How the insurance industry can advance ESG principles

Swiss Re's long tradition of sustainability makes for a compelling playbook on how insurers and reinsurers can support the global transition to a low-carbon economy

Global warming. Sustainable energy. Carbon neutrality.

These phrases are dominating headlines globally, especially with growing anxiety over climate change and intensified focus at the recent United Nations (UN) Climate Change Conference, or COP26.

In the insurance sector, environmental, social and governance, or ESG, principles can be applied to everything from sustainable and responsible underwriting, to investing and operations. They are so important that the UN Environment Programme's Principles for Sustainable Insurance initiative was launched in June last year as the first guide to help the global insurance industry manage ESG risks.

Given how climate change has boosted the discussion around ESG even more, the insurance sector plays an influential role in ensuring sustainability through risk management, underwriting and investment management activities.

Taking systematic, climate-friendly actions

For Swiss Re, one of the world's leading providers of reinsurance, insurance and other forms of insurance-based risk transfer, sustainability has been very much part of its DNA. Its first climate-related publication was released in 1979.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Since then, the company, a signatory to the Paris Pledge for Action in 2015, has taken definitive steps towards net-zero emissions, which it is committed to reach by 2050 across its entire business.

What it has done and continues to do, is one example of the reinsurance sector's role in contributing to a more resilient and sustainable world.

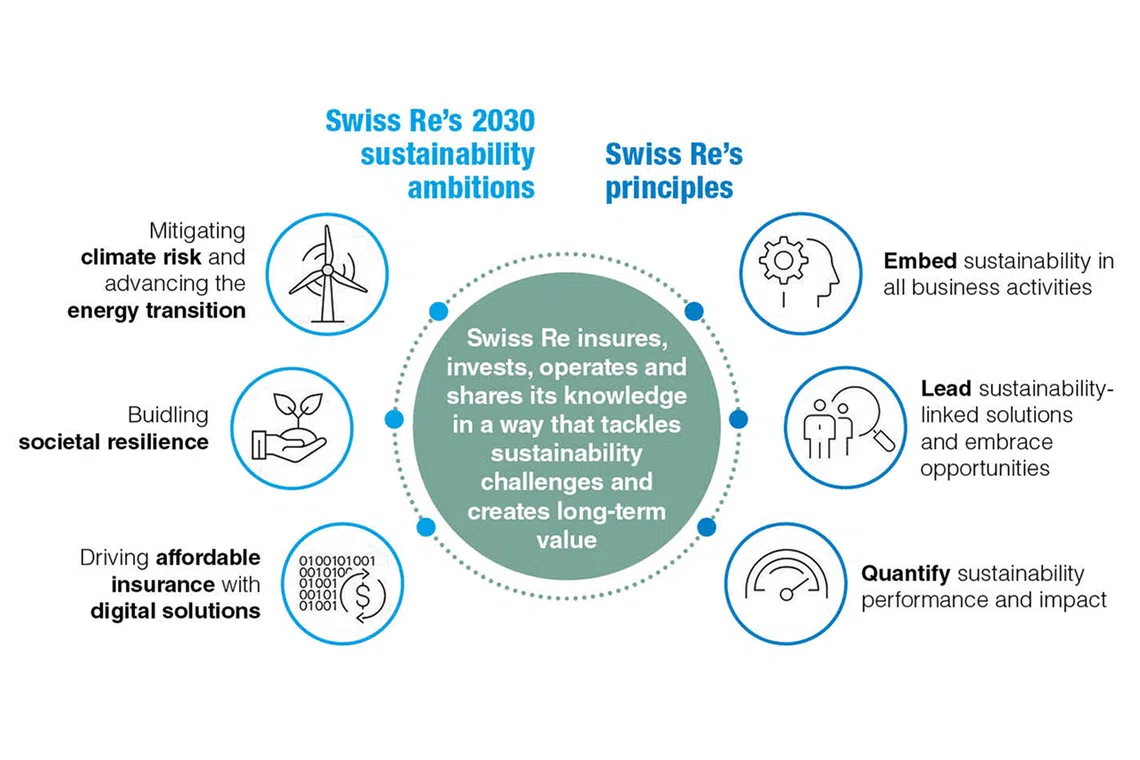

Swiss Re tackles ESG issues on several fronts - how it runs its own operations, the risks it underwrites, the investments it makes and the way it engages its stakeholders and partners.

"From last year on, for example, the power that we use around the world has come from renewable sources," says Mr Russell Higginbotham, Swiss Re's chief executive officer, Reinsurance Asia and regional president, Asia.

