Business sentiment in Singapore improves in Q1

Singapore

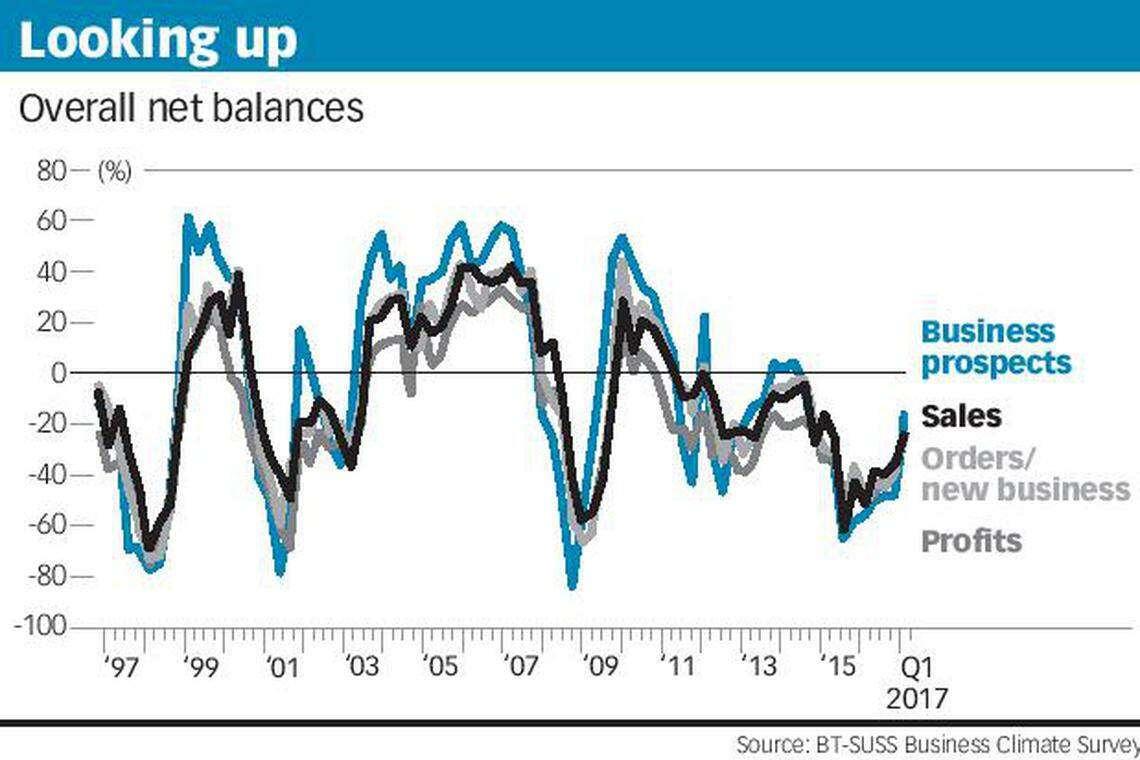

BUSINESS sentiment in Singapore improved in the first quarter of 2017, on the back of better sales, profits and orders, while pessimism over business prospects in the next six months has diminished substantially, said the latest Business Times-Singapore University of Social Sciences (SUSS) Business Climate Survey.

The survey paints a picture consistent with official surveys and predicts that GDP could accelerate further in the second quarter of 2017.

Of the 178 firms polled in March and April this year, 24 per cent expect business prospects to be better over the next six months, up from 15 per cent in the previous quarter's survey. Meanwhile, the proportion of firms expecting business conditions to worsen fell to 36 per cent, from 45 per cent a quarter earlier.

The business prospects net balance - a weighted diffusion index that takes the difference between the proportion of positive and negative firms - surged 33 points to -15 per cent, with all net balances showing business prospects to be far better than a year ago.

This is consistent with the results of the latest official business expectations surveys, which are looking up.

A net weighted balance of 7 per cent of manufacturers expect business conditions to improve from April to September 2017, led by the electronics and precision engineering clusters, based on data from the Economic Development Board.

