EDB forecasts S$8-10b in fixed-asset investments for 2018

Singapore

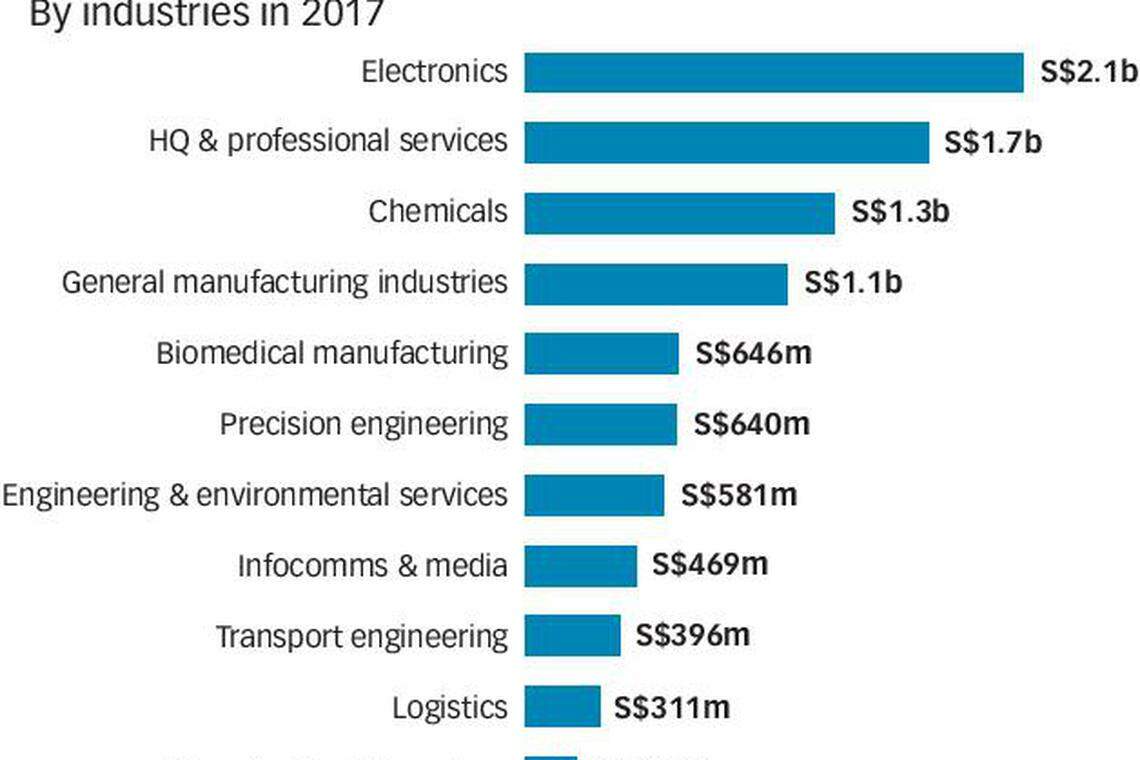

INVESTMENT commitments in Singapore held steady last year at S$9.4 billion, similar to 2016 levels and within the Economic Development Board's (EDB) forecasts.

This year, Singapore is once more expected to attract between S$8 billion and S$10 billion in fixed-asset investments (FAI), though fewer jobs are expected to be created, the EDB said at its annual year-in-review briefing on Tuesday.

While the United States remained the largest source of investment, China's share rose sharply to 9.6 per cent, from 1.1 per cent in 2016.

But EDB chairman Beh Swan Gin said year-on-year changes are affected by large projects and may not reflect underlying trends; he noted, for instance, that Chinese clean-energy firm Envision Energy made a "big investment" here last year.

"That having been said, China has been playing an increasing role as a source of investment," he added.

Last year's FAI of S$9.45 billion - comparable to S$9.39 billion in 2016 - was within the EDB's forecast of S$8 billion to S$10 billion.

The projects will create 22,500 new jobs, exceeding the forecast of 19,000 to 21,000. They are expected to contribute S$17.2 billion in value-added per annum - far above the forecast of S$12 billion to S$14 billion, and also up from the S$12.9 billion for projects committed in 2016.

But the EDB is no longer releasing forecasts for value-added per annum.

Explaining the move, Dr Beh said that figures for each project's expected value-added per annum are submitted by companies. Overall business sentiment might thus affect expectations, with lower estimates when conditions are bad and higher ones during optimistic times.

The 2017 investment figures reflect continued confidence in Singapore as a business location, said EDB managing director Chng Kai Fong.

Amid a global recovery and steady growth in Asia, the EDB's investment outlook this year is "cautiously optimistic", with one major uncertainty being the impact of United States corporate tax reforms.

Mr Chng said the EDB is watching this closely: "Our preliminary assessment is that it could be harder to attract investments that are meant to supply into the US."

As Singapore's largest investor last year, the US accounted for 38.3 per cent of investments. This was followed by Europe (28.7 per cent), with China, Japan and homegrown firms taking a 9.6 per cent share each.

For projects committed last year, total business expenditure (TBE) per annum was S$6.5 billion, within EDB's forecast of S$5 billion to S$7 billion. This refers to firms' incremental operating expenditure, including wages and rental.

TBE per annum from investments this year is similarly forecast between S$5 billion and S$7 billion.

But only 16,000 to 18,000 jobs are expected to be created.

Since 2008, inbound investments have created more than 20,000 jobs each year except in 2014 and 2015, when 18,600 and 16,800 jobs were added respectively.

The fall in new jobs reflects slower local workforce growth, as well as the kind of jobs created - higher-skilled, higher-value jobs in higher-technology industries, said Mr Chng.

As productivity rises, the trend is for fewer jobs to be created, he told The Business Times. But he added: "Even as we create fewer jobs, more Singaporeans take up these jobs and they are better-quality jobs."

Mr Chng, who became EDB's managing director in October, said the EDB's priorities this year are to develop the workforce, transform industries through technology and facilitate innovation. Advanced manufacturing and digital capabilities will be its areas of focus.

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

International

Philippines’ Recto sees rate-cut delay risk if peso sinks to 59

Ecuador president declares state of emergency over energy crisis

US Senate has agreement on Fisa reauthorisation, will vote on Friday night, Schumer says

US expects to finalise new Aukus trade exemptions in next 120 days

IMF concerned about debt, fiscal challenges facing low-income countries

Bank of Japan’s Ueda says ‘very likely’ to hike rates if inflation keeps rising