BT Explains: The 3 ways that MAS might change exchange rate policy

In a surprise off-cycle move, the Monetary Authority of Singapore (MAS) tightened monetary policy on Tuesday (Jan 25) by raising the rate of appreciation of the Singapore dollar nominal effective exchange rate (S$NEER) slightly, while keeping its width and level unchanged.

Private-sector economists expect further tightening in April, with some having already believed that MAS would both recentre and steepen the policy band then.

While most central banks in other countries use interest rates as a monetary policy tool, MAS makes adjustments to the policy band of the exchange rate - the S$NEER - to ensure prices of goods and services remain stable. BT explains the 3 different exchange rate policy levers that MAS has.

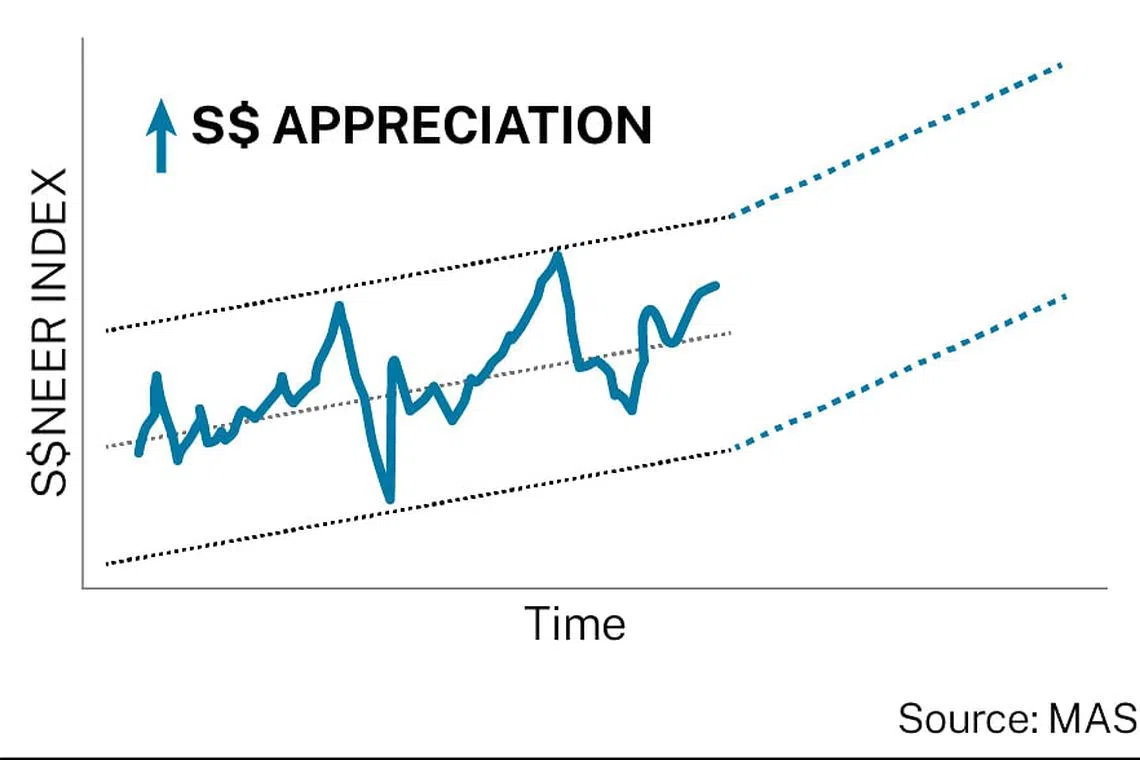

Steepening the slope

What this means: The slope of the band controls how quickly MAS allows the Singdollar to appreciate against a basket of currencies. If MAS steepens the band's slope, it is allowing the Singdollar to appreciate faster. Conversely, a flattening of the slope would cause the Singdollar to appreciate at a slower pace.

When might MAS do this: MAS has said that it changes the slope of the policy band when it "assesses that the trajectory of economic activity over the medium-term policy horizon is changing gradually".

For instance, if strong growth and inflationary pressures are expected, MAS may move to steepen the slope as a stronger Singdollar will make imports relatively cheaper. As a result, consumers would be protected against a sharp spike in the prices of goods and services.

