GIC’s 20-year annualised return at 4.2%; rebalances portfolio to keep up with inflation

Kelly Ng

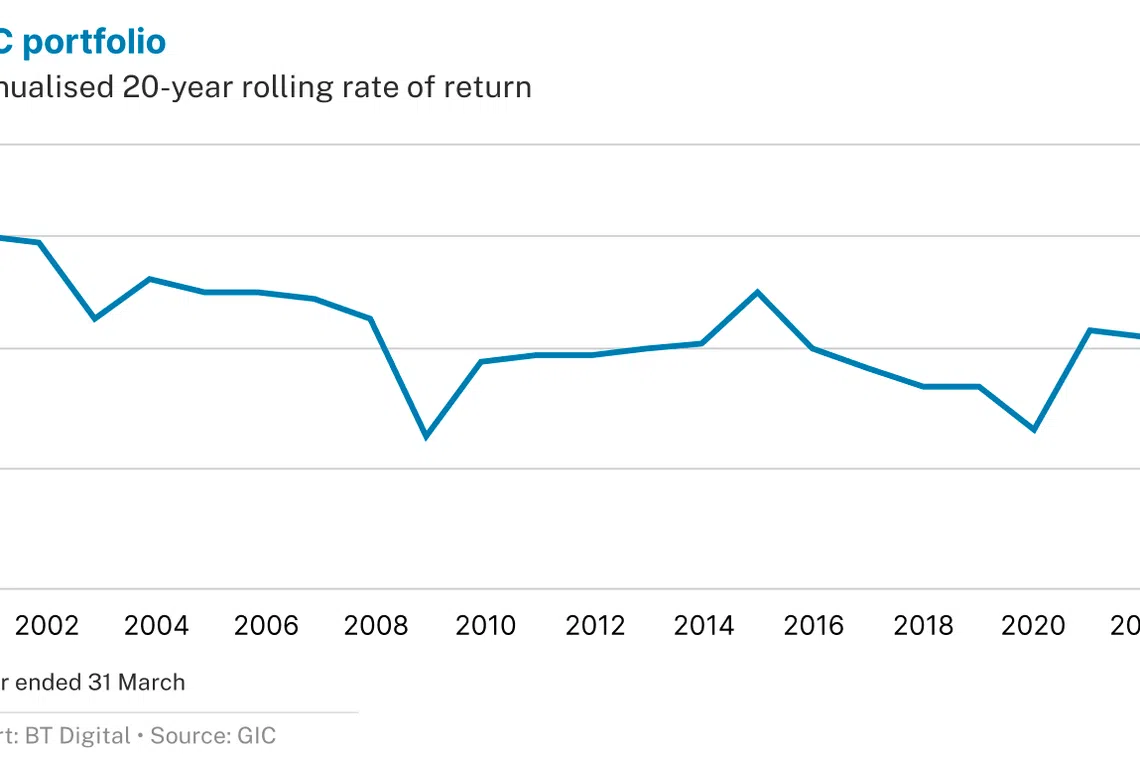

GIC reported a 4.2 per cent annualised rolling 20-year real rate of return for the latest period ended Mar 31, and is rebalancing its portfolio — by shoring up on private equity and real assets — as recession risks grow.

The rate of return, which spans 2003 to 2022 for the year ended Mar 31, is down 0.1 per cent from the previous year.

Annualised nominal return, not accounting for inflation, came in at 7 per cent in US dollar terms — demonstrating the extent to which global inflation has eaten into returns.

GIC said in its annual report published on Wednesday (Jul 27) that it has been increasing its allocation to certain high-growth asset classes, such as private equity, that “can provide returns that keep pace with elevated inflation".

As at Mar 31, 2022, the state investor’s allocation to private equity has risen to 17 per cent from 15 per cent a year ago.

Allocation to real estate stood at 10 per cent, up from 8 per cent in 2021, and 7 per cent in the previous year.

Investments in public equities, meanwhile, have fallen. Allocation to developed market equities stood at 14 per cent, down from 15 per cent in 2021, while allocation to emerging market equities stood at 16 per cent, down from 17 per cent the previous year.

Allocation to cash and bonds was cut to 37 per cent, down from 39 per cent in 2021. This asset class made up 44 per cent of GIC’s portfolio 2 years ago.

There are good reasons for holding equities during inflationary periods, as companies can pass some of their costs downstream, GIC’s group chief investment officer Dr Jeffrey Jaensubhakij said in a media briefing ahead of the report’s release.

“Where inflation affects (the companies) by rising costs, they try to pass it to their customers, provided they are in the types of products and services customers continue to want,” he said.

Dr Jaensubhakij added that private equities have been cheaper and have received lower valuations than public equities for some time now, which means they generally deliver higher growth and returns.

The private companies GIC looks out for are those “resilient to recessions”, he said, such as those providing business planning software or offerings that clients continue to depend on in an economic downturn.

GIC also continues to see real estate and infrastructure as inflation hedges, and has increased its headcount in these practices by over 35 per cent in the last 3 years.

Asked about GIC’s stance on digital assets, Dr Jaensubhakij said it is interested primarily in how blockchain technology can disrupt profit pools of existing intermediaries, rather than in cryptocurrencies themselves.

“We’ve not put money in cryptocurrencies as an investment, because in and of itself, it’s not something that disrupts anything. It is not taking anybody’s pool of profit… However, something like Coinbase supports the industry or provides the infrastructure and wallets and so on, that allows people to trade,” he said.

The ongoing “crypto winter” will likely result in some rationalisation of the industry, where stronger players with more robust technology will emerge. “From an investment point of view, it will become clearer for us what we should continue to do,” he said.

GIC chief economist Prakash Kannan said the risks of recession are significant for large parts of the world amid soaring inflation, although “some engine of growth could potentially come from China”.

“The challenge now that most central banks face is that there is a very substantial demand component as well, particularly coming through the labour market. And so in order for them to achieve the inflation objective, there is some necessary kind of cooling that needs to happen.

“The important thing to note here is that you have China actually on a very different part of the business cycle. We think most of the activity there has troughed and is coming up, so there is some hope,” Dr Kannan said, in response to The Business Times’ question of whether the group expects a recession.

Dr Jaensubhakij noted that high inflation is likely to be persistent. The group expects other short-term headwinds, including supply disruptions and fading fiscal stimulus, as well as long-term headwinds, including substantial debt build-up and dimming prospects of globalisation.

Intensifying political rivalry between key economies such as the US and China, as well as political shifts in domestic economies, will also continue to be sources of tension, potentially resulting in restrictions on trade and capital movements.

In terms of geographic exposure, about 37 per cent of GIC’s portfolio is in the US, and about 32 per cent is in Asia, as at Mar 31 this year.

GIC manages well over US$100 billion in assets and is one of the 3 reserves management entities in Singapore, alongside the Monetary Authority of Singapore and Temasek.

The 3 entities supplement Singapore’s annual budget through the Net Investment Returns Contribution. This contribution, which is the single largest revenue source for the Singapore government, is an estimated S$21.6 billion for FY2022. It stood at S$19.6 billion in the previous fiscal year.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.