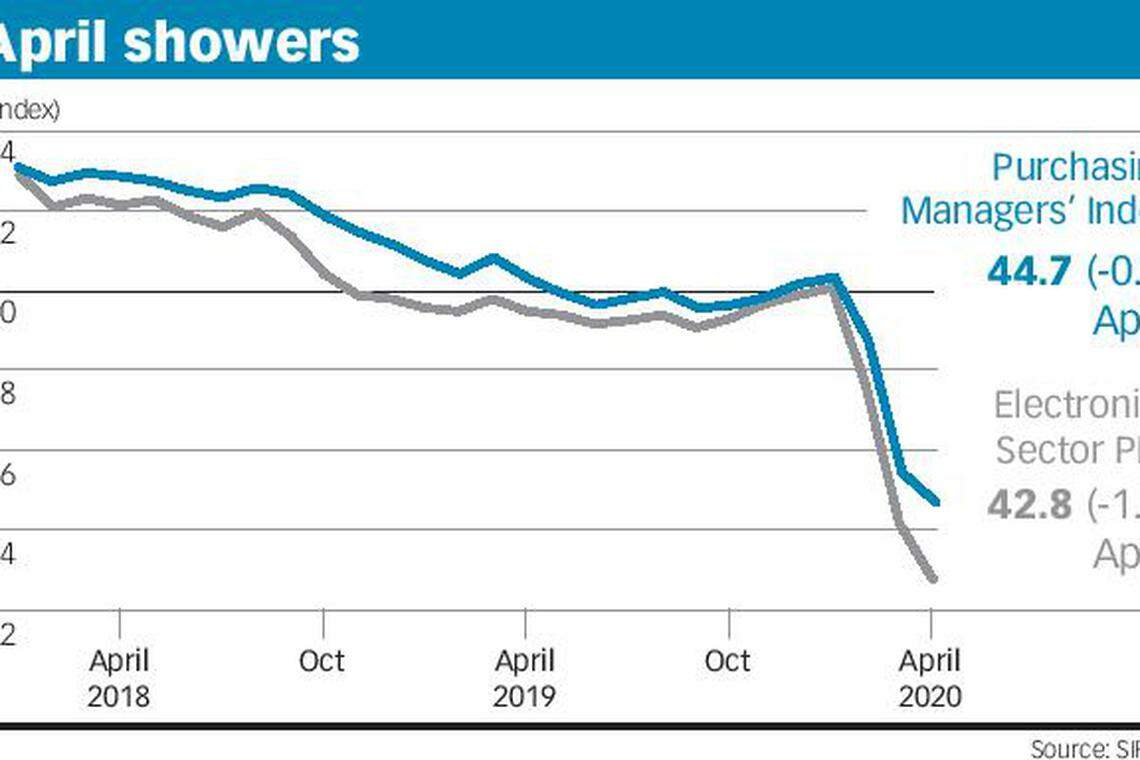

Manufacturing sentiment fell in April to its lowest since late 2008, data on Monday showed, as every segment of the Purchasing Managers' Index (PMI) stood in negative territory.

The overall PMI reading fell for the third straight month, losing 0.7 point on the month before, to 44.7 points, while the sub-index for the electronics industry shed 1.3 points to 42.8.

The Singapore Institute of Purchasing and Materials Management (SIPMM), which compiles the monthly data, fingered lower production capacity and supply-chain responsiveness, as well as order cancellations. Singapore's two-month virus-battling "circuit breaker" began in early April.

A NEWSLETTER FOR YOU

SGSME

Get updates on Singapore's SME community, along with profiles, news and tips.

But the Republic was far from alone in its misery. PMI readings in other manufacturing markets, such as Malaysia, Vietnam, South Korea and Japan, also came in lower in April. Prints turned negative in both Taiwan and mainland China, according to the private Caixin PMI survey.

"This suggests the resilience in March PMI may have reflected precautionary stocking amid fear of supply-chain disruption," Barclays Bank analysts said in a Monday note on Asia's emerging market (EM) PMI readings.

As for Singapore, the manufacturing contraction in April was broad-based, with inventory, employment, finished goods, input prices and order backlog among the key readings in the red. Electronics factory output, which dipped from 40.9 to 38.3 points, is now at its lowest recorded.

The PMI was launched here in January 1999, and readings below 50 indicate industry shrinkage, while those above 50 point to growth.

OCBC Bank chief economist Selena Ling added that lower input prices and employment gauges "suggest caution is needed for the near-term outlook and also herald impending softness for the domestic labour market".

A local slump on the manpower front fits right in with the gloomy prognosis for the rest of the region, where the Barclays research team said "knock-on effect on the underlying labour market is just starting".

That's although Ms Ling dubbed the PMI declines in Singapore "more muted" than plunges in other markets, such as Malaysia, where the reading fell to 31.3 from 48.4 before, or Vietnam, which fell to 32.7 from 41.9.

She also warned of risks from the return of trade tensions between the United States and China, which are rising amid the pandemic. The virus emerged late last year in the Chinese city of Wuhan, but the US has rapidly become the world's worst-hit nation.

Said United Overseas Bank economist Barnabas Gan: "The prognosis for Singapore's industrial production remains dim at this juncture. . . It is highly likely that Singapore's industrial production may contract into the second and third quarter of this year.

"Moreover, Singapore is highly reliant on trade, and further trade headwinds as seen in April's PMI report may portend further softness in export growth over the same period."

Indeed, the Barclays team was cautious about how "the longer-than-expected shock and its knock-on effect could weaken external demand further, even if the disease is brought under control", including in end-markets in Europe and North America.

An Economic Development Board poll recently found that 60 per cent of Singapore manufacturers expect business conditions to worsen in the next six months, amid softer external demand and supply chain disruptions.

With SIPMM vice-president Sophia Poh noting that "the supply chain operating environment has also weakened considerably", Ms Ling added that watchers will want to keep an eye on whether the PMI readings bottom out or keep sinking, given an extended circuit breaker in May.

KEYWORDS IN THIS ARTICLE

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Economy & Policy

Global wave of consultancy layoffs has not hit Singapore

Daily Debrief: What Happened Today (Apr 19)

An economy transformed: Lee Hsien Loong’s 20 years as Singapore’s Prime Minister

Daily Debrief: What Happened Today (Apr 18)

Singapore’s first RoboCluster launched for facilities management, to turn R&D into market solutions

Daily Debrief: What Happened Today (Apr 17)