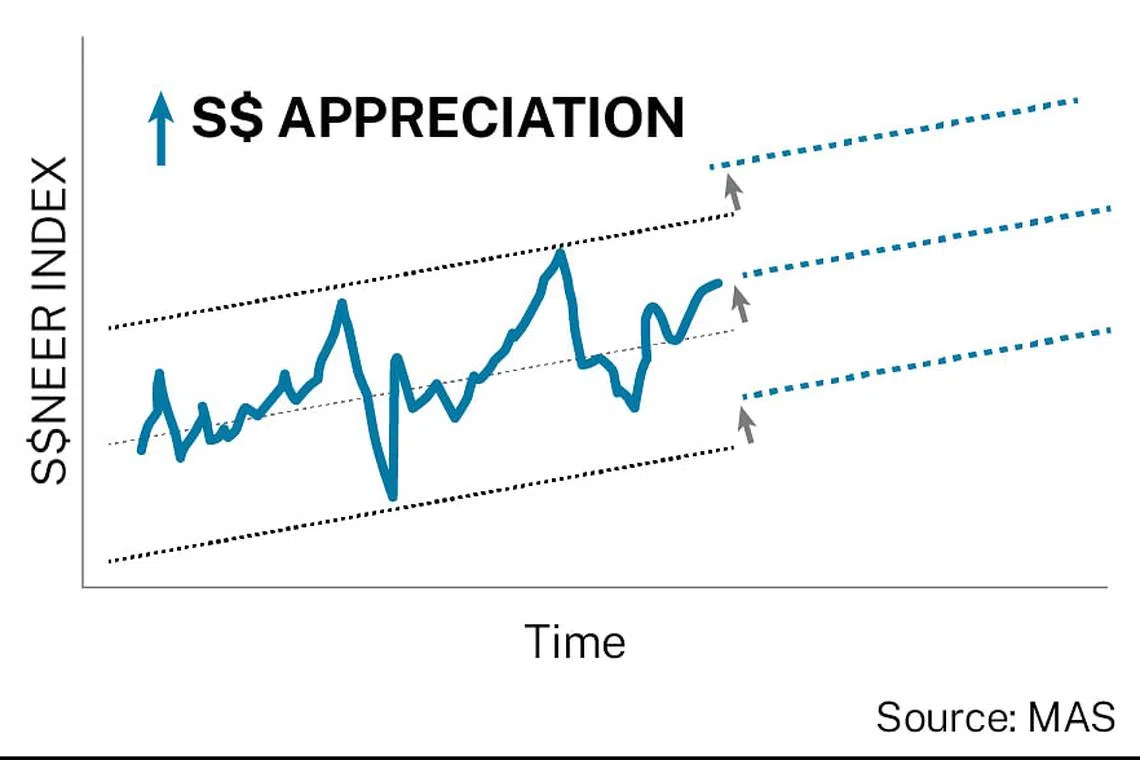

Recentring the band

What this means: Recentring refers to when MAS shifts the entire policy band upwards or downwards. It indicates a more significant adjustment in monetary policy.

When might MAS do this: MAS said such a move would be necessary if the outlook for growth and inflation for the country changes abruptly and rapidly, and therefore fundamentally changes the outlook of the economy. A recentring of the band can take place following, or together with, a change in the slope of the policy band.

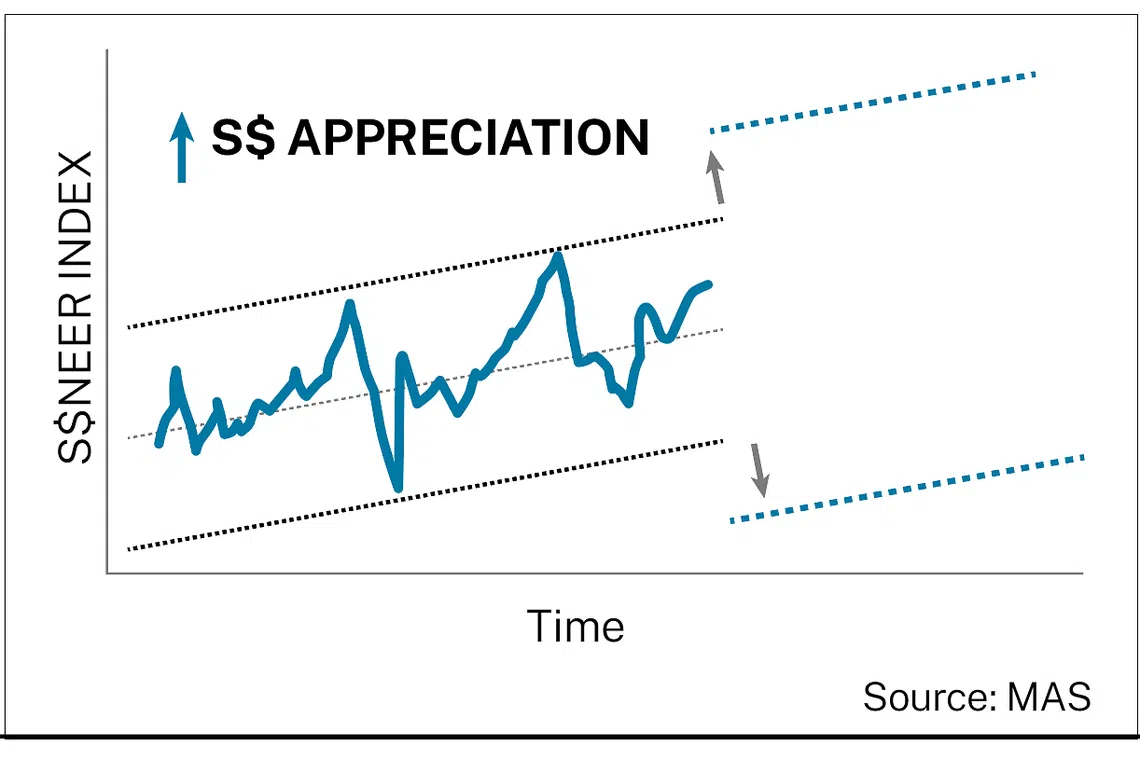

Widening the band

What this means: The width of the band controls the space within which the Singdollar is allowed to appreciate or depreciate.

That means that if the band is widened, the Singdollar is allowed to fluctuate within a bigger range than it normally can. As MAS puts it, "a wider policy band allows more room for market-determined movements in the S$NEER".

When might MAS do this: MAS said it moves to widen the policy band when there is significant increase in the level of uncertainty about the future path of the economy and inflation, and it expects this uncertainty to persist. After the Sep 11 terrorist attacks in the United States in 2001, for instance, the band was widened to accommodate such uncertainty. READ MORE

- Looking back at inflation in 2021

- MAS off-cycle move does not rule out further tightening in April, GST hike soon: economists

- Economists expect 'double tightening' of monetary policy after headline inflation surprises at 4% in Dec

- MAS to 'raise slightly' rate of appreciation of policy band

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.