GIC posts highest 20-year annualised real return since 2015

Improved returns due to medical advancements, global vaccine rollouts and government policies that spurred broad-based growth

EVEN as economic conditions improve, GIC continues to hold a cautious macro stance amid lofty asset prices and new Covid variants, as it reported a 4.3 per cent annualised rolling 20-year real rate of return - the highest since 2015 - on Friday.

The real return for the 20-year period ended March 31, 2021 is up from 2.7 per cent a year ago. Annualised nominal return for the latest period came in at 6.8 per cent, the highest since 2012. GIC manages well over US$100 billion in assets.

At a media briefing, its chief executive officer Lim Chow Kiat attributed the improved returns to medical advancements, global vaccine rollouts and government policies that have spurred broad-based growth.

"It wasn't just equities, almost all the risk assets have done really well. Even assets that directly had the negative impact from the pandemic held up reasonably well. We had a lot of assets performing and that contributed to the good performance of the portfolio," said Mr Lim.

But he cautioned that there is still a high degree of uncertainty in global vaccination rates and their efficacy levels, as well as new variants that risk derailing recovery.

Stretched asset valuations and potential inflationary pressures further back GIC's macro-cautious stance for the medium term.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

"In the near term, economic growth is going to be quite strong, benefiting from all the stimulus, from the reopening of the economy. The challenge is that a lot of the asset prices have already reflected that," said Mr Lim.

GIC is expecting returns from a broad range of asset classes to be low for the next five to 10 years.

As it is, investment markets are currently pricing in expectations of a strong economic recovery, which leaves them vulnerable to alternative scenarios. Credit spreads are at historically tight levels, implying low compensation for taking on default risk.

GIC group chief investment officer Jeffrey Jaensubhakij noted that near-term recovery will be accompanied by some supply constraints which could boost inflation - as now seen in some commodities and wage rates in the US - and pressure central banks to raise interest rates.

Consequently, rising bond yields and eroding values pose another risk to the portfolio, he said.

In this scenario, governments in economies that rely on external funding or lack institutional credibility may need to hike taxes or cut spending to cover budget shortfalls.

This is particularly concerning, given the sharp rise in global government debt which reached 87 per cent of global gross domestic product by end-2020.

"That risk of higher bond yields for already-elevated equity and risk asset valuations is a facet of the medium term that will imply probably low and rather volatile returns," said Dr Jaensubhakij.

Against this backdrop, GIC looks to double down on "niche" opportunities in the "micro" environment.

"We are seeing significant (micro-positive) opportunities, especially around long-term trends of technology transformation, sustainability, and in the way which we are looking at private market assets," said Dr Jaensubhakij.