In addition, the reinsurer is the first multi-national company to introduce a three-digit internal carbon levy of US$100 (S$135) per tonne of carbon dioxide (CO2) on both direct and indirect operational emissions. This will rise gradually over time to US$200 per tonne by 2030.

The levy generates funding to compensate residual emissions that cannot be reduced further via carbon removal, an activity for which it signed a world-first carbon removal purchase agreement in August with Climeworks - a Swiss company specialising in CO2 air capture. Swiss Re also announced a collaboration with Australia's Southern Green Gas on carbon removal initiatives to test and scale direct air capture technology and also build awareness of the opportunities.

In its role as an underwriter, Swiss Re has been steering away from activities and businesses that are heavy in CO2 emissions towards those that are more sustainable. "We will tighten our coal policy in 2023, and lower the exposure thresholds across various business lines year by year," says Mr Higginbotham. "By 2030, for OECD countries, we'll have that down to zero. And by 2040 for the rest of the world, so we won't have any thermal coal exposure then."

Similar limits are imposed on the oil and gas sector with a gradual shift away from the 5 per cent most carbon-intensive oil and gas production by this year and the 10 per cent most carbon-intensive by 2023.

Supporting climate-friendly solutions on all fronts

Reinsurers have an important role to play in advancing the development of nascent technologies and low carbon alternatives. By providing essential coverage to sustainable and climate-friendly solutions, they are encouraging innovators to take the path less trodden to mitigate and adapt to global warming.

At the end of last year, Swiss Re was providing risk cover to more than 5,600 wind and solar farms, resulting in over 22 million tonnes in CO2 emission cuts.

As a founding member of the UN-convened Net-Zero Asset Owner Alliance, the global reinsurance giant is walking the talk by investing in like-minded businesses. The value of Swiss Re's investments alone is worth over US$150 billion and it integrates ESG criteria along its investment process, aiming to further improve risk-adjusted returns.

Established in 2019, the alliance of institutional investors is committed to transitioning their investment portfolios to net-zero greenhouse gas emissions by 2050.

Through its actions, Swiss Re's single-minded focus on sustainability has rubbed off on its stakeholders and partners. And it continues to leverage its sphere of influence to advance the agenda.

"This year, we had over 400 ESG conversations with clients, we put out a lot of publications, a lot of research and we're a member of various forums," notes Mr Higginbotham. "So it's a holistic approach across the whole of the company and we try to take a leading stance."

The need for understanding and cooperation

While what Swiss Re is doing can be applied equally to others in the reinsurance and insurance sector, Mr Higginbotham stresses that these actions need steering over time. "You can't just flick a switch on, it needs to be transitioned," he says, adding that partnerships are key to long-term success.

"Societal resilience is about how governments, businesses, communities and individuals can work together to mitigate climate risk, because the job of insurance is not to mitigate the whole risk," he explains. "The wider society has to find ways to increase knowledge and understanding and build sustainability."

If, for example, a community is subject to flood risk, they need to have flood defences, recovery systems and emergency services available. If all that is done correctly, then the risk is reduced, with insurance and reinsurance coming in to remove the residual risk.

"It's a win-win, really, because if you're able to mitigate the risk, you reduce the cost of risk, and insurance becomes much more affordable. If you do nothing, then insurance costs are very high, or maybe not even possible. That's why a lot of it is about the partnerships we need to build."

To gain the understanding needed to effect mitigating actions, a huge amount of research is necessary. These include looking into trends and emerging risks, and leveraging data through technology to generate forward-looking models - the latter being more helpful than historical ones given increased weather volatility never experienced before in the past.

"It's really about understanding the data to give you that foundation of knowledge. Then you're able to cover the risks that are emerging and price that business appropriately."

The good thing is, climate change is finally being recognised as an existential global challenge - its environmental impact through extreme weather and temperatures, societal impact on how and where we live, economic impact in terms of loss of value and the impact on future generations.

"There's obviously a lot to achieve, so there has to be a massive amount of cooperation, not just in insurance, but in the wider society. It really needs everyone to be on board cooperating, problem solving and investing in new technologies," emphasises Mr Higginbotham.

"The target of net-zero globally for 2050 is a huge one, but it's entirely possible if everyone is pulling in the same direction. It's a big challenge, but we have a good level of optimism that we can get there."

Learn more about Swiss Re's sustainability initiatives: Group Sustainability Strategy | Swiss Re

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.