A net weighted balance of one per cent of firms in the services sector expect less favourable business conditions for the April to September 2017 period, said Department of Statistics Singapore.

Business activity in Q1 2017 strengthened almost across all types of firms, with widespread improvements in all four indicators, the BT-SUSS survey showed.

The sales net balance jumped 12 points to -23 per cent in Q1, with 3 per cent more companies reporting a greater than 25 per cent rise in sales compared to the previous quarter.

Sales contraction has diminished further in Q1 2017, except among small firms for which there was negligible change. About 23 per cent of companies reported up to 25 per cent lower sales, down from 35 per cent in the previous quarter. All sales net balances also showed improvements compared to a year ago.

The measure for orders of new business activity rose 15 points to -24 per cent in Q1. About 18 per cent of firms indicated better orders or new business, up 6 per cent from the previous quarter.

The degree of contraction was less severe, with fewer firms suffering much lower orders or new business. All net balances also improved from a year ago.

Profits net balance climbed seven points to -28 per cent in Q1. About 8 per cent fewer firms than previously were hit by over 10 per cent lower profits. All profit net balances were better than that a year ago.

The survey also showed that business conditions in both overseas and domestic markets improved in Q1, except for the overseas sales of small firms.

Improvement in overseas performance was stronger than in Singapore almost across the board, as reflected in high double-digit positive changes in the net balances. Hence, the better business performance in Q1 2017 was contributed by overseas activities to a large extent, said the survey, whose consultants are Chow Kit Boey and Chan Cheong Chiam.

"The latest business prospects net balance signal stronger economic growth in Q2 2017. If the upward trend in the net balance continues in the next quarter, there will be high probability of firms turning optimistic over business prospects in the second half of 2017," the survey said.

Other findings showed Singapore as the most-cited country whose economic performance will have the greatest impact on company sales in 2017, followed by China and Indonesia. Meanwhile, the manufacturing sector retained its status as the star performer in Q1 2017 for the fourth consecutive quarter by capturing 12 of the 20 top positions.

The net balances indicators, lagged a quarter, have tracked GDP growth closely over the survey's 22-year history.

A regression analysis of the indicators predicts Q2 growth of 3.1-3.3 per cent year-on-year, much better than the Bloomberg consensus forecast of 2.5 per cent for Q2. This is based on the official advance estimate for Q1 GDP of 2.5 per cent.

But economists are expecting the Ministry of Trade and Industry to revise this upwards when it releases final GDP figures in the next couple of weeks as manufacturing output continues to impress.

Maybank Kim Eng economist Chua Hak Bin said: "The optimistic projections are consistent with our views. We think the trade recovery seen since late last year has momentum. There are also visible signs that growth has broadened to services segments, including business, financial and wholesale trade services."

ANZ economist Ng Weiwen said there is a non-zero probability of growth of around 3 per cent in Q2.

"Despite the elevated risk of protectionism, it is worth noting that most of the major global trade agreements still remain intact and it is a boon for externally-oriented Singapore, which is the Asean economy most leveraged to global trade cycles."

But some economists said that the current upswing may not be sustainable throughout the year.

The exceptionally high growth profile is not Mr Ng's base case, as the bullish soft survey data might not be matched by hard economic activity data, he said.

"Specifically, China is reverting to its old but unsustainable investment-led growth model whereas the 'tech cycle' seems to be maturing."

Mizuho Bank economist Vishnu Varathan feels there are reasons to be conservative as some of the cyclical upswings are transitory and boosts in sentiment appear to overstate real economic effect. Policy shifts also suggest growth recovery will be gradual on a trend basis and susceptible to fluctuations in real-time and near-term horizon, he said.

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

International

China’s central bank hints it may add treasury bond trades to policy toolkit

US business activity cools in April; inflation measures mixed

India’s inflation at risk from extreme weather, geopolitical issues: central bank

Thailand to replace military-appointed Senate, reduce its powers

Bankers lose hope of London IPO revival for another year

Decarbonisation schemes are generating hot air