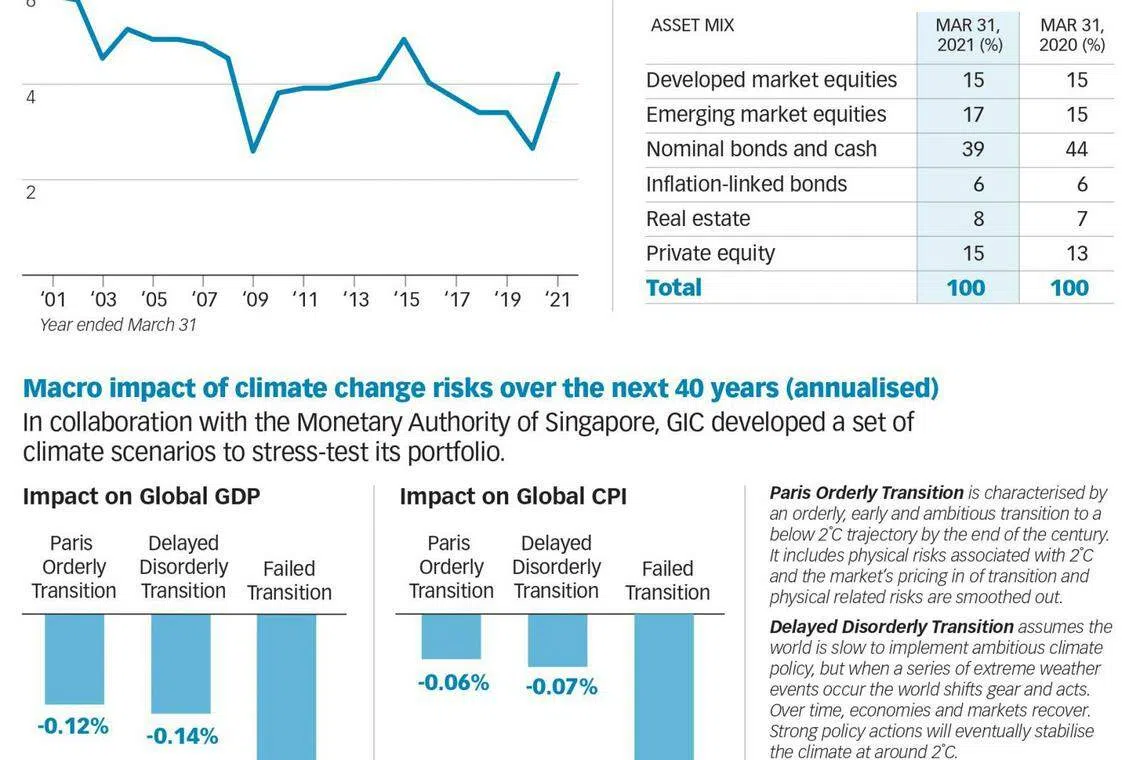

GIC's asset allocation as at end-March 2021 showed that cash and bonds allocation was cut to 39 per cent, from 44 per cent a year ago.

Private equity allocation rose to 15 per cent from 13 per cent a year ago, while allocation to real estate stood at 8 per cent, up from 7 per cent.

GIC has grown its private market teams by about 10 to 20 per cent over the years, with now close to 400 investment professionals across ten offices. It plans to open an office in Sydney next year to capture more real estate opportunities there.

"We are concentrating hard on these micro opportunities because even if the broad range of assets are not likely to do that well, there will still be smaller niche pieces that have very good opportunities," said Dr Jaensubhakij.

Meanwhile, portfolio allocation to emerging-market equities rose to 17 per cent, from 15 per cent a year ago, while allocation to developed-market equities remained unchanged at 15 per cent. Elevated equity valuations are notably seen in the US for now.

GIC remains bullish on Asia, with the region (excluding Japan) accounting for 26 per cent of its geographical mix as at end-March 2021, up from 20 per cent a year ago.

This change was mostly due to asset returns. To be clear, there is no top-down geographical allocation as the geographical distribution mainly reflects the global market composition and bottom-up opportunities sourced by GIC's investment teams.

Dr Jaensubhakij pointed out that there are many Asian countries with public debt fetching higher interest rates than in other regions.

"From (this) point of view, Asian debt becomes more attractive. We're not the only people who've noticed that; there's been a lot of inflow into Asian government debt, particularly Chinese debt, over the last year."

He further said the relative valuations of US and European companies, versus Asian companies, continues to widen amid global recovery.

This makes Asian companies more attractive over the longer term, based on future expected valuations.

When asked about the impact of China's tech crackdown, Mr Lim told reporters that GIC continues to see good prospects in terms of growth and asset returns.

"In the tech sector, we have always talked about investing in sustainable business practices... business models. What we see in China is a continuation of that," he noted.

On the sustainability front, GIC had developed a set of climate scenarios to stress-test its portfolio.

It uses the derived outputs, among other factors, for asset allocation, risk management and integration efforts, as well as for identifying companies better positioned to weather the impact of climate change over the long term.

Climate-related risks and opportunities are managed through a combination of offensive and defensive strategies, implemented via top-down monitoring and bottom-up integration.

With the global investable green market sized at US$4.5 trillion in market cap, GIC had in July 2020 set up an internal investment fund to invest in sustainability-related opportunities that generate good financial risk-returns over time.

For instance, it had invested in US-based Duke Energy to support the transition from fossil fuel and coal-related power plants to cleaner sources of energy. "In doing that, we believe there are good returns to be made from those new capital expenditures," said Dr Jaensubhakij.

GIC, alongside the Monetary Authority of Singapore and Temasek Holdings, supplement the annual Budget through the Net Investment Returns Contribution, the single largest revenue source for the Singapore government.

READ MORE:

- GIC to eye more 'granular' investment opportunities

- GIC, Temasek poised to reap capital gains bonanza from tech IPO season

- Temasek posts 24.5% one-year return; posts record investments and divestments

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.