Fake MAS e-mails scammed nine individuals of over S$50,000 in total

Fiona Lam

NINE individuals have reported that they were scammed by bogus e-mails misusing the Monetary Authority of Singapore's (MAS) name and logo, into making payments totalling more than S$50,000.

Since April this year, 16 people including the nine have reported that they received such e-mails impersonating MAS, the central bank said in a statement on Friday night.

These scam e-mails may ask loan applicants to pay "validation fees" before the requested loan agreements can be endorsed and downloaded from an "MAS portal".

MAS emphasised that it does not handle any loan applications and also does not require any validation fees.

It does not collect fees of any nature from members of the public.

"Individuals are advised to be wary of e-mails that involve fund transfers to third parties," an MAS spokesperson said.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Earlier on Friday, the Singapore Police Force (SPF) also issued an advisory on bogus websites impersonating licensed moneylenders in Singapore.

Some members of the public were tricked transferring funds to the scammers after visiting the websites, and the fake MAS e-mails were used to perpetuate some of these scams.

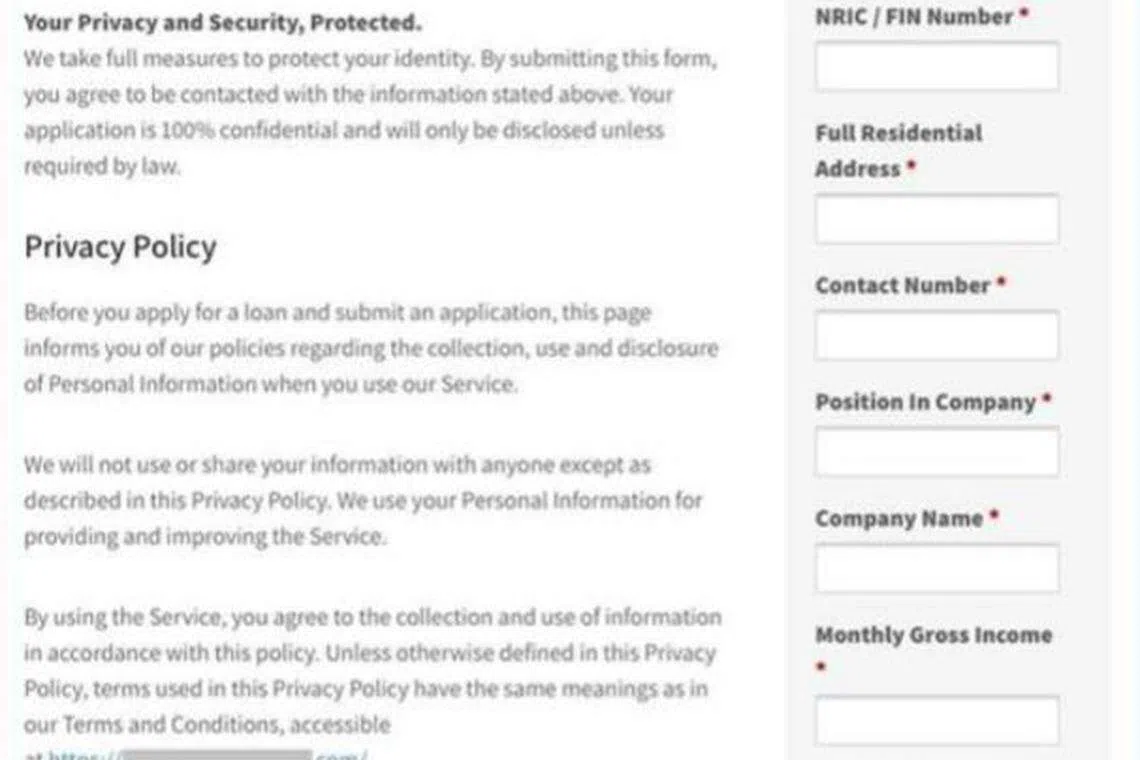

Such websites solicit victims' personal information such as their NRIC number, address and contact number, which can then be used by loansharks and scammers to harass or further scam their victims.

"Members of the public are advised to be wary when they come across websites advertising loans," SPF said.

Licensed moneylenders are not allowed to make cold calls or send unsolicited text messages to members of the public.

To see the list of licensed moneylenders, individuals should visit the MinLaw Registry of Moneylenders' website, instead of relying on online searches which might lead people to fraudulent websites, SPF noted.

It reminded members of the public not to provide personal information such as NRIC numbers, SingPass details or bank account details to strangers or unverified sources.

"A licensed moneylender must first meet you in person physically at the approved place of business before granting you a loan," SPF said. The approved places of business are published in the same list of licensed moneylenders on the MinLaw website.

Furthermore, a licensed moneylender will not ask loan applicants to make any payment before disbursing a loan. This includes the Goods and Services Tax (GST), any "admin fee", "processing fee" or any other fees, SPF said.

An administrative fee may be charged after the loan is granted, but this will usually be deducted from the loan principal that is disbursed to the borrower.

SPF on Friday said it is investigating seven persons for their suspected involvement in a case of loan scam after their bank accounts were found to have been used to receive money from a victim.

Preliminary investigations revealed that the victim made numerous payments in an attempt to get his loan application approved by the bogus moneylender.

To seek scam-related advice, call the anti-scam helpline at 1800-722-6688 or go to www.scamalert.sg.

Screengrabs of bogus websites impersonating licensed moneylenders, provided by SPF:

Copyright SPH Media. All rights reserved.