Credit searches by Singapore firms on overseas companies up 3% in 2017 on stronger trade outlook

THE stronger global trade outlook is reigniting Singapore companies' interest in doing business with - and conducting due diligence on - their overseas counterparts, especially in the region.

Overseas credit searches by local businesses rose by 3.04 per cent last year following a 1.16 per cent decline in 2016, according to the Singapore Commercial Credit Bureau (SCCB).

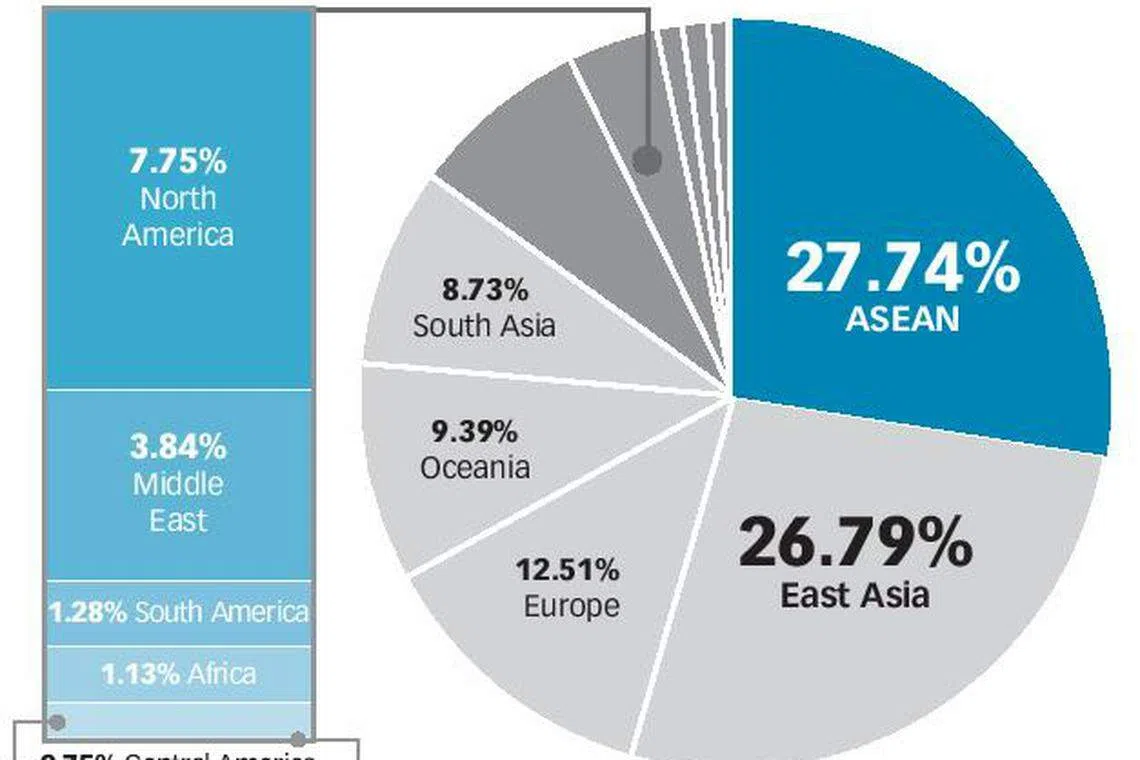

The Asean region accounted for the highest proportion of overseas credit searches by Singapore firms for the fifth consecutive year, followed by East Asia and Europe.

The proportion of credit searches made on Asean companies rose slightly from 27.17 per cent in 2016 to 27.74 per cent in 2017. Malaysia, Indonesia and Thailand registered the largest number of credit searches within Asean by Singapore firms.

The share of credit searches on East Asian companies also went up, climbing marginally from 26.70 per cent in 2016 to 26.79 per cent last year. According to SCCB, China, Hong Kong and South Korea were the most searched countries within East Asia by Singapore firms.

Credit searches on Europe declined for the second straight year, its share of searches down from 13.13 per cent in 2016 to 12.51 per cent in 2017. Britain, Italy and Germany were the most searched European countries by local firms.

Meanwhile, credit searches made by foreign companies on local firms surged 12.85 per cent last year, compared with a 1.21 per cent decline in 2016. Europe registered the highest proportion of credit searches done on Singapore companies, followed by North America and East Asia.

"The improved trade environment in 2017 has encouraged higher levels of credit vigilance among local firms over the past year. This is especially the case for the rise in overseas searches done on companies in Asean and East Asia," said SCCB chief executive Audrey Chia.

"While credit searches on European companies have declined slightly, we would expect due diligence activities to pick up in 2018 with the ratification of the bilateral trade and investment deal between Singapore and the EU in the coming months."

The SCCB also found that credit ratings, comprising financial strength and risk indicators, were unchanged for most Singapore firms last year.

However, the proportion of local firms with a deterioration in financial strength has increased approximately three times from 10.26 per cent in 2016 to 30.04 per cent in 2017. Conversely, significantly fewer firms saw improvements in financial strength, sliding from 31.19 per cent in 2016 to 10.14 per cent last year.

"The deterioration in financial strength of companies generally reflects the spillover effects of weaker business conditions seen in 2016 and 2017. Moving into 2018, we expect the fundamentals of companies to strengthen moderately," Ms Chia said.

Copyright SPH Media. All rights reserved.